Apollo Global Management Investor Day Presentation Deck

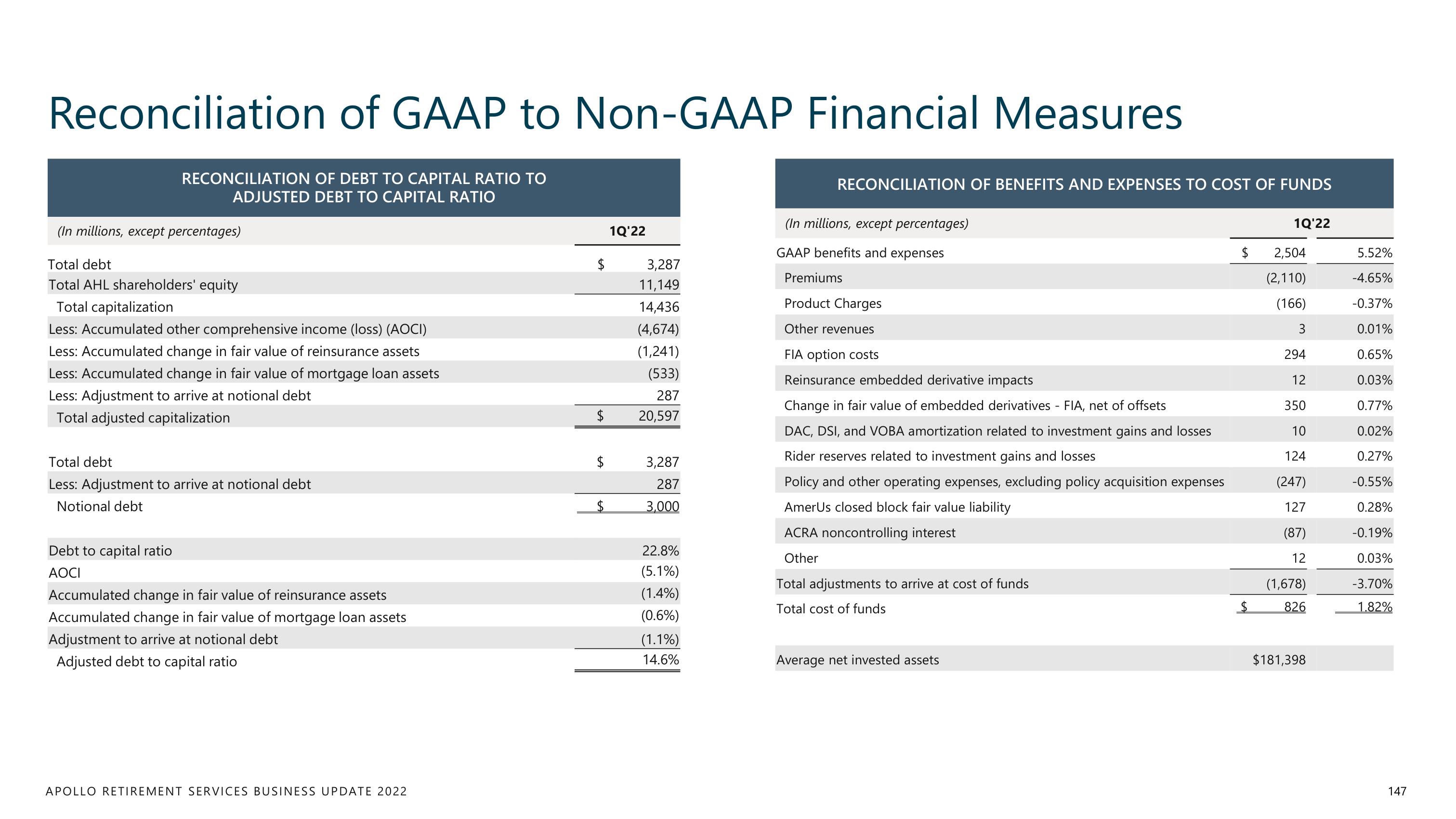

Reconciliation of GAAP to Non-GAAP Financial Measures

RECONCILIATION OF DEBT TO CAPITAL RATIO TO

ADJUSTED DEBT TO CAPITAL RATIO

(In millions, except percentages)

Total debt

Total AHL shareholders' equity

Total capitalization

Less: Accumulated other comprehensive income (loss) (AOCI)

Less: Accumulated change in fair value of reinsurance assets

Less: Accumulated change in fair value of mortgage loan assets

Less: Adjustment to arrive at notional debt

Total adjusted capitalization

Total debt

Less: Adjustment to arrive at notional debt

Notional debt

Debt to capital ratio

AOCI

Accumulated change in fair value of reinsurance assets

Accumulated change in fair value of mortgage loan assets

Adjustment to arrive at notional debt

Adjusted debt to capital ratio

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

1Q'22

$

3,287

11,149

14,436

(4,674)

(1,241)

(533)

287

$ 20,597

3,287

287

3,000

22.8%

(5.1%)

(1.4%)

(0.6%)

(1.1%)

14.6%

RECONCILIATION OF BENEFITS AND EXPENSES TO COST OF FUNDS

(In millions, except percentages)

GAAP benefits and expenses

Premiums

Product Charges

Other revenues

FIA option costs

Reinsurance embedded derivative impacts

Change in fair value of embedded derivatives - FIA, net of offsets

DAC, DSI, and VOBA amortization related to investment gains and losses

Rider reserves related to investment gains and losses

Policy and other operating expenses, excluding policy acquisition expenses

AmerUs closed block fair value liability

ACRA noncontrolling interest

Other

Total adjustments to arrive at cost of funds

Total cost of funds

Average net invested assets

$

$

1Q'22

2,504

(2,110)

(166)

3

294

12

350

10

124

(247)

127

(87)

12

(1,678)

826

$181,398

5.52%

-4.65%

-0.37%

0.01%

0.65%

0.03%

0.77%

0.02%

0.27%

-0.55%

0.28%

-0.19%

0.03%

-3.70%

1.82%

147View entire presentation