Enact IPO Presentation Deck

Enact | Investor Presentation

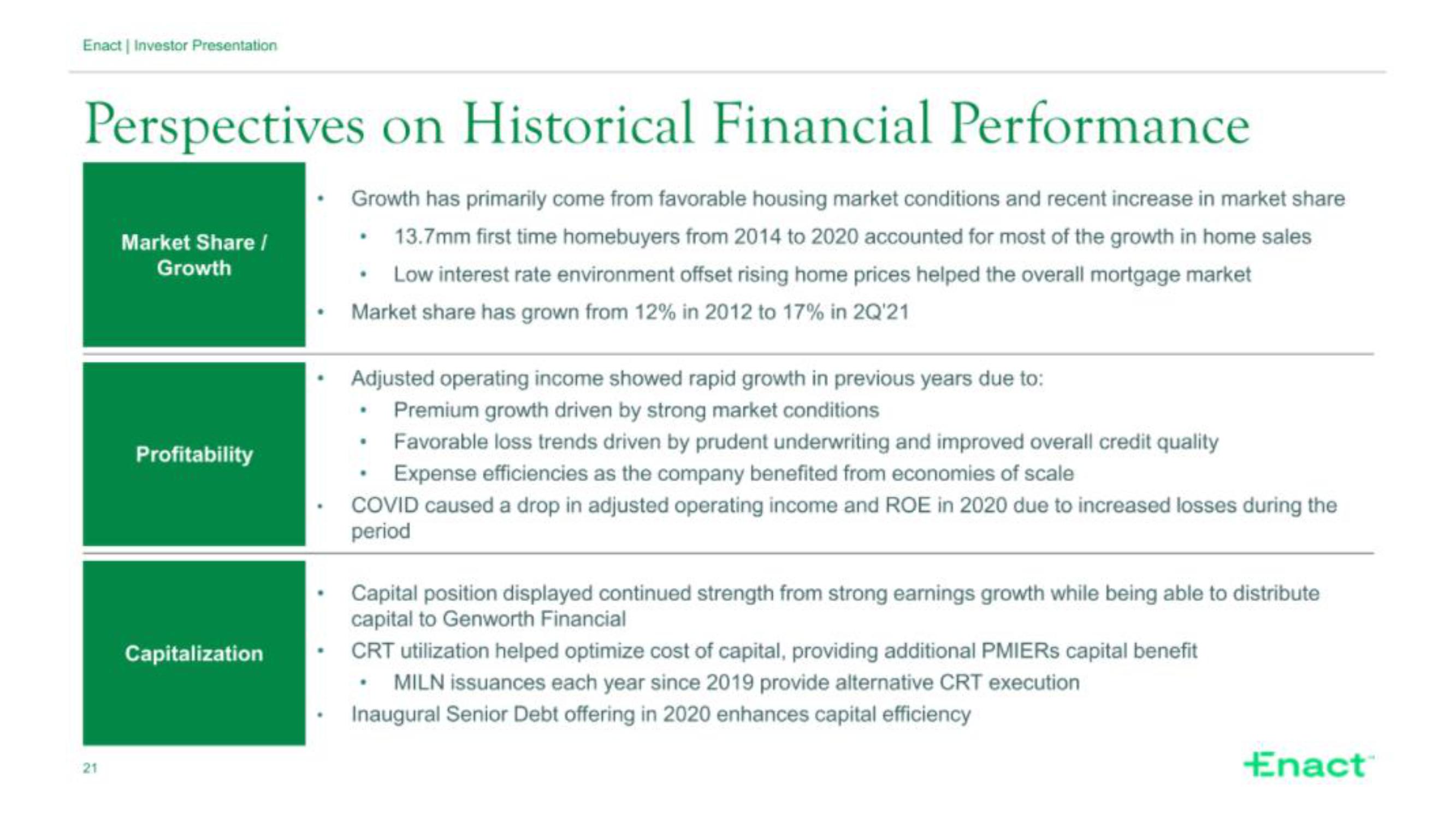

Perspectives on Historical Financial Performance

Growth has primarily come from favorable housing market conditions and recent increase in market share

• 13.7mm first time homebuyers from 2014 to 2020 accounted for most of the growth in home sales

Low interest rate environment offset rising home prices helped the overall mortgage market

Market share has grown from 12% in 2012 to 17% in 2Q'21

21

Market Share /

Growth

Profitability

Capitalization

Adjusted operating income showed rapid growth in previous years due to:

Premium growth driven by strong market conditions

Favorable loss trends driven by prudent underwriting and improved overall credit quality

Expense efficiencies as the company benefited from economies of scale

COVID caused a drop in adjusted operating income and ROE in 2020 due to increased losses during the

period

Capital position displayed continued strength from strong earnings growth while being able to distribute

capital to Genworth Financial

CRT utilization helped optimize cost of capital, providing additional PMIERS capital benefit

MILN issuances each year since 2019 provide alternative CRT execution

Inaugural Senior Debt offering in 2020 enhances capital efficiency

EnactView entire presentation