Bed Bath & Beyond Results Presentation Deck

APPENDIX

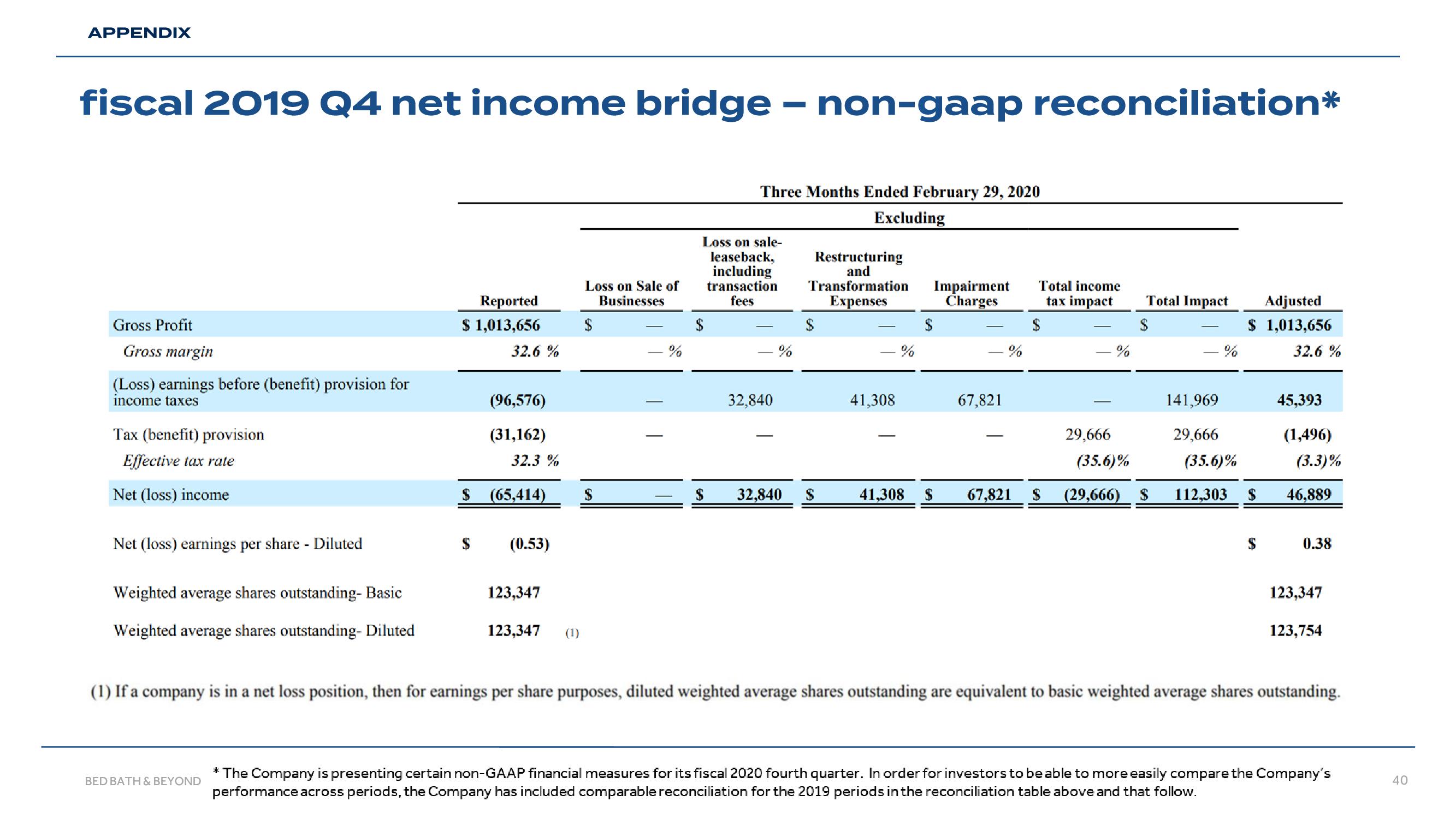

fiscal 2019 Q4 net income bridge

Gross Profit

Gross margin

(Loss) earnings before (benefit) provision for

income taxes

Tax (benefit) provision

Effective tax rate

Net (loss) income

Net (loss) earnings per share - Diluted

Weighted average shares outstanding- Basic

Weighted average shares outstanding- Diluted

Reported

$ 1,013,656

BED BATH & BEYOND

32.6 %

(96,576)

(31,162)

32.3 %

$ (65,414)

(0.53)

123,347

123,347 (1)

Loss on Sale of

Businesses

$

S

-%

$

-

Loss on sale-

leaseback,

including

transaction

fees

Three Months Ended February 29, 2020

Excluding

32,840

%

non-gaap reconciliation*

Restructuring

and

Transformation Impairment

Expenses

Charges

$ 32,840 $

41,308

%

$

-%

67,821

Total income

tax impact

$

%

Total Impact

$

29,666

(35.6)%

41,308 S 67,821 $ (29,666) S

141,969

%

Adjusted

$ 1,013,656

29,666

(35.6)%

112,303 $

32.6 %

45,393

(1,496)

(3.3)%

46,889

0.38

123,347

123,754

(1) If a company is in a net loss position, then for earnings per share purposes, diluted weighted average shares outstanding are equivalent to basic weighted average shares outstanding.

* The Company is presenting certain non-GAAP financial measures for its fiscal 2020 fourth quarter. In order for investors to be able to more easily compare the Company's

performance across periods, the Company has included comparable reconciliation for the 2019 periods in the reconciliation table above and that follow.

40View entire presentation