GlobalFoundries Results Presentation Deck

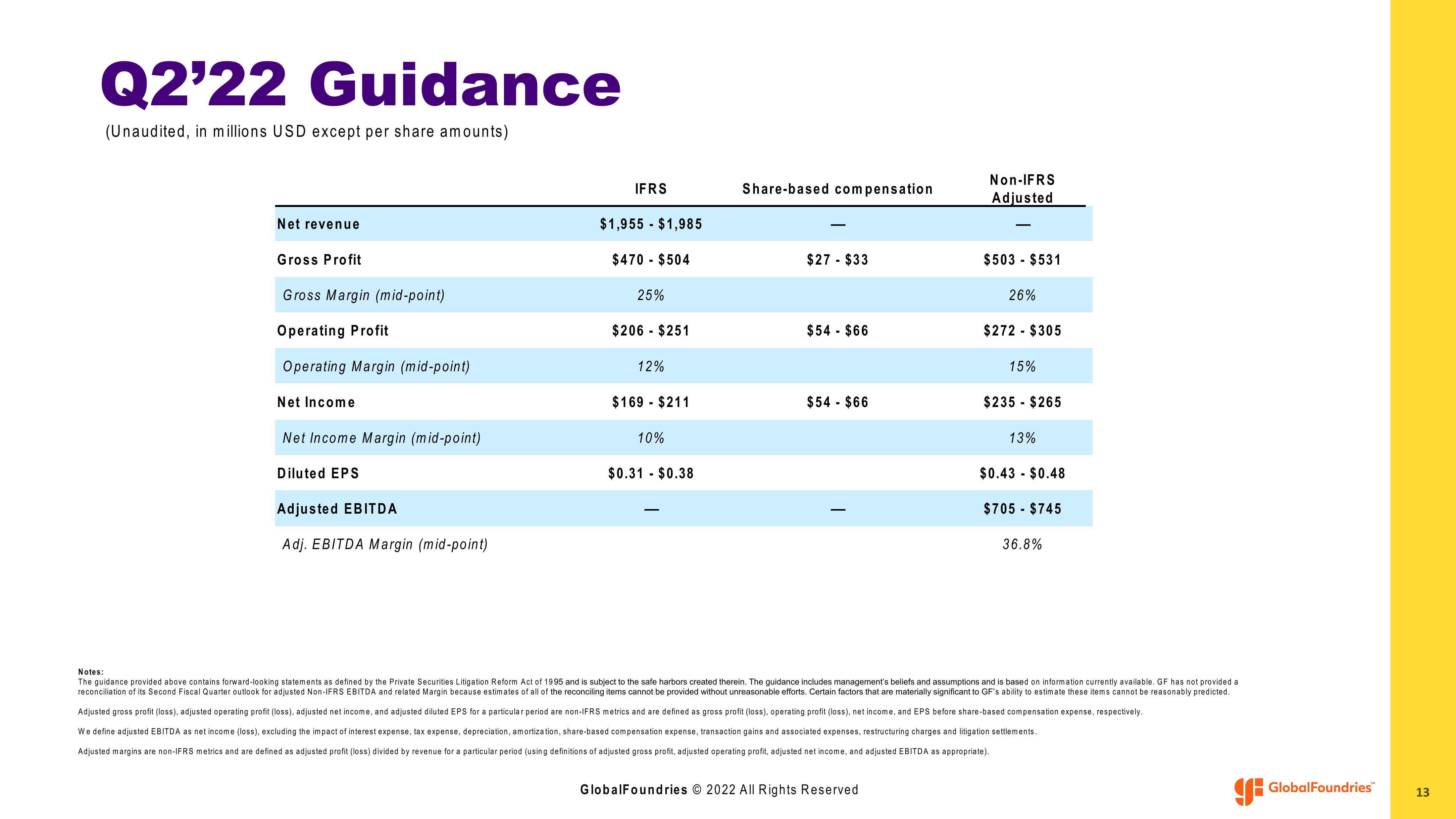

Q2'22 Guidance

(Unaudited, in millions USD except per share amounts)

Net revenue

Gross Profit

Gross Margin (mid-point)

Operating Profit

Operating Margin (mid-point)

Net Income

Net Income Margin (mid-point)

Diluted EPS

Adjusted EBITDA

Adj. EBITDA Margin (mid-point)

IFRS

$1,955 $1,985

$470-$504

25%

$206 - $251

12%

$169 $211

10%

$0.31 $0.38

Share-based compensation

$27 - $33

$54- $66

$54- $66

Non-IFRS

Adjusted

GlobalFoundries © 2022 All Rights Reserved

$503 $531

26%

$272 $305

15%

$235- $265

13%

$0.43 $0.48

$705- $745

36.8%

Notes:

The guidance provided above contains forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995 and is subject to the safe harbors created therein. The guidance includes management's beliefs and assumptions and is based on information currently available. GF has not provided a

reconciliation of its Second Fiscal Quarter outlook for adjusted Non-IFRS EBITDA and related Margin because estimates of all of the reconciling items cannot be provided without unreasonable efforts. Certain factors that are materially significant to GF's ability to estimate these items cannot be reasonably predicted.

Adjusted gross profit (loss), adjusted operating profit (loss), adjusted net income, and adjusted diluted EPS for a particular period are non-IFRS metrics and are defined as gross profit (loss), operating profit (loss), net income, and EPS before share-based compensation expense, respectively.

We define adjusted EBITDA as net income (loss), excluding the impact of interest expense, tax expense, depreciation, amortization, share-based compensation expense, transaction gains and associated expenses, restructuring charges and litigation settlements.

Adjusted margins are non-IFRS metrics and are defined as adjusted profit (loss) divided by revenue for a particular period (using definitions of adjusted gross profit, adjusted operating profit, adjusted net income, and adjusted EBITDA as appropriate).

GlobalFoundries™

13View entire presentation