Citi Investment Banking Pitch Book

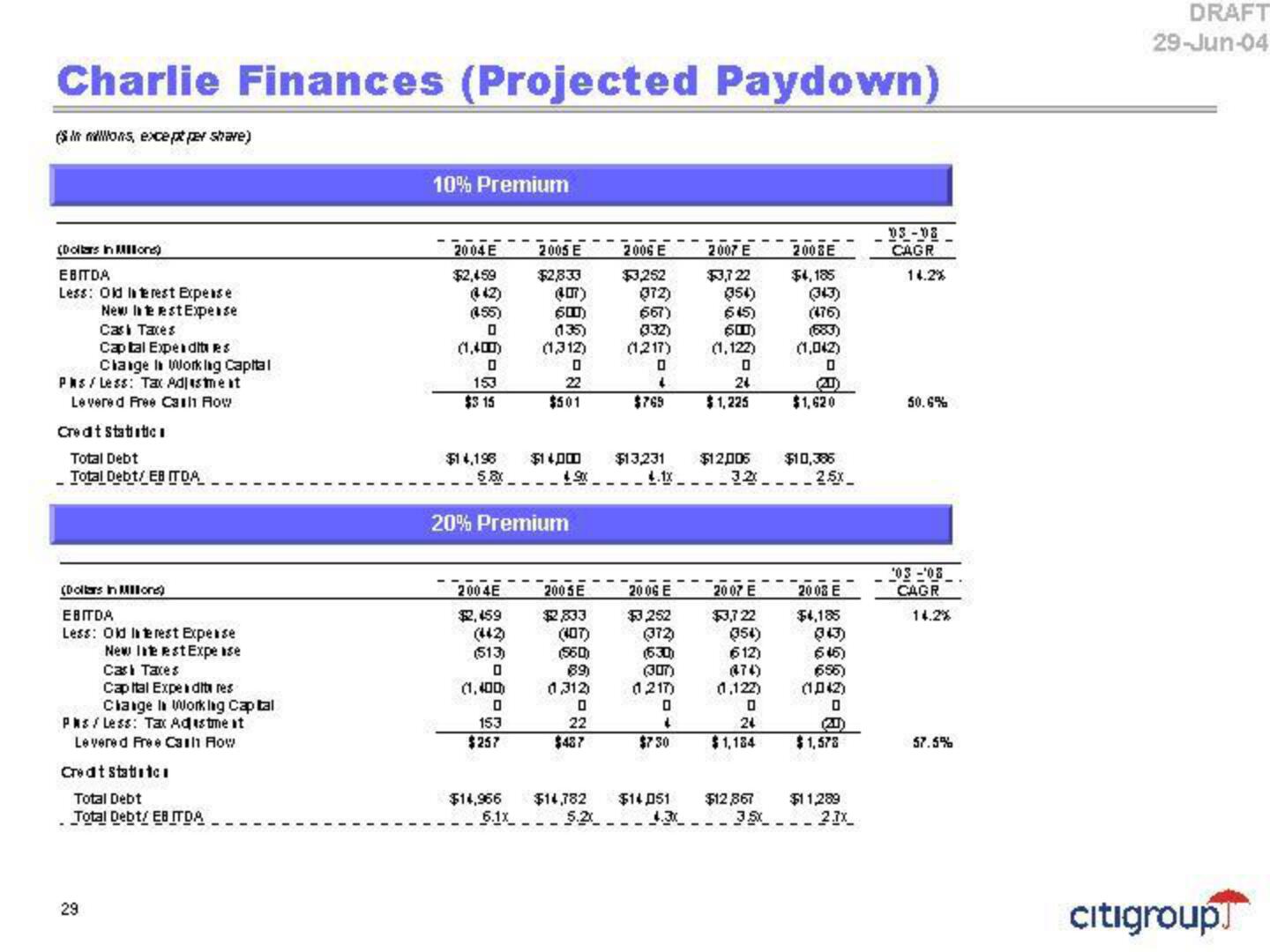

Charlie Finances (Projected Paydown)

(Simons, excepper share)

(Dots in Mons)

EBITDA

Less: Old Interest Expense

New Interest Expense

Casi Taxes

Captal Expenditures

Change In Working Capital

Pas / Less: Tax Adjustment

Levered Free Cash Row

Credit Statistic.

Total Debt

Total Debt/ EBITDA

(Dollars in Milone)

EBITDA

Less: Old Interest Expense

New Inte est Expense

Cari Taxes

Capital Expedita res

Change In Working Capital

PMs / Less: Tax Adjustment

Levered Free Cash Flow

Credt Statisti

Total Debt

Total Debt/ EBITDA

29

10% Premium

2004 E

$2,459

(442)

(455)

0

(1,400)

0

153

$315

2004E

$2,459

2005 E

$2,833

(442)

(513)

0

(1,400)

0

153

$257

(407)

5000)

(135)

(1,312)

20% Premium

$14,966

0

22

$501

2005E

$2,833

(407)

(550)

89)

(1,312)

0

22

$487

2006 E

$3,252

(372)

(667)

(332)

(1,217)

0

4

$769

$10,385

$14,198 $14,000 $13,231 $12,005

58904.1x. 32 25x

6.1x 5.2

2006 E

$3,252

(372)

(630)

(30)

(217)

2007 E

$3,7 22

(354)

0

4

$7.30

645)

5000)

(1,122)

0

24

$1,225

2007 E

$3,7 22

(354)

612)

(474)

(1,122)

0

24

$1,184

$14,782 $14,051 $12,867

4.30

2003E

$4,185

(343)

(476)

(683)

(1,042)

0

$1,620

2008 E

$4,185

(343)

645)

(656)

(1,042)

0

(20)

$1,578

$11,289

350 23x_

03-08

CAGR

14.2%

50.6%

'03-'08.

CAGR

14.2%

57.5%

DRAFT

29-Jun-04

citigroup]View entire presentation