Hagerty Investor Presentation Deck

Millions

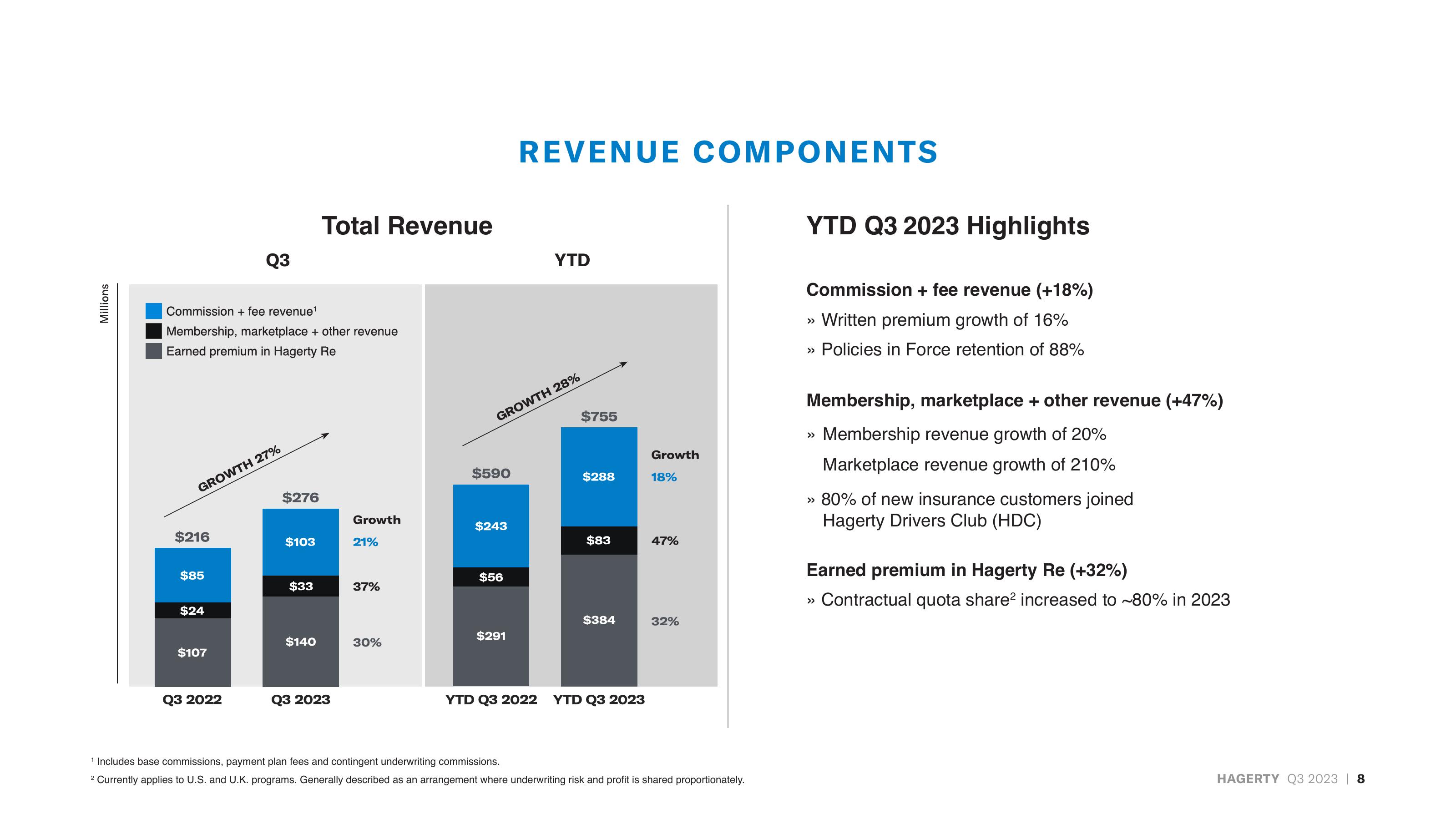

Commission + fee revenue¹

Membership, marketplace + other revenue

Earned premium in Hagerty Re

GROWTH 27%

$216

$85

$24

Q3

$107

Q3 2022

$276

$103

$33

Total Revenue

$140

Q3 2023

Growth

21%

37%

30%

$590

$243

GROWTH 28%

$56

REVENUE COMPONENTS

$291

YTD

$755

$288

$83

$384

YTD Q3 2022 YTD Q3 2023

Growth

18%

47%

32%

¹ Includes base commissions, payment plan fees and contingent underwriting commissions.

2 Currently applies to U.S. and U.K. programs. Generally described as an arrangement where underwriting risk and profit is shared proportionately.

YTD Q3 2023 Highlights

Commission + fee revenue (+18%)

>> Written premium growth of 16%

>> Policies in Force retention of 88%

Membership, marketplace + other revenue (+47%)

Membership revenue growth of 20%

Marketplace revenue growth of 210%

>> 80% of new insurance customers joined

Hagerty Drivers Club (HDC)

Earned premium in Hagerty Re (+32%)

>> Contractual quota share² increased to ~80% in 2023

HAGERTY Q3 2023 | 8View entire presentation