Dutch Bros Results Presentation Deck

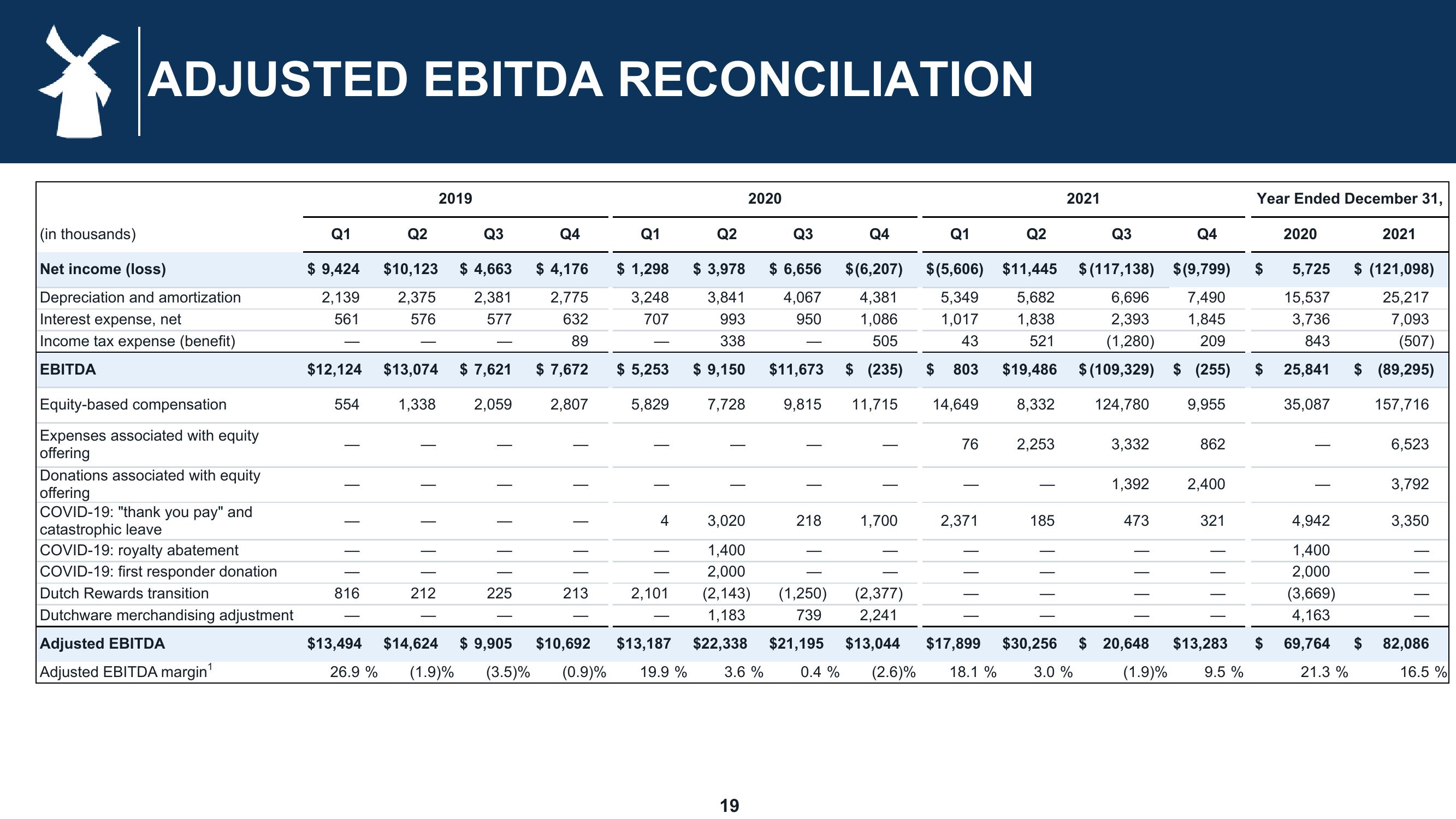

ADJUSTED EBITDA RECONCILIATION

(in thousands)

Net income (loss)

Depreciation and amortization

Interest expense, net

Income tax expense (benefit)

EBITDA

Equity-based compensation

Expenses associated with equity

offering

Donations associated with equity

offering

COVID-19: "thank you pay" and

catastrophic leave

COVID-19: royalty abatement

COVID-19: first responder donation

Dutch Rewards transition

Dutchware merchandising adjustment

Adjusted EBITDA

Adjusted EBITDA margin¹

Q1

$ 9,424

2,139

561

554

$12,124 $13,074

||||

Q2

816

$10,123

2,375

576

1,338

||||

212

2019

Q3

$ 4,663

2,381

577

$ 7,621

2,059

225

Q4

$ 4,176

2,775

632

89

$ 7,672

2,807

213

Q1

$ 1,298

3,248

707

$ 5,253

5,829

4

2,101

$13,494 $14,624 $ 9,905 $10,692 $13,187

26.9% (1.9)% (3.5)% (0.9)% 19.9 %

Q2

$ 3,978

3,841

993

338

$ 9,150

7,728

2020

19

Q3

$ 6,656

4,067

950

218

Q4

$11,673

9,815 11,715 14,649

Q1

Q2

Q3

Q4

5,725

15,537

$ (6,207) $(5,606) $11,445 $(117,138) $(9,799)

4,381 5,349

7,490

1,086 1,017

1,845

3,736

505

43

209

843

(235) $ 803

(255) $ 25,841

9,955

35,087

5,682

1,838

521

$19,486

6,696

2,393

(1,280)

$ (109,329)

124,780

3,020

1,400

2,000

(2,143) (1,250) (2,377)

1,183

739 2,241

$22,338 $21,195 $13,044

3.6 % 0.4 % (2.6)% 18.1 %

76

1,700

2,371

8,332

2,253

2021

185

3,332

1,392

473

$17,899 $30,256 $ 20,648

3.0 %

(1.9)%

862

2,400

Year Ended December 31,

321

$13,283 $

9.5 %

2020

2021

$ (121,098)

25,217

7,093

(507)

(89,295)

157,716

4,942

1,400

2,000

(3,669)

4,163

69,764 $

21.3 %

6,523

3,792

3,350

82,086

16.5 %View entire presentation