Rigetti SPAC Presentation Deck

Transaction Summary

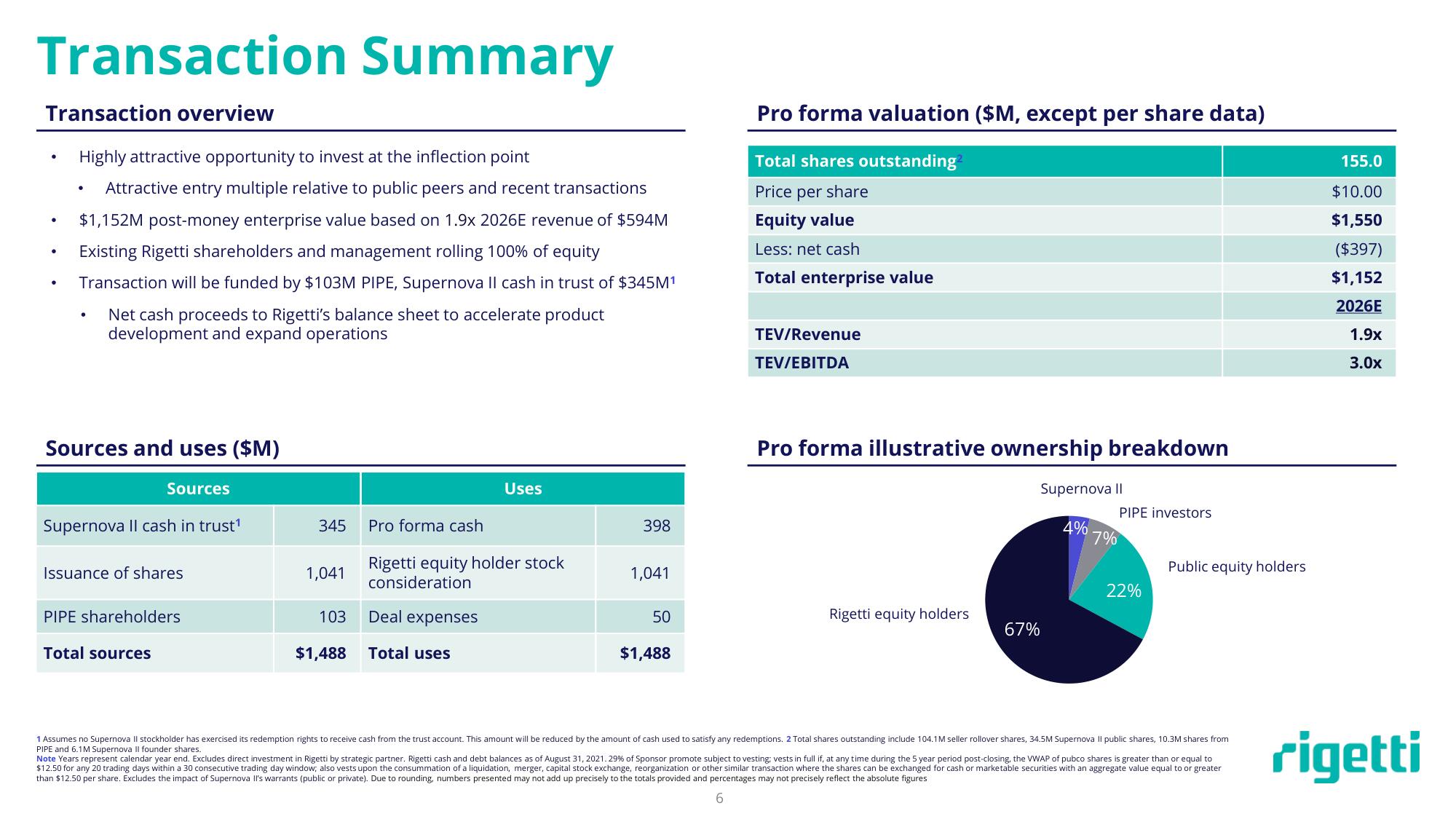

Transaction overview

Highly attractive opportunity to invest at the inflection point

Attractive entry multiple relative to public peers and recent transactions

$1,152M post-money enterprise value based on 1.9x 2026E revenue of $594M

Existing Rigetti shareholders and management rolling 100% of equity

Transaction will be funded by $103M PIPE, Supernova Il cash in trust of $345M¹

Net cash proceeds to Rigetti's balance sheet to accelerate product

development and expand operations

●

●

.

.

Sources and uses ($M)

Sources

Supernova Il cash in trust¹

Issuance of shares

PIPE shareholders

Total sources

345

1,041

103

$1,488

Uses

Pro forma cash

Rigetti equity holder stock

consideration

Deal expenses

Total uses

398

1,041

50

$1,488

Pro forma valuation ($M, except per share data)

Total shares outstanding

Price per share

Equity value

Less: net cash

Total enterprise value

TEV/Revenue

TEV/EBITDA

Pro forma illustrative ownership breakdown

Rigetti equity holders

67%

Supernova II

4%

7%

PIPE investors

22%

Public equity holders

1 Assumes no Supernova II stockholder has exercised its redemption rights to receive cash from the trust account. This amount will be reduced by the amount of cash used to satisfy any redemptions. 2 Total shares outstanding include 104.1M seller rollover shares, 34.5M Supernova Il public shares, 10.3M shares from

PIPE and 6.1M Supernova II founder shares.

Note Years represent calendar year end. Excludes direct investment in Rigetti by strategic partner. Rigetti cash and debt balances as of August 31, 2021.29% of Sponsor promote subject to vesting; vests in full if, at any time during the 5 year period post-closing, the VWAP of pubco shares is greater than or equal to

$12.50 for any 20 trading days within a 30 consecutive trading day window, also vests upon the consummation of a liquidation, merger, capital stock exchange, reorganization or other similar transaction where the shares can be exchanged for cash or marketable securities with an aggregate value equal to or greater

than $12.50 per share. Excludes the impact of Supernova Il's warrants (public or private). Due to rounding, numbers presented may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures

6

155.0

$10.00

$1,550

($397)

$1,152

2026E

1.9x

3.0x

rigettiView entire presentation