Apollo Global Management Investor Day Presentation Deck

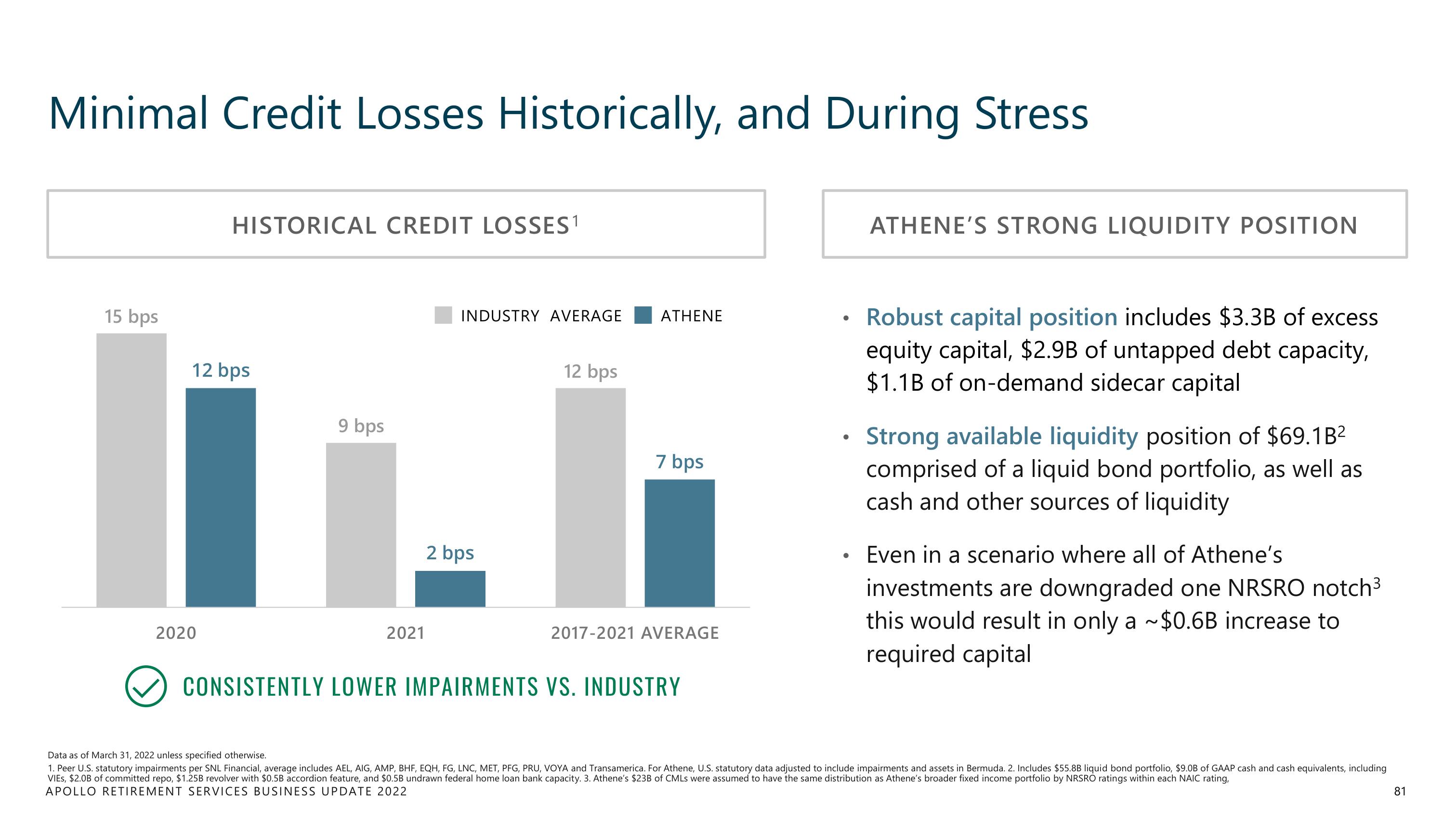

Minimal Credit Losses Historically, and During Stress

15 bps

HISTORICAL CREDIT LOSSES1

12 bps

2020

9 bps

2021

INDUSTRY AVERAGE

2 bps

12 bps

ATHENE

7 bps

2017-2021 AVERAGE

CONSISTENTLY LOWER IMPAIRMENTS VS. INDUSTRY

●

ATHENE'S STRONG LIQUIDITY POSITION

Robust capital position includes $3.3B of excess

equity capital, $2.9B of untapped debt capacity,

$1.1B of on-demand sidecar capital

Strong available liquidity position of $69.1B²

comprised of a liquid bond portfolio, as well as

cash and other sources of liquidity

Even in a scenario where all of Athene's

investments are downgraded one NRSRO notch³

this would result in only a ~$0.6B increase to

required capital

Data as of March 31, 2022 unless specified otherwise.

1. Peer U.S. statutory impairments per SNL Financial, average includes AEL, AIG, AMP, BHF, EQH, FG, LNC, MET, PFG, PRU, VOYA and Transamerica. For Athene, U.S. statutory data adjusted to include impairments and assets in Bermuda. 2. Includes $55.8B liquid bond portfolio, $9.0B of GAAP cash and cash equivalents, including

VIES, $2.0B of committed repo, $1.25B revolver with $0.5B accordion feature, and $0.5B undrawn federal home loan bank capacity. 3. Athene's $23B of CMLs were assumed to have the same distribution as Athene's broader fixed income portfolio by NRSRO ratings within each NAIC rating,

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

81View entire presentation