Sonos Results Presentation Deck

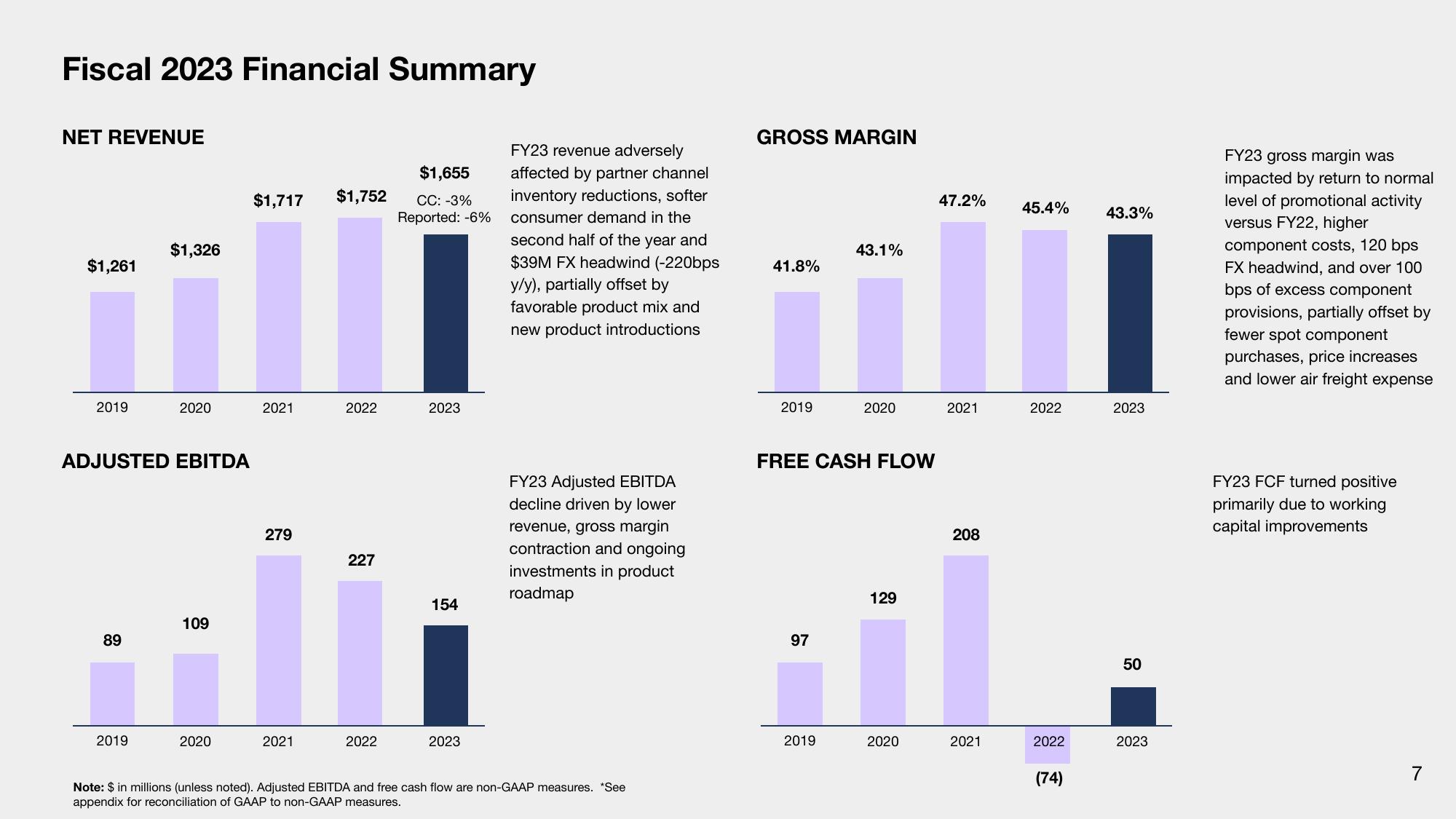

Fiscal 2023 Financial Summary

NET REVENUE

$1,261

2019

89

$1,326

ADJUSTED EBITDA

2019

2020

109

2020

$1,717 $1,752

2021

279

2021

2022

227

2022

$1,655

CC: -3%

Reported: -6%

2023

154

2023

FY23 revenue adversely

affected by partner channel

inventory reductions, softer

consumer demand in the

second half of the year and

$39M FX headwind (-220bps

y/y), partially offset by

favorable product mix and

new product introductions

FY23 Adjusted EBITDA

decline driven by lower

revenue, gross margin

contraction and ongoing

investments in product

roadmap

Note: $ in millions (unless noted). Adjusted EBITDA and free cash flow are non-GAAP measures. "See

appendix for reconciliation of GAAP to non-GAAP measures.

GROSS MARGIN

41.8%

2019

97

43.1%

FREE CASH FLOW

2019

2020

129

2020

47.2%

2021

208

2021

45.4%

1

2022

2022

43.3%

(74)

2023

50

2023

FY23 gross margin was

impacted by return to normal

level of promotional activity

versus FY22, higher

component costs, 120 bps

FX headwind, and over 100

bps of excess component

provisions, partially offset by

fewer spot component

purchases, price increases

and lower air freight expense

FY23 FCF turned positive

primarily due to working

capital improvements

7View entire presentation