Q3 Fiscal 2019

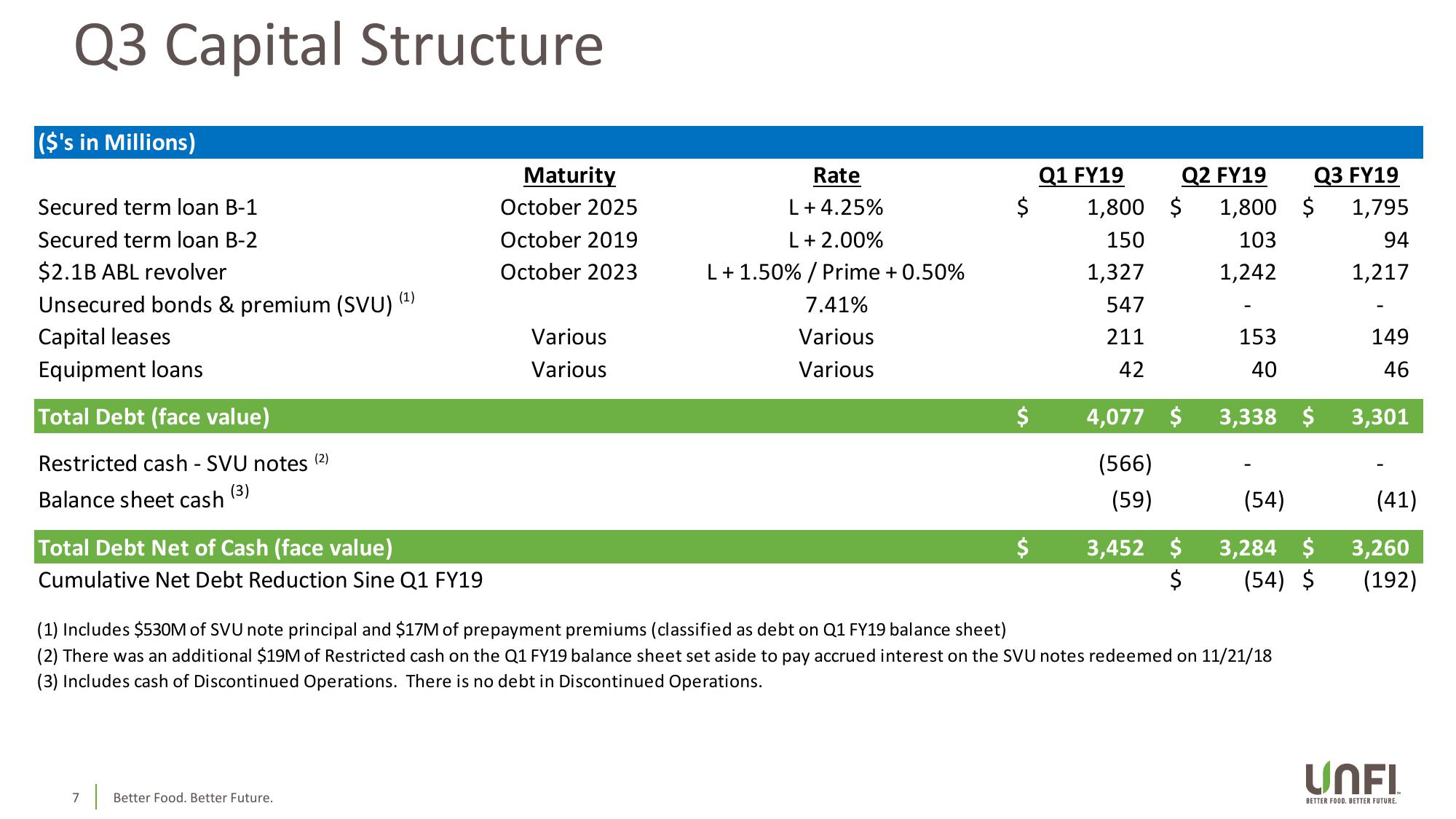

Q3 Capital Structure

($'s in Millions)

Secured term loan B-1

Secured term loan B-2

$2.1B ABL revolver

Unsecured bonds & premium (SVU) (¹)

Capital leases

Equipment loans

Total Debt (face value)

Restricted cash - SVU notes (²)

Balance sheet cash

Total Debt Net of Cash (face value)

Cumulative Net Debt Reduction Sine Q1 FY19

Maturity

October 2025

October 2019

October 2023

7 | Better Food. Better Future.

Variou

Various

Rate

L +4.25%

L + 2.00%

L + 1.50% / Prime + 0.50%

7.41%

Various

Various

$

$

Q1 FY19

1,800

150

1,327

547

211

42

Q2 FY19

$ 1,800

103

1,242

4,077 $

(566)

(59)

3,452 $

$

153

40

Q3 FY19

(1) Includes $530M of SVU note principal and $17M of prepayment premiums (classified as debt on Q1 FY19 balance sheet)

(2) There was an additional $19M of Restricted cash on the Q1 FY19 balance sheet set aside to pay accrued interest on the SVU notes redeemed on 11/21/18

(3) Includes cash of Discontinued Operations. There is no debt in Discontinued Operations.

$

3,338 $

(54)

3,284 $

(54) $

1,795

94

1,217

149

46

3,301

(41)

3,260

(192)

UNFL

BETTER FOOD. BETTER FUTURE.View entire presentation