Tudor, Pickering, Holt & Co Investment Banking

EXITDA

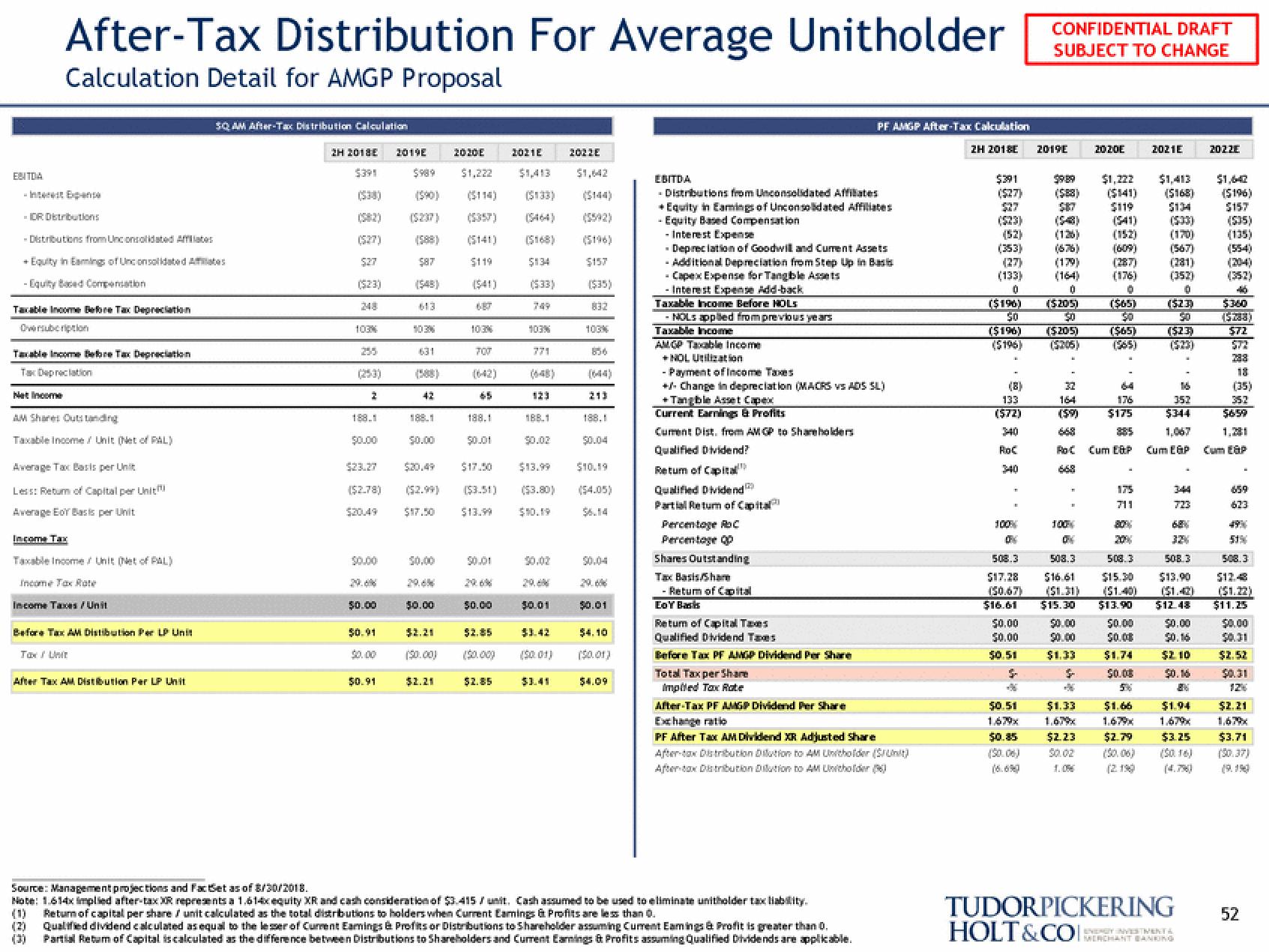

After-Tax Distribution For Average Unitholder

Calculation Detail for AMGP Proposal

Interest Expense

-DR Distributions

- Distributions from Unconsolidated Affilates

+ Equity in Earnings of Unconsolidated Affinates

-Equity Bed Compensation

Taxable Income Before Tax Depreciation

Oversubcription

Taxable Income Before Tax Depreciation

Tax Depreciation

Net Income

AM Share Outstanding

Taxable income / Unit (Net of PAL)

Average Tax Basis per Unit

Less: Return of Capital per Unit

Average EoY Basis per Unit

Income Tax

Taxable income / Unit (Net of PAL)

Income Tax Rate

Income Taxes / Unit

Before Tax AM Distibution Per LP Unit

Tax / Unit

SQ AM After-Tax Distribution Calculation

After Tax AM Distribution Per LP Unit

2H 2018E 2019E

5391

$989

($27)

527

($23)

248

103%

255

(253)

2

188.1

$0.00

($2.78)

$20.49

$0.00

50.00

$0.91

$0.91

(588)

613

103%

631

42

188.1

$0.00

$20.49

($2.99)

$17.50

50.00

29.6%

50.00

$2.21

$2.21

2020E

$1,222

$119

($41)

103%

65

188.1

$17.50

($3.51)

$13.99

$0.01

50.00

$2.85

(50.00)

$2.85

2021E

$134

(533)

103%

771

123

188.1

50.02

$13.99

($3.80)

50.02

29.4

$0.01

$3.42

2022E

($35)

832

100%

213

$0.04

$10.19

($4.05)

$0.01

$4.10

($0.01)

EBITDA

- Distributions from Unconsolidated Affiliates

+ Equity in Earings of Unconsolidated Affiliates

-Equity Based Compensation

- Interest Expense

- Depreciation of Goodwill and Current Assets

- Additional Depreciation from Step Up in Basis

-Capex Expense for Tangible Assets

-Interest Expense Add-back

Taxable income Before HOLS

- NOLS applied from previous years

Taxable Income

AMGP Taxable income

+NOL Utilization

- Payment of Income Taxes

+/- Change in depreciation (MACRS vs ADS SL)

+Tangible Asset Capex

Current Earnings & Profits

Current Dist, from AM GP to Shareholders

Qualified Dividend?

Retum of Capital

Qualified Dividend

Partial Return of Capital

Percentage Roc

Percentage op

Shares Outstanding

Tax Basis Sham

Retum of Capital

EoY Basis

Retum of Capital Taxes

Qualified Dividend Taxes

Before Tax PF AMGP Dividend Per Share

PF AMGP After-Tax Calculation

2H 2018E

Total Tax per Share

Impiled Tax Rate

After-Tax PF AMGP Dividend Per Share

PF After Tax AM Dividend XR Adjusted Share

After-tax Distribution Dilution to AM Unitholder (Sunit)

After-tax Distribution Dilution to AM Unitholder (

Source: Management projections and FactSet as of 8/30/2018.

Note: 1.614x implied after-tax XR represents a 1.614x equity XR and cash consideration of $3.415 / unit. Cash assumed to be used to eliminate unitholder tax liability.

Return of capital per share / unit calculated as the total distributions to holders when Current Eamings & Profits are less than 0.

(1)

Qualified dividend calculated as equal to the lesser of Current Eamings & Profits or Distributions to Shareholder assuming Current Eamings & Profit is greater than 0.

Partial Return of Capital is calculated as the difference between Distributions to Shareholders and Current Earnings & Profits assuming Qualified Dividends are applicable.

$391

($27)

$27

(52)

(353)

(27)

(133)

0

($196)

50

($196)

(5196)

(8)

133

(572)

340

Roc

340

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

50.51

1.679x

$0.85

2019E

($88)

$87

(126)

$9.89 $1,222 $1,413 $1,642

($141) ($168)

$119

$134

(179)

0

(5205)

$0

($205)

($205)

37

164

RoC

668

100%

OFC

ON

508.3 508.3

$17.28 $16.61

(50.67)

$16.61

$0.00

50.00

50.51

S-

2020E

$1.33

1,67%

$2.23

50.02

($41)

(152)

(176)

0

($65)

$0

($65)

(565)

64

176

$175

Cum E&P

175

711

80%

$15.30 $13.90

$0.00 $0.00

90.00

$0.00

$1.33

$1.74

$

$0.00

$1.66

2021E

$2.79

(2190)

(567)

(281)

(352)

0

(523)

50

(523)

16

352

$344

508.3

508.3

$15.30 $13.90

Cum E&P

723

68%

32%

$12.43

$0.00

$0.16

$2.10

50.16

EN

$1.94

1,67%

$3.25

2022E

TUDORPICKERING

HOLT&COCHANT BANKING

($196)

$157

(135)

(554)

(204)

46

$360

($288)

$72

572

18

(35)

35.2

$659

1.281

Cum EGP

659

623

49%

51%

508.3

$12.48

$11.25

$0.00

$0.31

12%

$2.21

1,67%

$3.71

52View entire presentation