Kinnevik Results Presentation Deck

WE ENDED THE YEAR WITH A MORE BALANCED GROWTH PORTFOLIO AFTER

CONTINUED HIGH TRANSACTION ACTIVITY THROUGH THE FOURTH QUARTER

PLEO

jobandtalent

vay

NICK'S

VillageMD*

Teladoc

Note:

Mathem

HEALTH

Travel Perk

KINNEVIK

SUSTAINABILITY

LINKED

FINANCING

FRAMEWORK

2021

Highlights of The Quarter

Q4 2021

We invested in Pleo's USD 200m financing round to further build on our

>10x return on investment to date

We continued to strengthen our Growth Portfolio through three new

investment - Jobandtalent, a world-leading digital temp staffing agency;

Vay, a tech-enabled mobility company and Nick's, a global food-tech

innovator

We maintained a high capital reallocation activity with SEK 5.3bn released

from Teladoc and Village MD

Mathem agreed to merge with Mat.se, Axfood's online grocer business, and

to enter into a long-term strategic supply agreement with Axfood's

purchasing and logistics company Dagab.

At another one of our software successes, TravelPerk raised USD 115m, of

which 25m from us, at an 80 percent premium to last quarter's fair value - a

testament to how the founder Avi Meir and his team steered the company

through the pandemic

We launched updated Diversity & Inclusion targets for 2022 and published

our first Sustainability-Linked Financing Framework

Net Asset Value pro forma Zalando and adjusted for Other Net Assets/Liabilities. A more detailed breakdown of NAV can be found on p. 8

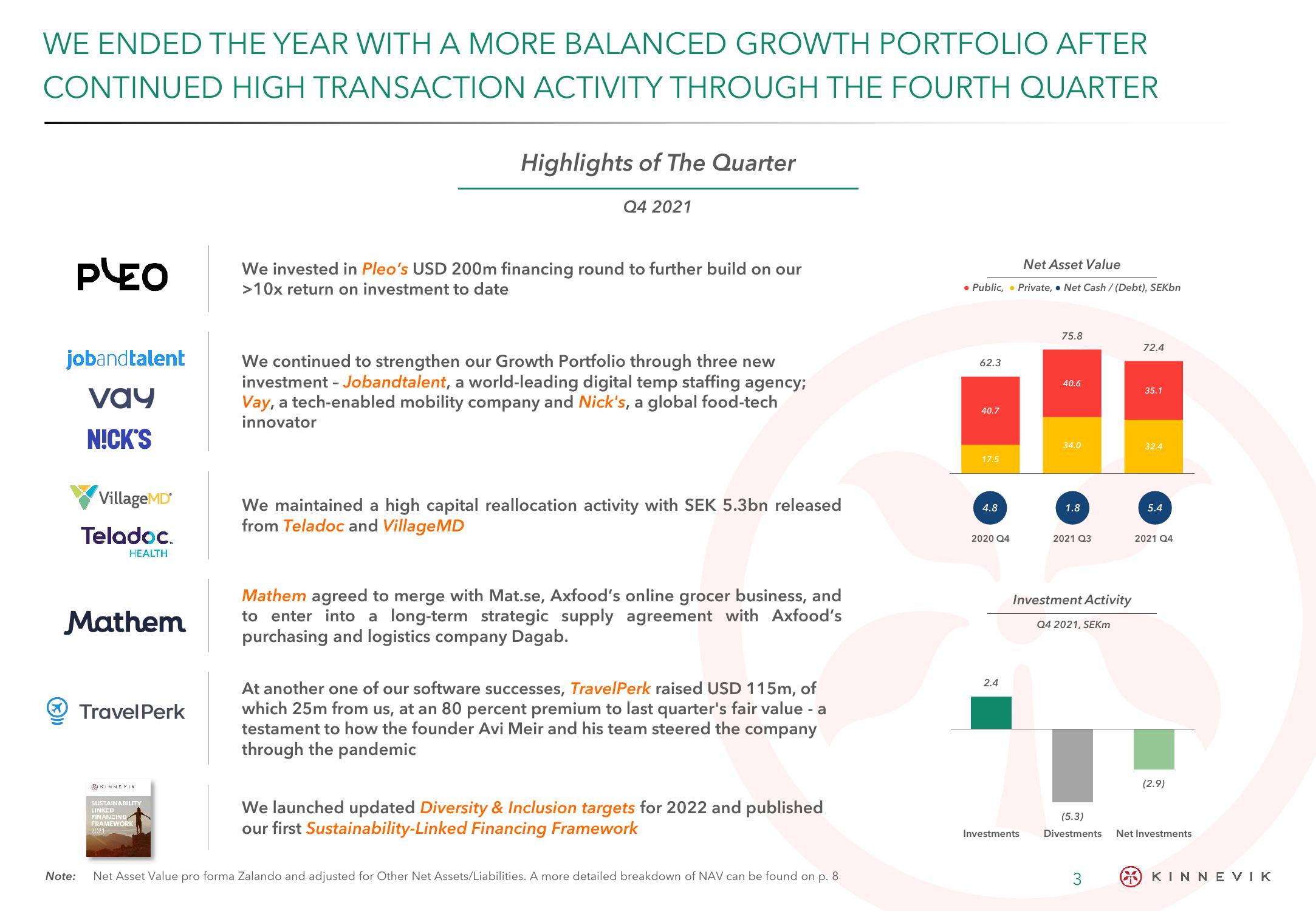

Net Asset Value

• Public, Private, Net Cash / (Debt), SEKbn

62.3

40.7

17.5

4.8

2020 Q4

2.4

75.8

Investments

40.6

34.0

1.8

2021 Q3

Investment Activity

Q4 2021, SEKM

(5.3)

Divestments

3

72.4

35.1

32.4

5.4

2021 Q4

(2.9)

Net Investments

(5) ΚΙΝΝΕVIKView entire presentation