Main Street Capital Investor Day Presentation Deck

Asset Management Business

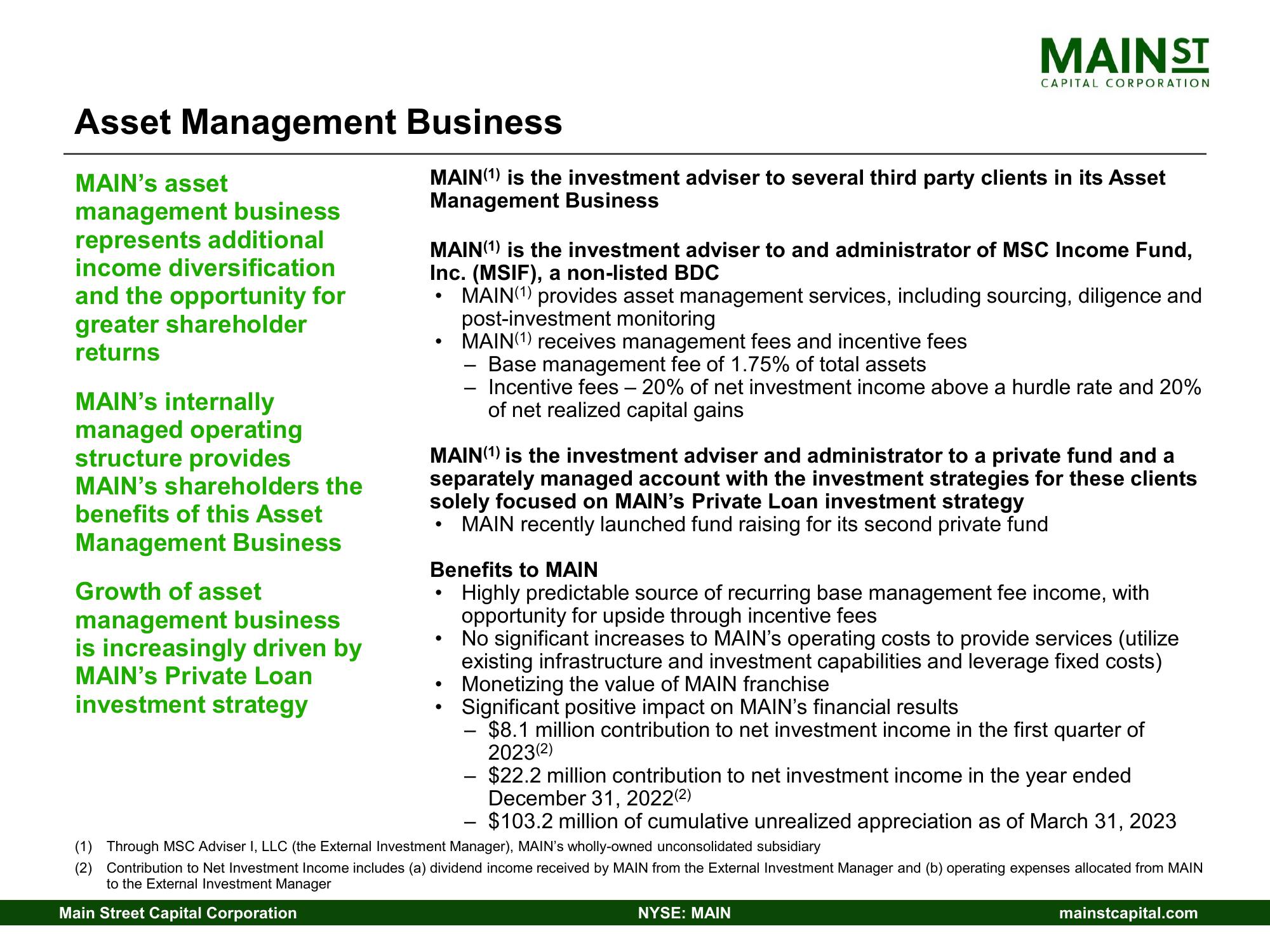

MAIN's asset

management business

represents additional

income diversification

and the opportunity for

greater shareholder

returns

MAIN's internally

managed operating

structure provides

MAIN's shareholders the

benefits of this Asset

Management Business

Growth of asset

management business

is increasingly driven by

MAIN's Private Loan

investment strategy

MAIN(1) is the investment adviser to several third party clients in its Asset

Management Business

●

MAIN(1) is the investment adviser to and administrator of MSC Income Fund,

Inc. (MSIF), a non-listed BDC

MAIN(1) provides asset management services, including sourcing, diligence and

post-investment monitoring

●

●

●

MAIN(1) is the investment adviser and administrator to a private fund and a

separately managed account with the investment strategies for these clients

solely focused on MAIN's Private Loan investment strategy

MAIN recently launched fund raising for its second private fund

●

MAINST

●

CAPITAL CORPORATION

-

Benefits to MAIN

Highly predictable source of recurring base management fee income, with

opportunity for upside through incentive fees

No significant increases to MAIN's operating costs to provide services (utilize

existing infrastructure and investment capabilities and leverage fixed costs)

Monetizing the value of MAIN franchise

Significant positive impact on MAIN's financial results

$8.1 million contribution to net investment income in the first quarter of

2023(2)

●

MAIN(1) receives management fees and incentive fees

Base management fee of 1.75% of total assets

Incentive fees - 20% of net investment income above a hurdle rate and 20%

of net realized capital gains

- $22.2 million contribution to net investment income in the year ended

December 31, 2022(²)

-

- $103.2 million of cumulative unrealized appreciation as of March 31, 2023

NYSE: MAIN

(1) Through MSC Adviser I, LLC (the External Investment Manager), MAIN's wholly-owned unconsolidated subsidiary

(2) Contribution to Net Investment Income includes (a) dividend income received by MAIN from the External Investment Manager and (b) operating expenses allocated from MAIN

to the External Investment Manager

Main Street Capital Corporation

mainstcapital.comView entire presentation