Deutsche Bank Results Presentation Deck

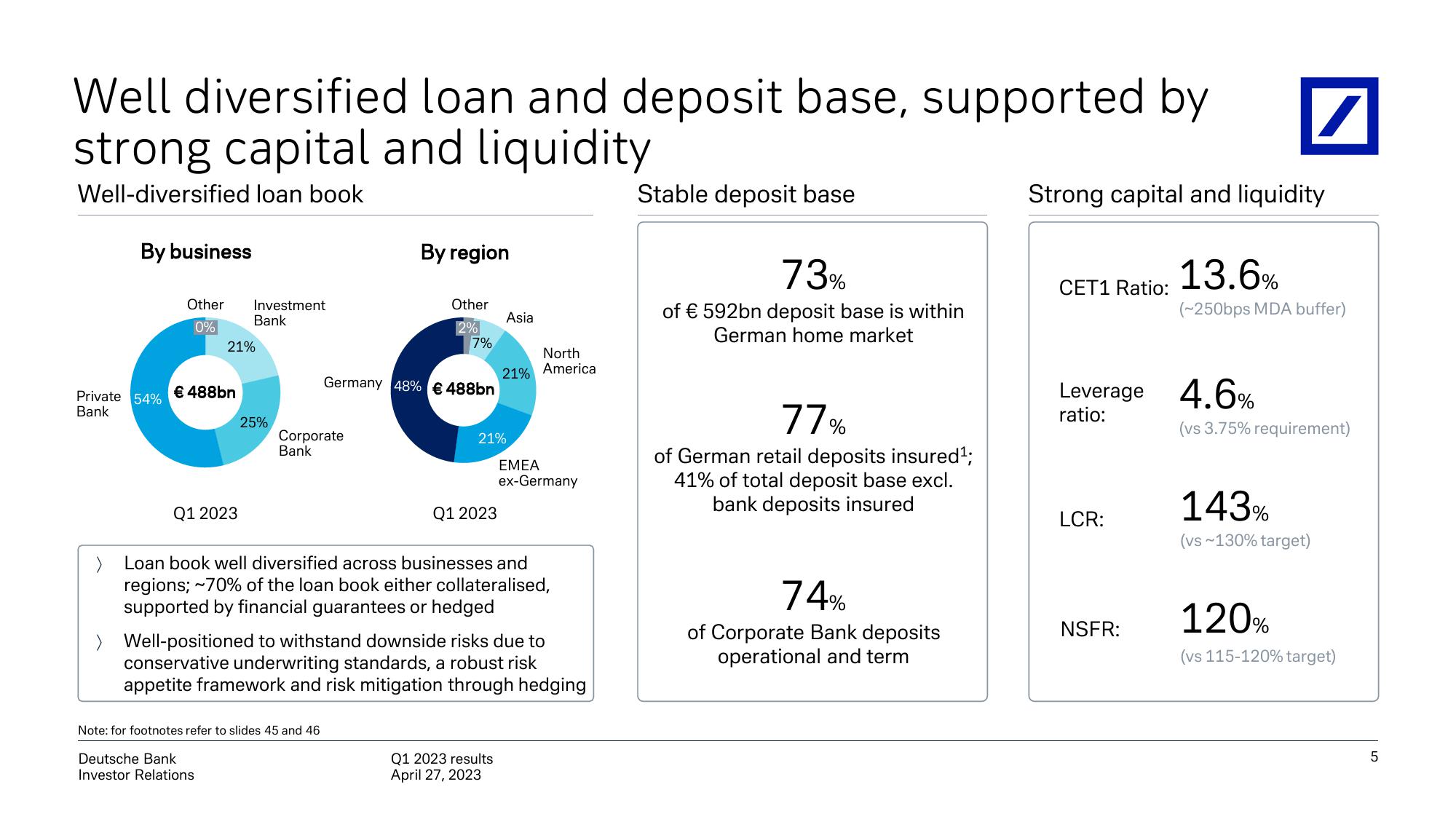

Well diversified loan and deposit base, supported by

strong capital and liquidity

Well-diversified loan book

By business

Private 54%

Bank

Other Investment

Bank

0%

21%

€ 488bn

Q1 2023

25%

Corporate

Bank

By region

Other

2%

Note: for footnotes refer to slides 45 and 46

Deutsche Bank

Investor Relations

7%

Germany 48% € 488bn

21%

Q1 2023

Asia

North

21% America

>

Loan book well diversified across businesses and

regions; ~70% of the loan book either collateralised,

supported by financial guarantees or hedged

Q1 2023 results

April 27, 2023

EMEA

ex-Germany

> Well-positioned to withstand downside risks due to

conservative underwriting standards, a robust risk

appetite framework and risk mitigation through hedging

Stable deposit base

73%

of € 592bn deposit base is within

German home market

77%

of German retail deposits insured¹;

41% of total deposit base excl.

bank deposits insured

74%

of Corporate Bank deposits

operational and term

Strong capital and liquidity

CET1 Ratio:

Leverage 4.6%

ratio:

LCR:

NSFR:

/

13.6%

(~250bps MDA buffer)

(vs 3.75% requirement)

143%

(vs~130% target)

120%

(vs 115-120% target)

5View entire presentation