Maersk Investor Presentation Deck

Financial highlights Q3 2020

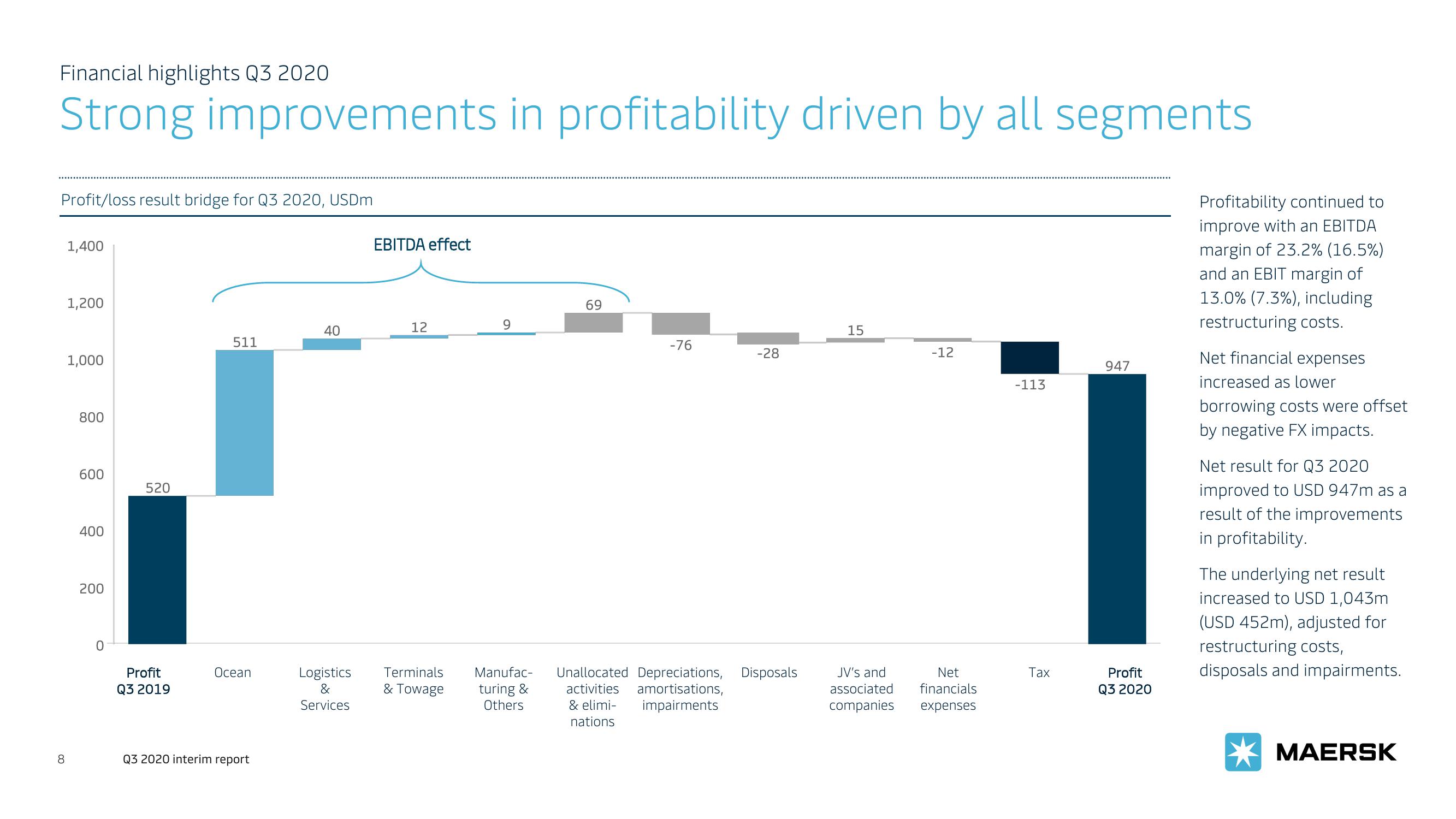

Strong improvements in profitability driven by all segments

Profit/loss result bridge for Q3 2020, USDm

8

1,400

1,200

1,000

800

600

400

200

0

520

Profit

Q3 2019

511

Ocean

Q3 2020 interim report

40

Logistics

&

Services

EBITDA effect

12

Terminals

& Towage

9

Manufac-

turing &

Others

69

-76

-28

Unallocated Depreciations, Disposals

activities amortisations,

impairments

& elimi-

nations

15

-12

JV's and

Net

associated financials

companies expenses

-113

Tax

947

Profit

Q3 2020

Profitability continued to

improve with an EBITDA

margin of 23.2% (16.5%)

and an EBIT margin of

13.0% (7.3%), including

restructuring costs.

Net financial expenses

increased as lower

borrowing costs were offset

by negative FX impacts.

Net result for Q3 2020

improved to USD 947m as a

result of the improvements

in profitability.

The underlying net result

increased to USD 1,043m

(USD 452m), adjusted for

restructuring costs,

disposals and impairments.

MAERSKView entire presentation