OpenText Investor Presentation Deck

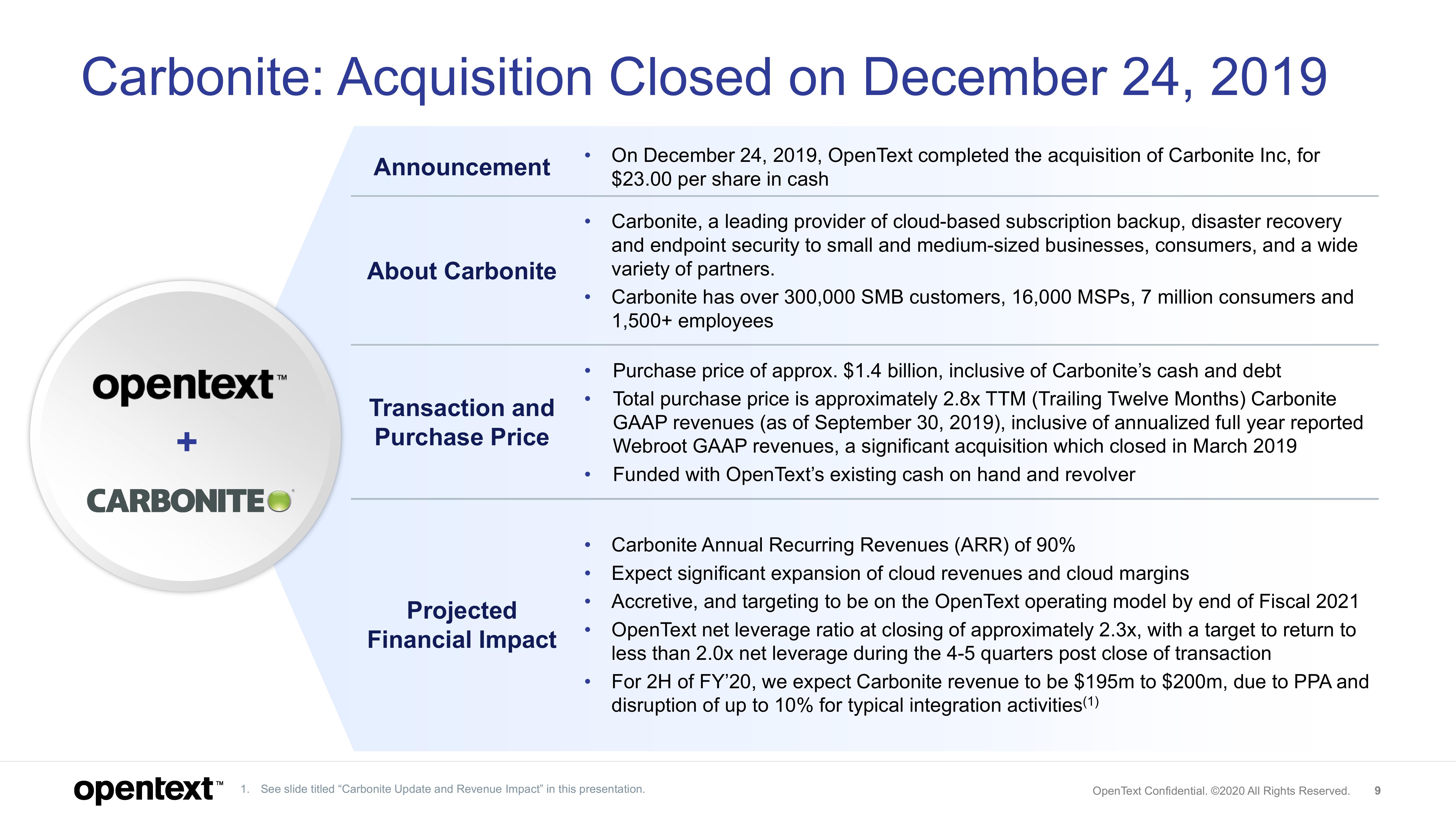

Carbonite: Acquisition Closed on December 24, 2019

On December 24, 2019, OpenText completed the acquisition of Carbonite Inc, for

$23.00 per share in cash

opentext™

CARBONITE

opentext™

Announcement

About Carbonite

Transaction and

Purchase Price

Projected

Financial Impact

●

●

●

●

●

●

●

●

Carbonite, a leading provider of cloud-based subscription backup, disaster recovery

and endpoint security to small and medium-sized businesses, consumers, and a wide

variety of partners.

Carbonite has over 300,000 SMB customers, 16,000 MSPs, 7 million consumers and

1,500+ employees

Purchase price of approx. $1.4 billion, inclusive of Carbonite's cash and debt

Total purchase price is approximately 2.8x TTM (Trailing Twelve Months) Carbonite

GAAP revenues (as of September 30, 2019), inclusive of annualized full year reported

Webroot GAAP revenues, a significant acquisition which closed in March 2019

Funded with Open Text's existing cash on hand and revolver

Carbonite Annual Recurring Revenues (ARR) of 90%

Expect significant expansion of cloud revenues and cloud margins

Accretive, and targeting to be on the Open Text operating model by end of Fiscal 2021

Open Text net leverage ratio at closing of approximately 2.3x, with a target to return to

less than 2.0x net leverage during the 4-5 quarters post close of transaction

For 2H of FY'20, we expect Carbonite revenue to be $195m to $200m, due to PPA and

disruption of up to 10% for typical integration activities (1)

1. See slide titled "Carbonite Update and Revenue Impact" in this presentation.

Open Text Confidential. ©2020 All Rights Reserved.

9View entire presentation