J.P.Morgan 4Q23 Earnings Results

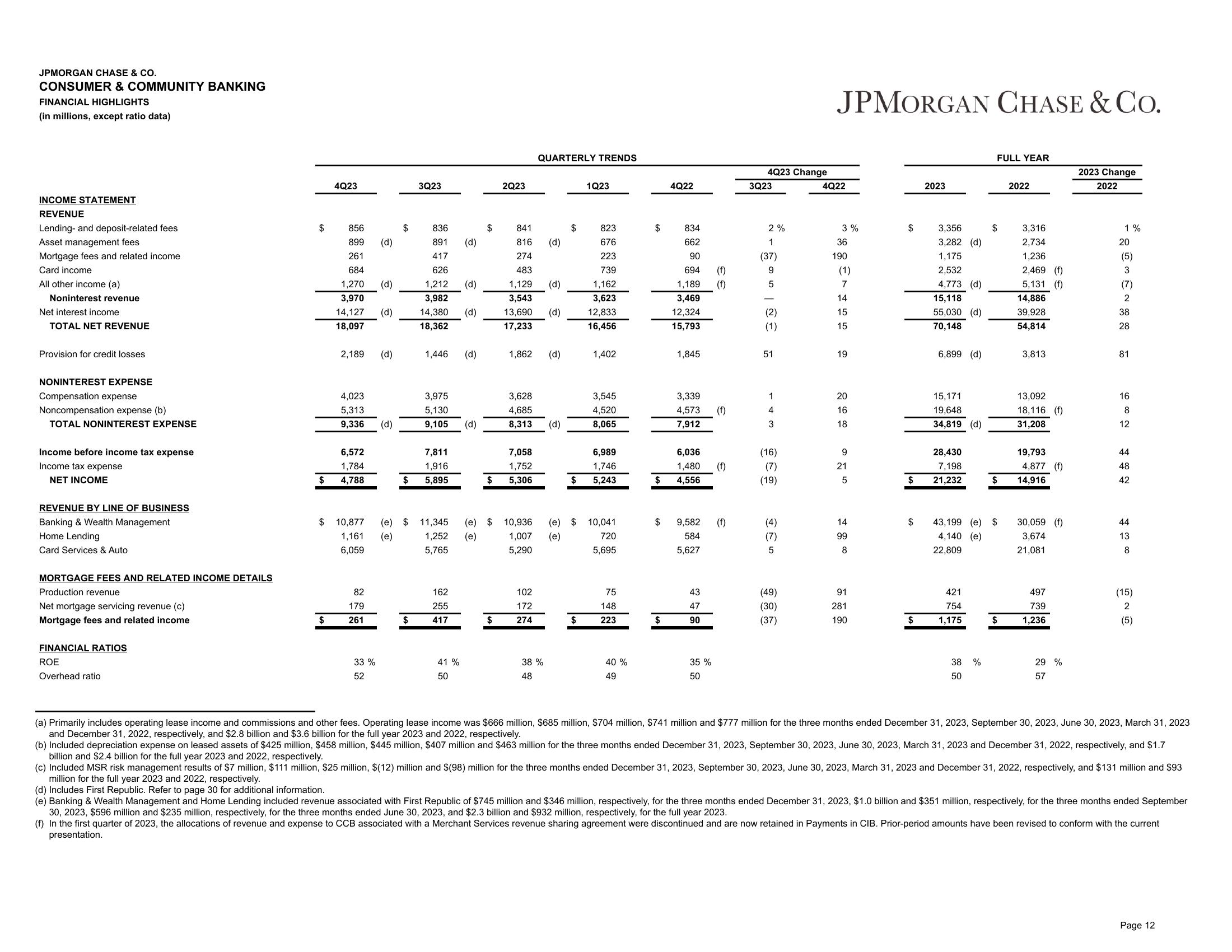

JPMORGAN CHASE & CO.

CONSUMER & COMMUNITY BANKING

FINANCIAL HIGHLIGHTS

(in millions, except ratio data)

INCOME STATEMENT

REVENUE

Lending- and deposit-related fees

Asset management fees

Mortgage fees and related income

Card income

All other income (a)

Noninterest revenue

Net interest income

TOTAL NET REVENUE

Provision for credit losses

NONINTEREST EXPENSE

Compensation expense

Noncompensation expense (b)

TOTAL NONINTEREST EXPENSE

Income before income tax expense

Income tax expense

NET INCOME

REVENUE BY LINE OF BUSINESS

Banking & Wealth Management

Home Lending

Card Services & Auto

MORTGAGE FEES AND RELATED INCOME DETAILS

Production revenue

Net mortgage servicing revenue (c)

Mortgage fees and related income

FINANCIAL RATIOS

ROE

Overhead ratio

$

4Q23

856

899 (d)

261

684

1,270

3,970

14,127

18,097

$

4,023

5,313

9,336

6,572

1,784

$ 4,788

2,189 (d)

(d)

82

179

261

(d)

33%

52

(d)

$ 10,877 (e) $

(e)

1,161

6,059

$

$

$

3Q23

836

891

417

626

1,212 (d)

3,982

14,380 (d)

18,362

1,446

3,975

5,130

9,105

7,811

1,916

5,895

11,345

1,252

5,765

162

255

417

41 %

50

(d)

(d)

(d)

$

$

(e) $

$

2Q23

841

816

274

483

1,129

3,543

13,690 (d)

17,233

3,628

4,685

8,313

7,058

1,752

5,306

QUARTERLY TRENDS

1,862 (d)

10,936

1,007

5,290

102

172

274

(d)

38 %

48

(d)

(d)

$

1Q23

823

676

223

739

1,162

3,623

12,833

16,456

$

1,402

3,545

4,520

8,065

6,989

1,746

$ 5,243

(e) $ 10,041

(e)

720

5,695

75

148

223

40 %

49

$

$

4Q22

$

834

662

90

694

1,189

3,469

12,324

15,793

1,845

3,339

4,573 (f)

7,912

6,036

1,480

4,556

$ 9,582

584

5,627

43

47

90

(f)

(f)

35 %

50

(f)

(f)

4Q23 Change

3Q23

2%

1

(37)

9

5

(2)

(1)

51

1

4

3

(16)

(7)

(19)

(4)

(7)

5

(49)

(30)

(37)

JPMORGAN CHASE & Co.

4Q22

3%

36

190

(1)

7

14

15

15

19

20

16

18

9

21

5

14

99

8

91

281

190

$

$

$

$

2023

3,356

3,282 (d)

1,175

2,532

4,773 (d)

15,118

55,030 (d)

70,148

6,899 (d)

15,171

19,648

34,819 (d)

28,430

7,198

21,232

421

754

1,175

38

50

FULL YEAR

43,199 (e) $

4,140 (e)

22,809

%

$

$

$

2022

3,316

2,734

1,236

2,469 (f)

5,131 (f)

14,886

39,928

54,814

3,813

13,092

18,116 (f)

31,208

19,793

4,877 (f)

14,916

30,059 (f)

3,674

21,081

497

739

1,236

29 %

57

2023 Change

2022

1%

20

(5)

3

(7)

2

38

28

81

16

8

12

44

48

42

44

13

8

(15)

2

(5)

(a) Primarily includes operating lease income and commissions and other fees. Operating lease income was $666 million, $685 million, $704 million, $741 million and $777 million for the three months ended December 31, 2023, September 30, 2023, June 30, 2023, March 31, 2023

and December 31, 2022, respectively, and $2.8 billion and $3.6 billion for the full year 2023 and 2022, respectively.

(b) Included depreciation expense on leased assets of $425 million, $458 million, $445 million, $407 million and $463 million for the three months ended December 31, 2023, September 30, 2023, June 30, 2023, March 31, 2023 and December 31, 2022, respectively, and $1.7

billion and $2.4 billion for the full year 2023 and 2022, respectively.

(c) Included MSR risk management results of $7 million, $111 million, $25 million, $(12) million and $(98) million for the three months ended December 31, 2023, September 30, 2023, June 30, 2023, March 31, 2023 and December 31, 2022, respectively, and $131 million and $93

million for the full year 2023 and 2022, respectively.

(d) Includes First Republic. Refer to page 30 for additional information.

(e) Banking & Wealth Management and Home Lending included revenue associated with First Republic of $745 million and $346 million, respectively, for the three months ended December 31, 2023, $1.0 billion and $351 million, respectively, for the three months ended September

30, 2023, $596 million and $235 million, respectively, for the three months ended June 30, 2023, and $2.3 billion and $932 million, respectively, for the full year 2023.

(f) In the first quarter of 2023, the allocations of revenue and expense to CCB associated with a Merchant Services revenue sharing agreement were discontinued and are now retained in Payments in CIB. Prior-period amounts have been revised to conform with the current

presentation.

Page 12View entire presentation