Blackwells Capital Activist Presentation Deck

A

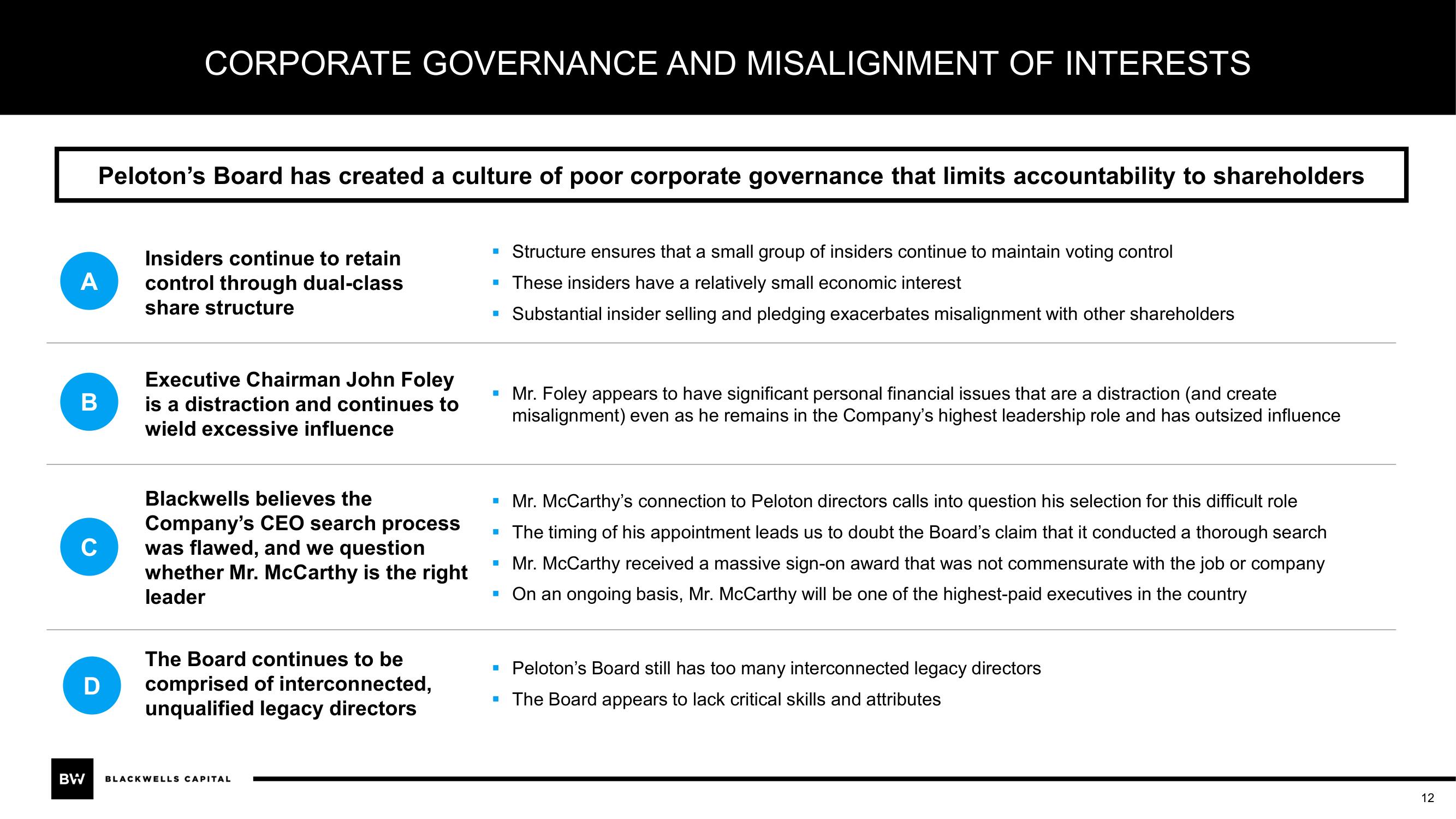

Peloton's Board has created a culture of poor corporate governance that limits accountability to shareholders

B

C

D

BW

CORPORATE GOVERNANCE AND MISALIGNMENT OF INTERESTS

Insiders continue to retain

control through dual-class

share structure

Executive Chairman John Foley

is a distraction and continues to

wield excessive influence

Blackwells believes the

Company's CEO search process

was flawed, and we question

whether Mr. McCarthy is the right

leader

The Board continues to be

comprised of interconnected,

unqualified legacy directors

BLACKWELLS CAPITAL

■ Structure ens

▪ These insiders have a relatively small economic interest

Substantial insider selling and pledging exacerbates misalignment with other shareholders

■

res that a small group of insiders continue to maintain voting control

▪ Mr. Foley appears to have significant personal financial issues that are a distraction (and create

misalignment) even as he remains in the Company's highest leadership role and has outsized influence

▪ Mr. McCarthy's connection to Peloton directors calls into question his selection for this difficult role

▪ The timing of his appointment leads us to doubt the Board's claim that it conducted a thorough search

▪ Mr. McCarthy received a massive sign-on award that was not commensurate with the job or company

▪ On an ongoing basis, Mr. McCarthy will be one of the highest-paid executives in the country

■

Peloton's Board still has too many interconnected legacy directors

▪ The Board appears to lack critical skills and attributes

12View entire presentation