AMC Mergers and Acquisitions Presentation Deck

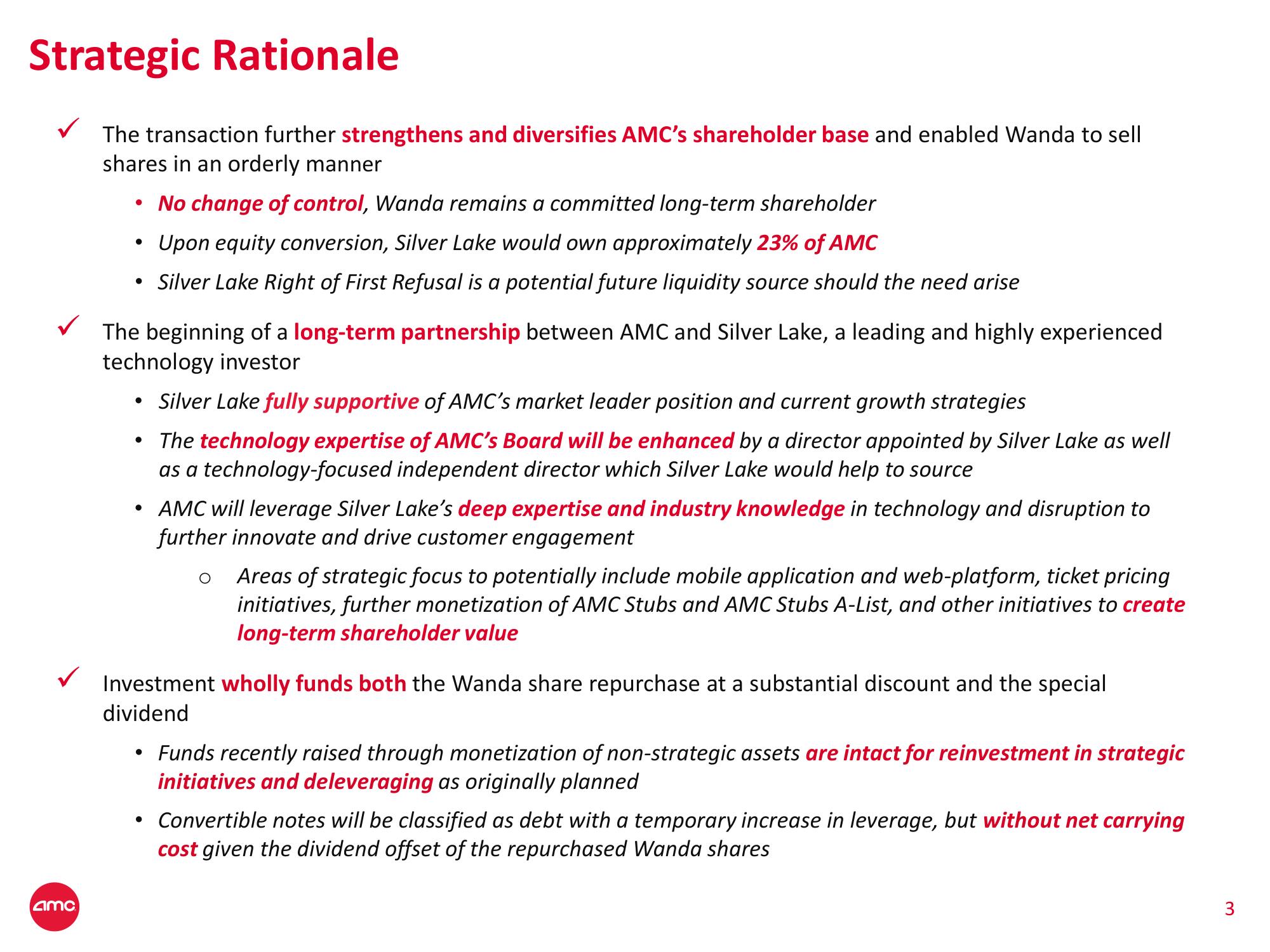

Strategic Rationale

✓ The transaction further strengthens and diversifies AMC's shareholder base and enabled Wanda to sell

shares in an orderly manner

No change of control, Wanda remains a committed long-term shareholder

Upon equity conversion, Silver Lake would own approximately 23% of AMC

• Silver Lake Right of First Refusal is a potential future liquidity source should the need arise

4mc

●

The beginning of a long-term partnership between AMC and Silver Lake, a leading and highly experienced

technology investor

●

Silver Lake fully supportive of AMC's market leader position and current growth strategies

The technology expertise of AMC's Board will be enhanced by a director appointed by Silver Lake as well

as a technology-focused independent director which Silver Lake would help to source

• AMC will leverage Silver Lake's deep expertise and industry knowledge in technology and disruption to

further innovate and drive customer engagement

●

O

Areas of strategic focus to potentially include mobile application and web-platform, ticket pricing

initiatives, further monetization of AMC Stubs and AMC Stubs A-List, and other initiatives to create

long-term shareholder value

Investment wholly funds both the Wanda share repurchase at a substantial discount and the special

dividend

Funds recently raised through monetization of non-strategic assets are intact for reinvestment in strategic

initiatives and deleveraging as originally planned

Convertible notes will be classified as debt with a temporary increase in leverage, but without net carrying

cost given the dividend offset of the repurchased Wanda shares

3View entire presentation