Clover Health Investor Presentation Deck

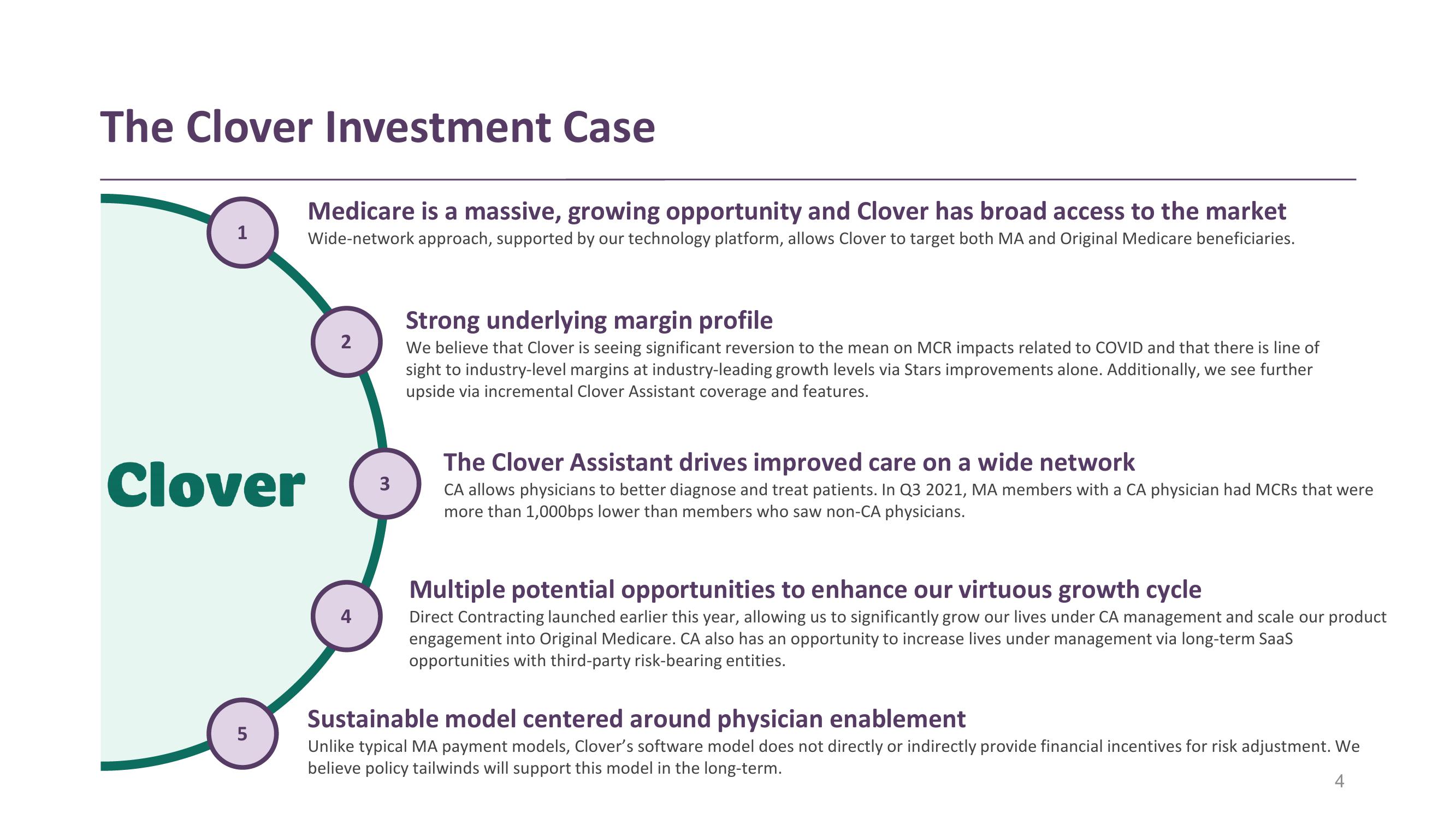

The Clover Investment Case

1

Clover

5

Medicare is a massive, growing opportunity and Clover has broad access to the market

Wide-network approach, supported by our technology platform, allows Clover to target both MA and Original Medicare beneficiaries.

2

4

3

Strong underlying margin profile

We believe that Clover is seeing significant reversion to the mean on MCR impacts related to COVID and that there is line of

sight to industry-level margins at industry-leading growth levels via Stars improvements alone. Additionally, we see further

upside via incremental Clover Assistant coverage and features.

The Clover Assistant drives improved care on a wide network

CA allows physicians to better diagnose and treat patients. In Q3 2021, MA members with a CA physician had MCRS that were

more than 1,000bps lower than members who saw non-CA physicians.

Multiple potential opportunities to enhance our virtuous growth cycle

Direct Contracting launched earlier this year, allowing us to significantly grow our lives under CA management and scale our product

engagement into Original Medicare. CA also has an opportunity to increase lives under management via long-term SaaS

opportunities with third-party risk-bearing entities.

Sustainable model centered around physician enablement

Unlike typical MA payment models, Clover's software model does not directly or indirectly provide financial incentives for risk adjustment. We

believe policy tailwinds will support this model in the long-term.

4View entire presentation