J.P.Morgan 4Q23 Earnings Results

JPMORGAN CHASE & CO.

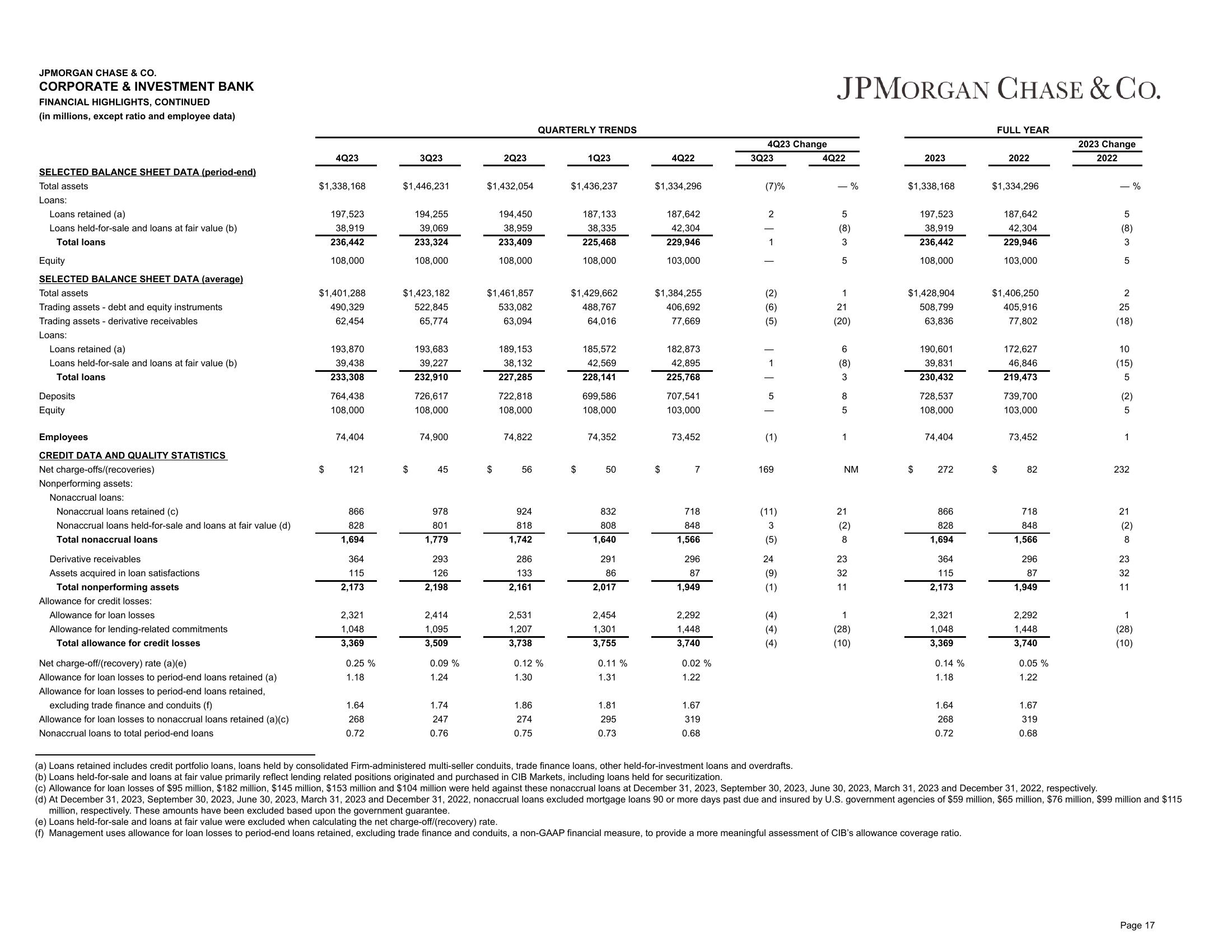

CORPORATE & INVESTMENT BANK

FINANCIAL HIGHLIGHTS, CONTINUED

(in millions, except ratio and employee data)

SELECTED BALANCE SHEET DATA (period-end)

Total assets

Loans:

Loans retained (a)

Loans held-for-sale and loans at fair value (b)

Total loans

Equity

SELECTED BALANCE SHEET DATA (average)

Total assets

Trading assets - debt and equity instruments

Trading assets - derivative receivables

Loans:

Loans retained (a)

Loans held-for-sale and loans at fair value (b)

Total loans

Deposits

Equity

Employees

CREDIT DATA AND QUALITY STATISTICS

Net charge-offs/(recoveries)

Nonperforming assets:

Nonaccrual loans:

Nonaccrual loans retained (c)

Nonaccrual loans held-for-sale and loans at fair value (d)

Total nonaccrual loans

Derivative receivables

Assets acquired in loan satisfactions

Total nonperforming assets

Allowance for credit losses:

Allowance for loan losses

Allowance for lending-related commitments

Total allowance for credit losses

Net charge-off/(recovery) rate (a)(e)

Allowance for loan losses to period-end loans retained (a)

Allowance for loan losses to period-end loans retained,

excluding trade finance and conduits (f)

Allowance for loan losses to nonaccrual loans retained (a)(c)

Nonaccrual loans to total period-end loans

4Q23

$1,338,168

$

197,523

38,919

236,442

108,000

$1,401,288

490,329

62,454

193,870

39,438

233,308

764,438

108,000

74,404

121

866

828

1,694

364

115

2,173

2,321

1,048

3,369

0.25%

1.18

1.64

268

0.72

3Q23

$1,446,231

$

194,255

39,069

233,324

108,000

$1,423,182

522,845

65,774

193,683

39,227

232,910

726,617

108,000

74,900

45

978

801

1,779

293

126

2,198

2,414

1,095

3,509

0.09 %

1.24

1.74

247

0.76

2Q23

$1,432,054

$

194,450

38,959

233,409

108,000

$1,461,857

533,082

63,094

189,153

38,132

227,285

722,818

108,000

74,822

56

924

818

1,742

286

133

2,161

2,531

1,207

3,738

QUARTERLY TRENDS

0.12 %

1.30

1.86

274

0.75

1Q23

$1,436,237

$

187,133

38,335

225,468

108,000

$1,429,662

488,767

64,016

185,572

42,569

228,141

699,586

108,000

74,352

50

832

808

1,640

291

86

2,017

2,454

1,301

3,755

0.11%

1.31

1.81

295

0.73

4Q22

$1,334,296

$

187,642

42,304

229,946

103,000

$1,384,255

406,692

77,669

182,873

42,895

225,768

707,541

103,000

73,452

7

718

848

1,566

296

87

1,949

2,292

1,448

3,740

0.02%

1.22

1.67

319

0.68

4Q23 Change

3Q23

(7)%

2

| | |

(2)

(6)

(5)

| G | - |

(1)

169

(11)

3

(5)

24

(9)

(1)

(4)

(4)

(4)

JPMORGAN CHASE & CO.

4Q22

5

(8)

3

5

1

21

(20)

6

(8)

3

8

5

%

1

NM

21

(2)

8

23

32

11

1

(28)

(10)

2023

$1,338,168

$

197,523

38,919

236,442

108,000

$1,428,904

508,799

63,836

190,601

39,831

230,432

728,537

108,000

74,404

272

866

828

1,694

364

115

2,173

2,321

1,048

3,369

0.14%

1.18

1.64

268

0.72

FULL YEAR

2022

$1,334,296

$

187,642

42,304

229,946

103,000

$1,406,250

405,916

77,802

172,627

46,846

219,473

739,700

103,000

73,452

82

718

848

1,566

296

87

1,949

2,292

1,448

3,740

0.05%

1.22

1.67

319

0.68

2023 Change

2022

- %

5

(8)

3

5

2

25

(18)

10

(15)

5

(2)

5

1

232

21

(2)

8

23

32

11

1

(28)

(10)

(a) Loans retained includes credit portfolio loans, loans held by consolidated Firm-administered multi-seller conduits, trade finance loans, other held-for-investment loans and overdrafts.

(b) Loans held-for-sale and loans at fair value primarily reflect lending related positions originated and purchased in CIB Markets, including loans held for securitization.

(c) Allowance for loan losses of $95 million, $182 million, $145 million, $153 million and $104 million were held against these nonaccrual loans at December 31, 2023, September 30, 2023, June 30, 2023, March 31, 2023 and December 31, 2022, respectively.

(d) At December 31, 2023, September 30, 2023, June 30, 2023, March 31, 2023 and December 31, 2022, nonaccrual loans excluded mortgage loans 90 or more days past due and insured by U.S. government agencies of $59 million, $65 million, $76 million, $99 million and $115

million, respectively. These amounts have been excluded based upon the government guarantee.

(e) Loans held-for-sale and loans at fair value were excluded when calculating the net charge-off/(recovery) rate.

(f) Management uses allowance for loan losses to period-end loans retained, excluding trade finance and conduits, a non-GAAP financial measure, to provide a more meaningful assessment of CIB's allowance coverage ratio.

Page 17View entire presentation