Evercore Investment Banking Pitch Book

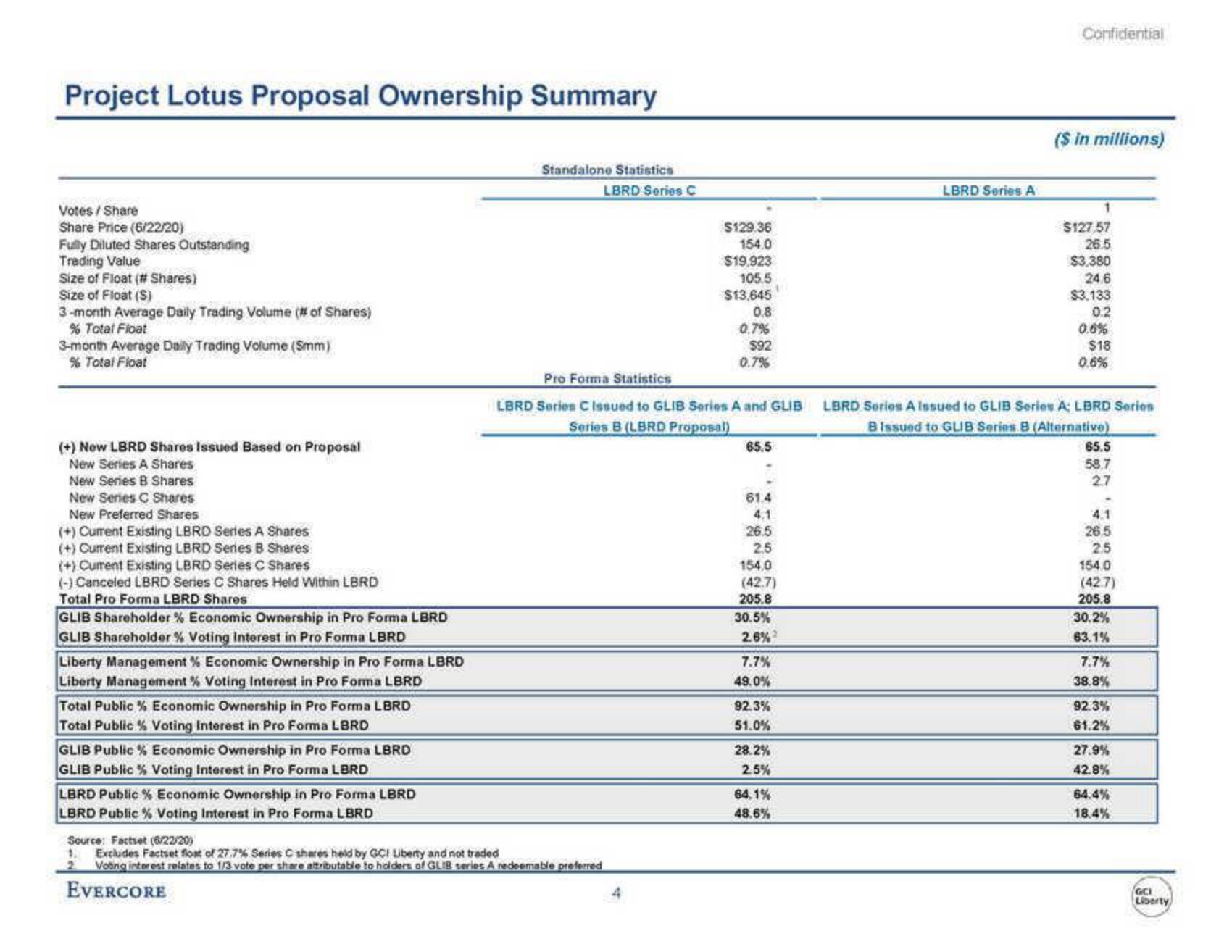

Project Lotus Proposal Ownership Summary

Votes/ Share

Share Price (6/22/20)

Fully Diluted Shares Outstanding

Trading Value

Size of Float (# Shares)

Size of Float (S)

3-month Average Daily Trading Volume (# of Shares)

% Total Float

3-month Average Daily Trading Volume (Smm)

% Total Float

(+) New LBRD Shares Issued Based on Proposal

New Series A Shares

New Series B Shares

New Series C Shares

New Preferred Shares

(+) Current Existing LBRD Series A Shares

(+) Current Existing LBRD Series B Shares

(+) Current Existing LBRD Series C Shares

(-) Canceled LBRD Series C Shares Held Within LBRD

Total Pro Forma LBRD Shares

GLIB Shareholder % Economic Ownership in Pro Forma LBRD

GLIB Shareholder % Voting Interest in Pro Forma LBRD

Liberty Management % Economic Ownership in Pro Forma LBRD

Liberty Management % Voting Interest in Pro Forma LBRD

Total Public Economic Ownership in Pro Forma LBRD

Total Public % Voting Interest in Pro Forma LBRD

GLIB Public % Economic Ownership in Pro Forma LBRD

GLIB Public % Voting Interest in Pro Forma LBRD

LBRD Public % Economic Ownership in Pro Forma LBRD

LBRD Public % Voting Interest in Pro Forma LBRD

Standalone Statistics

LBRD Series C

$129.36

154.0

$19,923

105.5

$13,645

Source: Factset (6/22/20)

Excludes Factset float of 27.7% Series C shares held by GCF Liberty and not traded

2 Voting interest relates to 1/3 vote per share attributable to holders of GLIB series A redeemable preferred

EVERCORE

0.8

0.7%

$92

0.7%

Pro Forma Statistics

LBRD Series C Issued to GLIB Series A and GLIB

Series B (LBRD Proposal)

65.5

61.4

4.1

26.5

2.5

154,0

(42.7)

205.8

30.5%

2.6%2

7.7%

49.0%

92.3%

51.0%

28.2%

2.5%

64,1%

48.6%

LBRD Series A

Confidential

($ in millions)

1

$127.57

26.5

$3,380

24.6

$3,133

0.2

0.6%

$18

0.6%

LBRD Series A Issued to GLIB Series A: LBRD Series

BIssued to GLIB Series B (Alternative)

65.5

58.7

27

4.1

26.5

2.5

154.0

(42.7)

205.8

30.2%

63.1%

7.7%

38.8%

92.3%

61.2%

27.9%

42.8%

64.4%

18.4%

GCI

LibertyView entire presentation