Baird Investment Banking Pitch Book

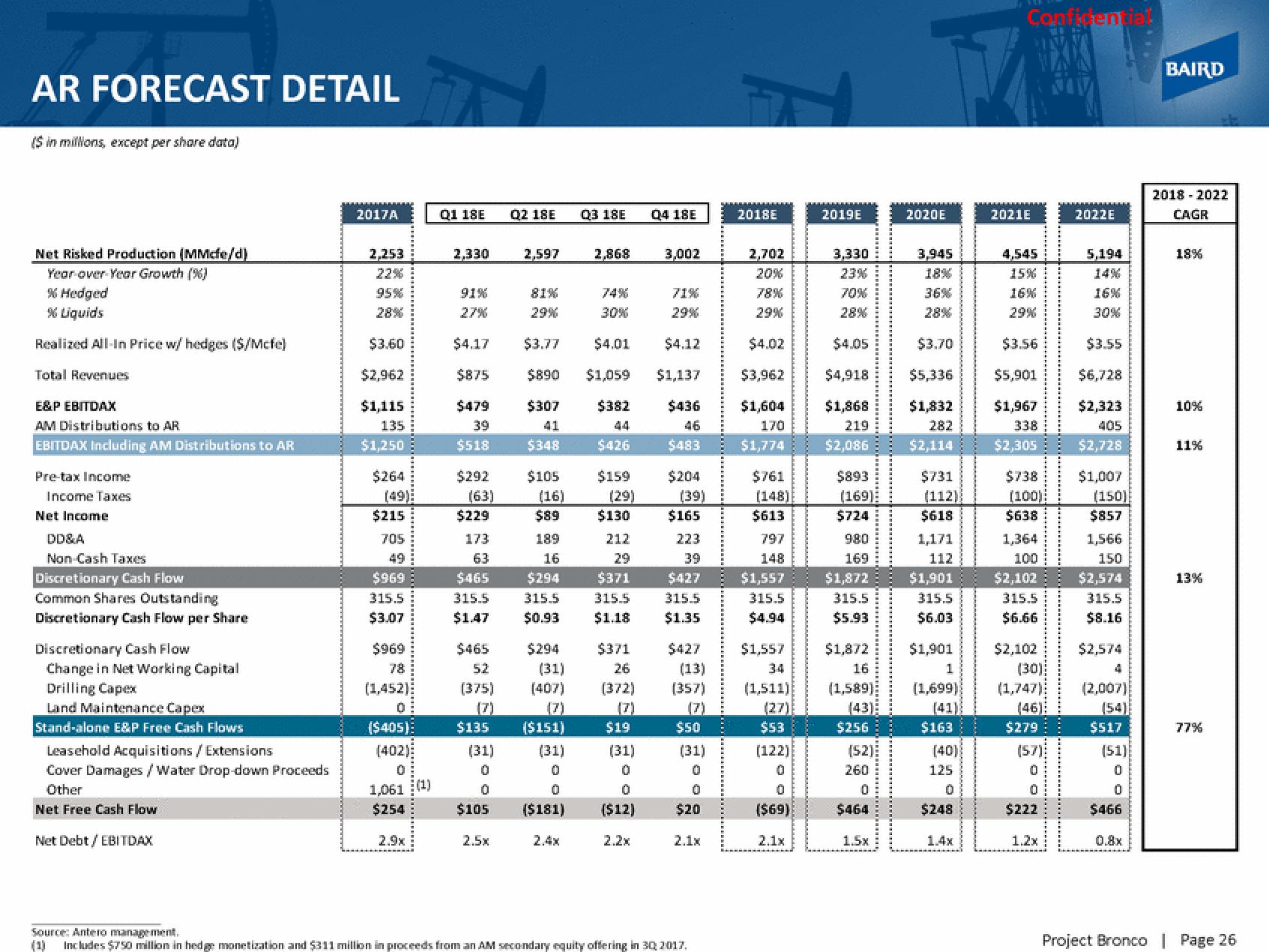

AR FORECAST DETAIL

($ in millions, except per share data)

Net Risked Production (MMcfe/d)

Year over Year Growth (%)

% Hedged

% Liquids

Realized All-In Price w/ hedges ($/Mcfe)

Total Revenues

E&P EBITDAX

AM Distributions to AR

EBITDAX Including AM Distributions to AR

Pre-tax Income

Income Taxes

Net Income

DD&A

Non Cash Taxes

Discretionary Cash Flow

Common Shares Outstanding

Discretionary Cash Flow per Share

Discretionary Cash Flow

Change in Net Working Capital

Drilling Capex

Land Maintenance Capex

Stand-alone E&P Free Cash Flows

Leasehold Acquisitions / Extensions

Cover Damages/Water Drop-down Proceeds

Other

Net Free Cash Flow

Net Debt / EBITDAX

2017A

2,253

22%

95%

28%

$3.60

$2,962

$1,115

135

$1,250

$264

(49)

$215

705

$969

315.5

$3.07

$969

78

(1,452)

($405):

(402)

0

1,061

$254

2.9x

(1)

Q1 18E

2,330

91%

$4.17

$875

$479

39

$518

$292

(63)

$229

173

63

$465

315.5

$1.47

$465

52

(375)

(7)

$135

(31)

0

0

$105

2.5x

Q2 18E

2,597

$105

(16)

$89

189

16

$294

315.5

$0.93

81%

71%

29%

30%

29%

$3.77

$4.01

$4.12

$890 $1,059 $1,137

$307

$382

$436

41

$348

$294

(31)

(407)

03 18E

($151)

(31)

0

0

($181)

2,868

$426

$159

(29)

$130

212

29

$371

315.5

$1.18

$371

26

(372)

$19

Q4 18E

(31)

0

0

($12)

2.2x

3,002

$483

$204

(39)

$165

223

39

$427

315.5

$1.35

$427

(13)

(357)

$50

(31)

0

0

$20

2.1x

Source: Antero management.

(1)

Includes $750 million in hedge monetization and $311 million in proceeds from an AM secondary equity offering in 30 2017.

2018E

2,702

20%

78%

29%

$4.02

$3,962

$1,604

170

$1,774

$761

(148)

$613

797

148

$1,557

315.5

$4.94

$1,557

34

(1,511)

(27)

$53

(122)

0

0

($69)

2.1x

2019E

3,330

23%

70%

28%

$4.05

$4,918

$1,868

219

$2,086

$893

(169)

$724

980

169

$1,872

315.5

$5.93

$1,872

16

(1,589)

(43)

$256

(52)

260

0

$464

1.5x

2020E

3,945

18%

36%

28%

$3.70

$5,336

$1,832

282

$2,114

$731

(112)

$618

1,171

112

$1,901

315.5

$6.03

$1,901

1

(1,699)

(41)

$163

(40)

125

0

$248

1.4x

Confidential

2021E

4,545

15%

16%

29%

$3.56

$5,901

$1,967

338

$2,305

$738

(100):

$638

1,364

100

$2,102

315.5

$6.66

$2,102

(30)

(1,747)

(46):

$279:

(57)

0

0

$222

1.2x

2022E

5,194

16%

30%

$3.55

$6,728

$2,323

405

$2,728

$1,007

(150)

$857

1,566

150

$2,574

315.5

$8.16

$2,574

4

(2,007)

$517

(51)

0

0

$466

0.8x

BAIRD

2018-2022

CAGR

18%

10%

11%

13%

77%

Project Bronco | Page 26View entire presentation