Innovid SPAC Presentation Deck

33

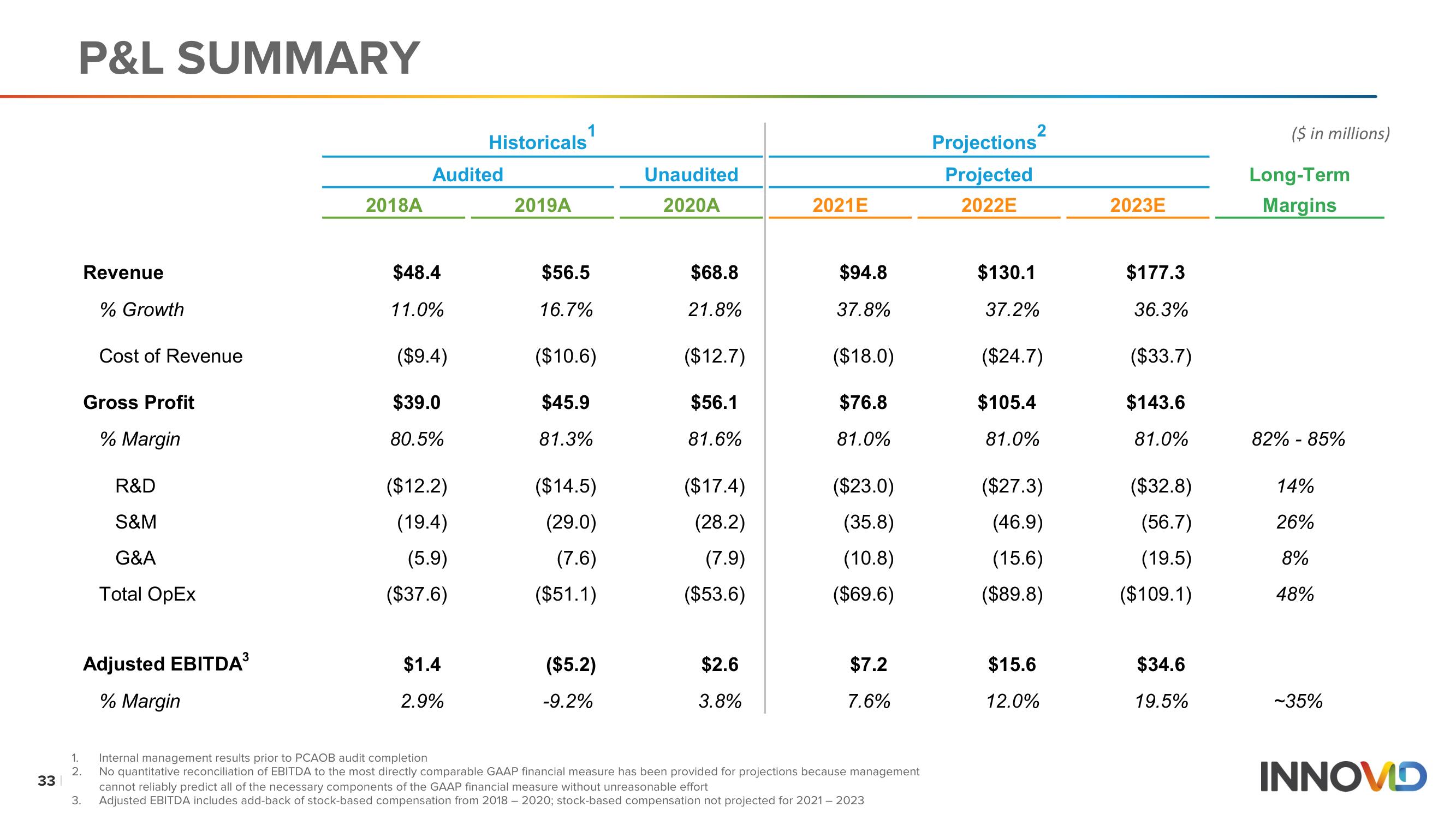

P&L SUMMARY

Revenue

% Growth

1.

2.

Cost of Revenue

Gross Profit

% Margin

R&D

S&M

G&A

Total OpEx

Adjusted EBITDA³

% Margin

2018A

Audited

$48.4

11.0%

($9.4)

$39.0

80.5%

($12.2)

(19.4)

(5.9)

($37.6)

Historicals

$1.4

2.9%

2019A

$56.5

16.7%

($10.6)

$45.9

81.3%

($14.5)

(29.0)

(7.6)

($51.1)

($5.2)

-9.2%

Unaudited

2020A

$68.8

21.8%

($12.7)

$56.1

81.6%

($17.4)

(28.2)

(7.9)

($53.6)

$2.6

3.8%

2021E

$94.8

37.8%

($18.0)

$76.8

81.0%

($23.0)

(35.8)

(10.8)

($69.6)

$7.2

7.6%

Internal management results prior to PCAOB audit completion

No quantitative reconciliation of EBITDA to the most directly comparable GAAP financial measure has been provided for projections because management

cannot reliably predict all of the necessary components of the GAAP financial measure without unreasonable effort

3. Adjusted EBITDA includes add-back of stock-based compensation from 2018-2020; stock-based compensation not projected for 2021 - 2023

2

Projections

Projected

2022E

$130.1

37.2%

($24.7)

$105.4

81.0%

($27.3)

(46.9)

(15.6)

($89.8)

$15.6

12.0%

2023E

$177.3

36.3%

($33.7)

$143.6

81.0%

($32.8)

(56.7)

(19.5)

($109.1)

$34.6

19.5%

($ in millions)

Long-Term

Margins

82% - 85%

14%

26%

8%

48%

-35%

INNOVDView entire presentation