Vici Investor Presentation

RECONCILIATION FROM GAAP TO NON-GAAP FINANCIAL MEASURES (CONT.)

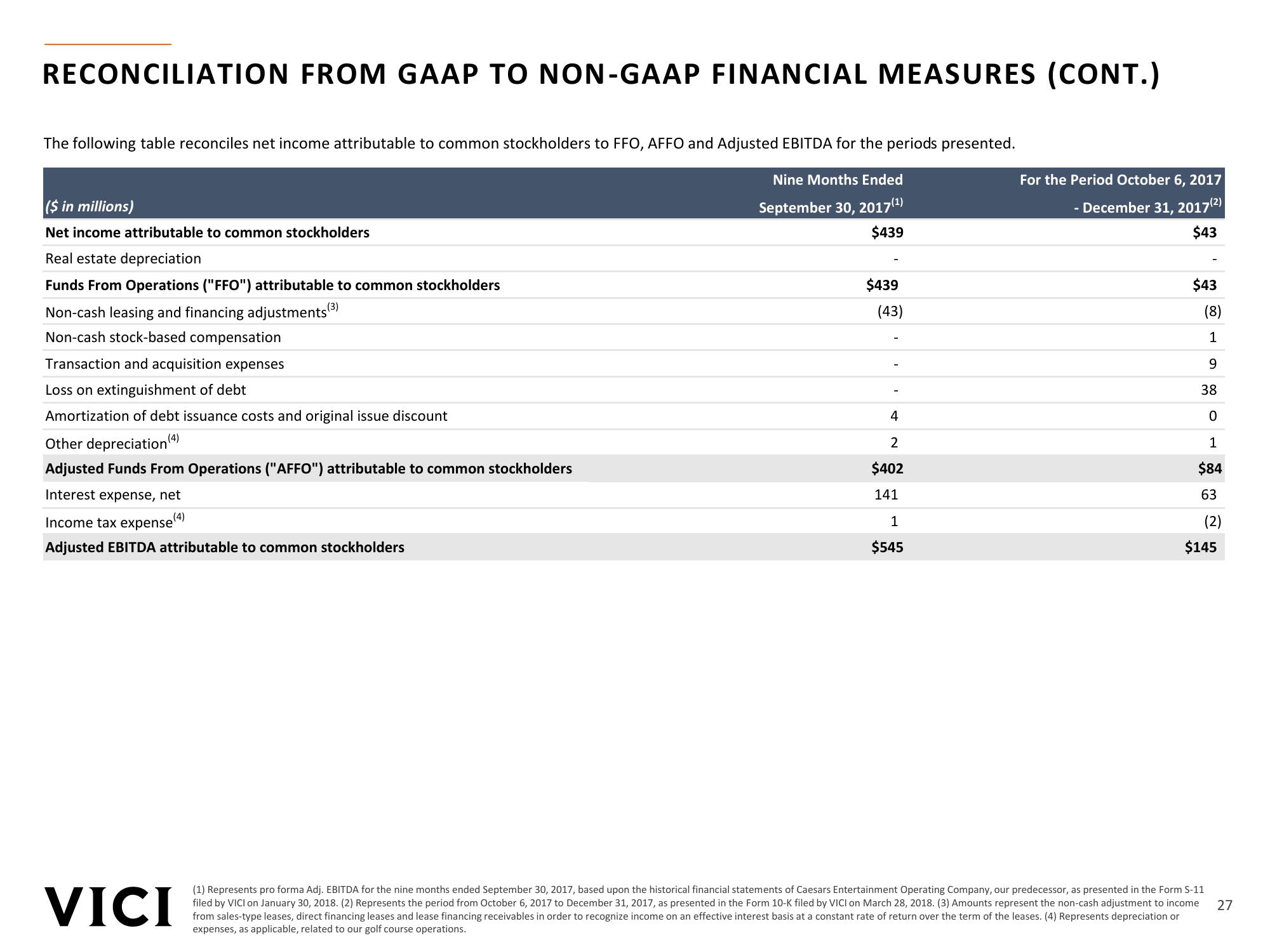

The following table reconciles net income attributable to common stockholders to FFO, AFFO and Adjusted EBITDA for the periods presented.

Nine Months Ended

September 30, 2017 (¹)

$439

($ in millions)

Net income attributable to common stockholders

Real estate depreciation

Funds From Operations ("FFO") attributable to common stockholders

Non-cash leasing and financing adjustments (3)

Non-cash stock-based compensation

Transaction and acquisition expenses

Loss on extinguishment of debt

Amortization of debt issuance costs and original issue discount

Other depreciation (4)

Adjusted Funds From Operations ("AFFO") attributable to common stockholders

Interest expense, net

(4)

Income tax expense

Adjusted EBITDA attributable to common stockholders

VICI

$439

(43)

4

2

$402

141

1

$545

For the Period October 6, 2017

- December 31, 2017 (²)

$43

$43

(8)

1

9

38

0

1

$84

63

(2)

$145

(1) Represents pro forma Adj. EBITDA for the nine months ended September 30, 2017, based upon the historical financial statements of Caesars Entertainment Operating Company, our predecessor, as presented in the Form S-11

filed by VICI on January 30, 2018. (2) Represents the period from October 6, 2017 to December 31, 2017, as presented in the Form 10-K filed by VICI on March 28, 2018. (3) Amounts represent the non-cash adjustment to income

from sales-type leases, direct financing leases and lease financing receivables in order to recognize income on an effective interest basis at a constant rate of return over the term of the leases. (4) Represents depreciation or

expenses, as applicable, related to our golf course operations.

27View entire presentation