Maersk Investor Presentation Deck

Financial highlights Q4 2020

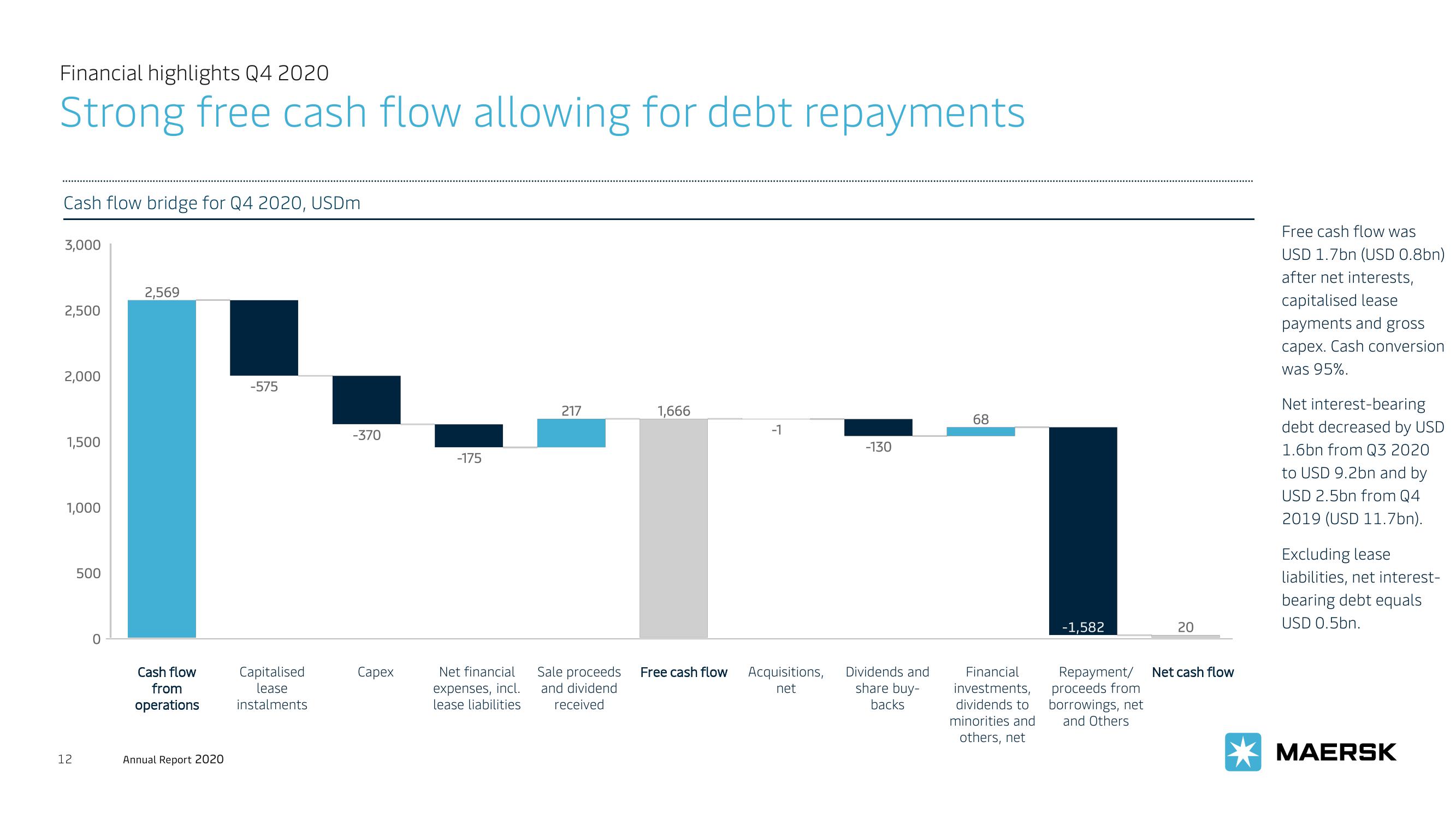

Strong free cash flow allowing for debt repayments

Cash flow bridge for Q4 2020, USDm

3,000

2,500

2,000

1,500

1,000

12

500

0

2,569

Cash flow

from

operations

Annual Report 2020

-575

Capitalised

lease

instalments

-370

Capex

-175

Net financial

expenses, incl.

lease liabilities

217

1,666

Sale proceeds Free cash flow

and dividend

received

-1

Acquisitions,

net

-130

Dividends and

share buy-

backs

68

Financial

investments,

dividends to

minorities and

others, net

-1,582

20

Repayment/ Net cash flow

proceeds from

borrowings, net

and Others

Free cash flow was

USD 1.7bn (USD 0.8bn)

after net interests,

capitalised lease

payments and gross

capex. Cash conversion

was 95%.

Net interest-bearing

debt decreased by USD

1.6bn from Q3 2020

to USD 9.2bn and by

USD 2.5bn from Q4

2019 (USD 11.7bn).

Excluding lease

liabilities, net interest-

bearing debt equals

USD 0.5bn.

MAERSKView entire presentation