J.P.Morgan Software Investment Banking

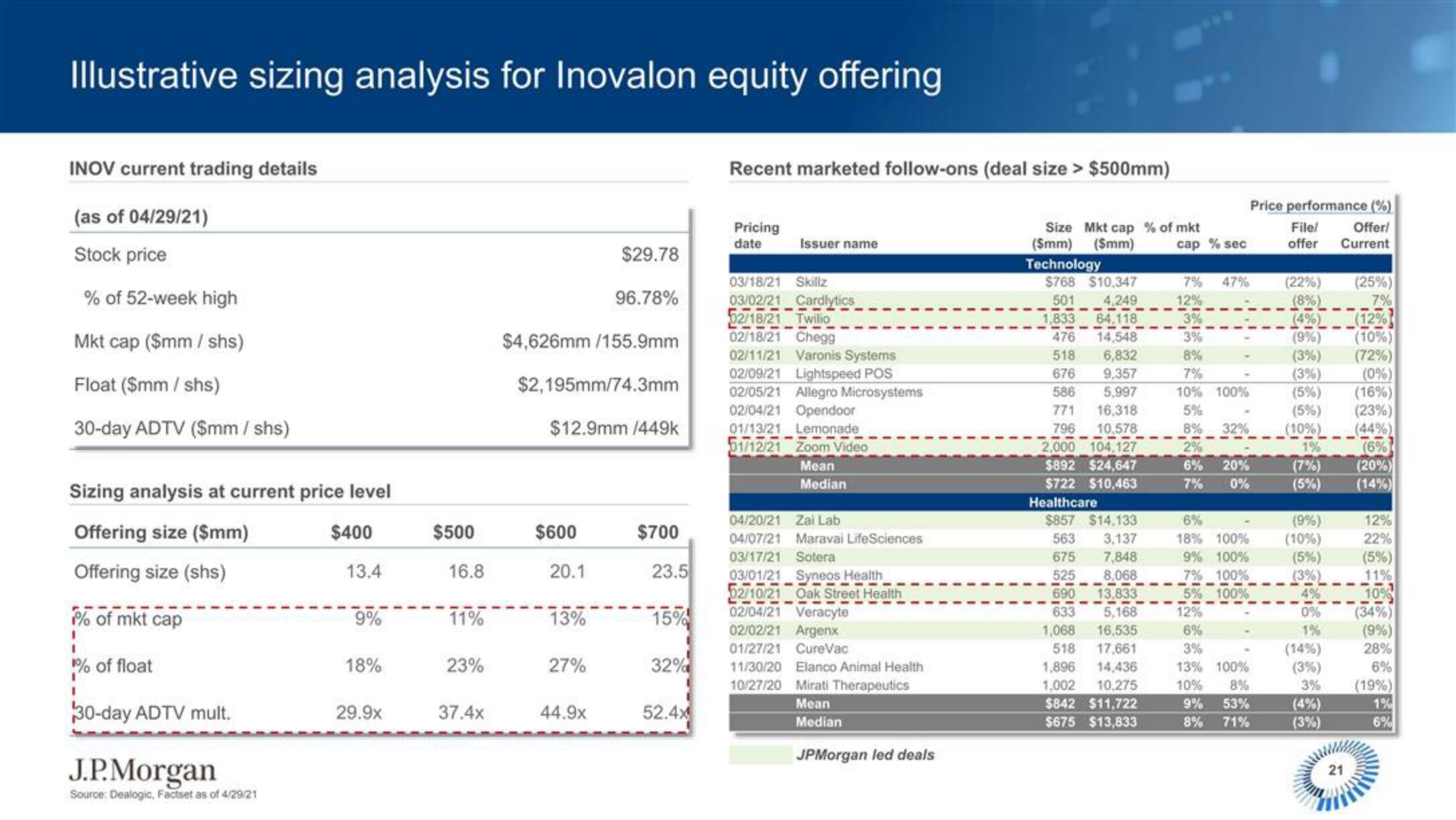

Illustrative sizing analysis for Inovalon equity offering

INOV current trading details

(as of 04/29/21)

Stock price

% of 52-week high

Mkt cap ($mm/shs)

Float ($mm / shs)

30-day ADTV (Smm / shs)

Sizing analysis at current price level

Offering size ($mm)

$400

Offering size (shs)

of mkt cap

I

%% of float

1

30-day ADTV mult.

J.P.Morgan

Source: Dealogic, Factset as of 4/29/21

13.4

9%

18%

29.9x

$500

16.8

11%

23%

37.4x

$29.78

96.78%

$4,626mm /155.9mm

$2,195mm/74.3mm

$12.9mm /449k

$600

20.1

13%

27%

44.9x

$700

23.5

15%

32%

52.4x

Recent marketed follow-ons (deal size > $500mm)

Pricing

date

Issuer name

LIII-

03/18/21 Skillz

03/02/21 Cardlytics

52/18/21 Twilio

02/18/21 Chegg

02/11/21 Varonis Systems

02/09/21 Lightspeed POS

02/05/21 Allegro Microsystems

02/04/21 Opendoor

01/13/21 Lemonade

01/12/21 Zoom Video

Mean

Median

04/20/21 Zai Lab

04/07/21 Maravai LifeSciences

03/17/21 Sotera

03/01/21 Syneos Health

52/10/21 Oak Street Health

02/04/21 Veracyte

02/02/21 Argenx

01/27/21 CureVac

11/30/20 Elanco Animal Health

10/27/20 Mirati Therapeutics

Mean

Median

---

JPMorgan led deals

Size Mkt cap % of mkt

(Smm)

($mm)

Technology

$768 $10,347

501 4,249

---

64,118

------

14,548

1,833

476

518 6,832

676 9,357

586 5,997

771

16,318

796 10,578

2,000 104,127

$892 $24,647

$722 $10,463

Healthcare

$857 $14,133

563 3,137

675 7,848

525

8,068

690 13,833

633

5,168

1,068 16,535

518 17,661

1,896 14,436

1,002 10,275

$842 $11,722

$675 $13,833

------

----

---

cap % sec

7% 47%

12%

3%

8%

7%

10% 100%

5%

8%

32%

6% 20%

7% 0%

6%

18% 100%

9% 100%

7% 100%

---

5% 100%

12%

6%

3%

13% 100%

10%

9%

8%

8%

53%

71%

Price performance (%)

Offer!

Current

File/

offer

(22%)

(8%)

(4%)

(9%)

(3%)

(3%)

(5%)

(5%)

(10%)

1%

(7%)

(5%)

(9%)

(10%)

(5%)

(3%)

4%

0%

(14%)

(3%)

3%

(3%)

21

(25%)

7%

(12%

(10%)

(72%)

(0%)

(16%)

(23%)

(44%)

(6%

(20%)

(14%)

12%

22%

(5%)

11%

10%

(34%)

(9%)

28%

6%

(19%)

1%

6%View entire presentation