Tudor, Pickering, Holt & Co Investment Banking

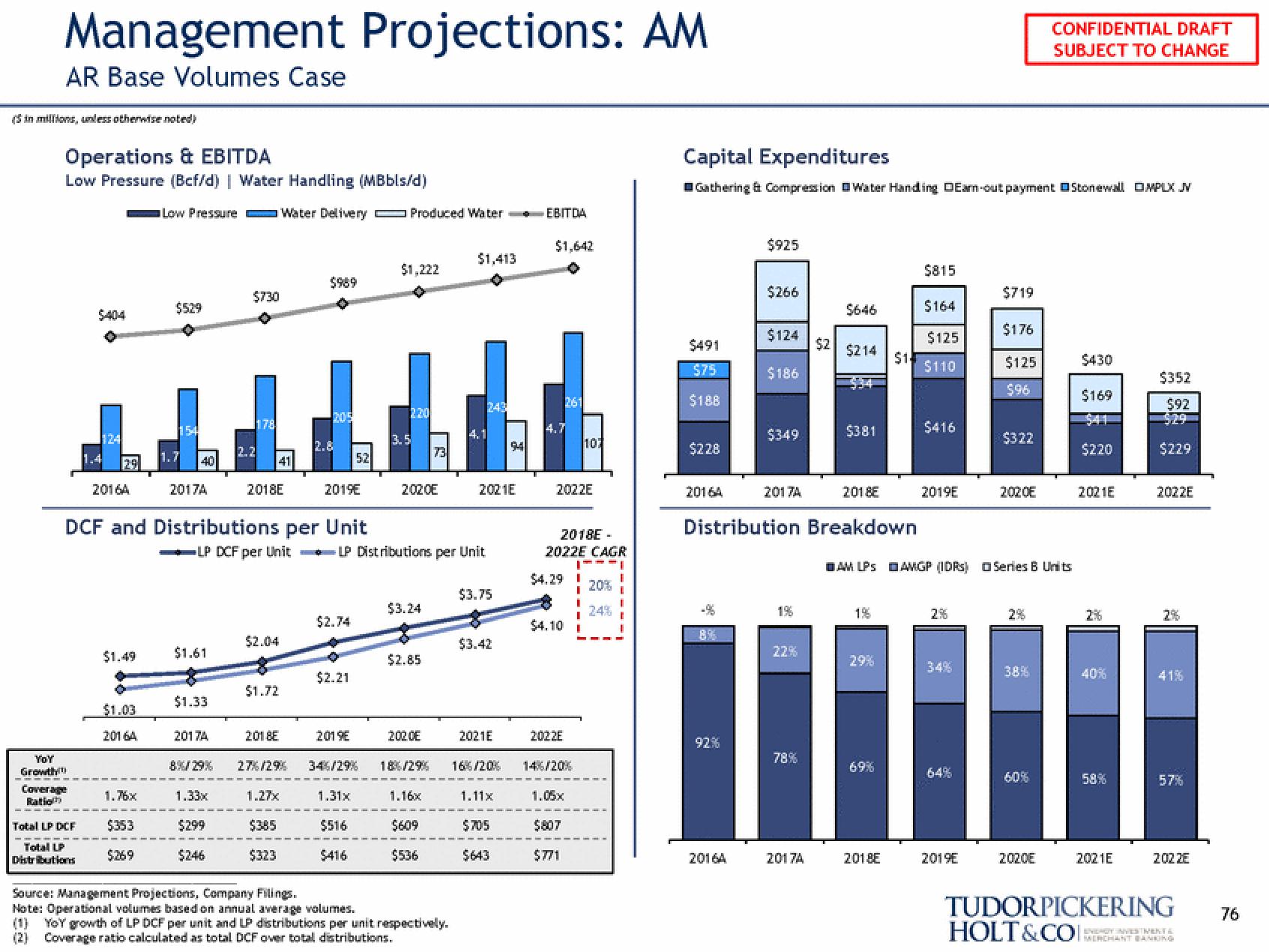

Management Projections: AM

AR Base Volumes Case

(in millions, unless otherwise noted)

YOY

Growth

Operations & EBITDA

Low Pressure (Bcf/d) | Water Handling (MBbls/d)

Coverage

Ratio

$404

Total LP DCF

Total LP

Distributions

124

1.4

2016A

$1.49

$1.03

20164

1.76x

Low Pressure Water Delivery Produced Water EBITDA

$1,642

$353

$269

$529

40

2017A

$1.61

$1.33

T

DCF and Distributions per Unit

LP DCF per Unit

$730

2017A

178

41

2018E

$2.04

$1.72

2018E

8%/29% 27%/29%

1.33x

$299

$246

$989

1.27x

$385

$323

205

2019E

52

$2.74

$2.21

$1,222

2019€

34%/29%

1.31x

$516

$416

220

3.5

2020E

LP Distributions per Unit

$3.24

$2.85

202.0E

18%/29%

73

1.16x

$609

$536

$1,413

Source: Management Projections, Company Filings.

Note: Operational volumes based on annual average volumes.

YoY growth of LP DCF per unit and LP distributions per unit respectively.

(2) Coverage ratio calculated as total DCF over total distributions.

243

2021E

$3.75

$3.42

2021E

16%/20%

1.11x

94

$705

$643

4.7

2022E

2018E -

2022E CAGR

$4.29 I

$4.10 I

2022E

14%/20%

107

1.05x

$807

$771

I

20% I

E

Capital Expenditures

Gathering & Compression Water Handing DEam-out payment Stonewall OMPLX JV

$491

$75

$188

$228

2016A

92%

$925

2016A

$266

$124

$186

$349

2017A

22%

78%

$646

Distribution Breakdown

2017A

$2 $214

$381

2018

1%

29%

$15

69%

2018E

$815

$164

$125

$110

$416

2019E

AM LPS AMGP (IDRS) □ Series B Units

2%

64%

$719

2019E

$176

$125

$96

$322

2020E

38%

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

60%

2020E

$430

$169

$220

2021E

40%

58%

2021E

$352

$92

$229

2022E

2%

41%

57%

202 ZE

TUDORPICKERING

HOLT&COI:

EVAGY INVESTMENT &

MERCHANT BANKING

76View entire presentation