J.P.Morgan 4Q23 Earnings Results

JPMORGAN CHASE & CO.

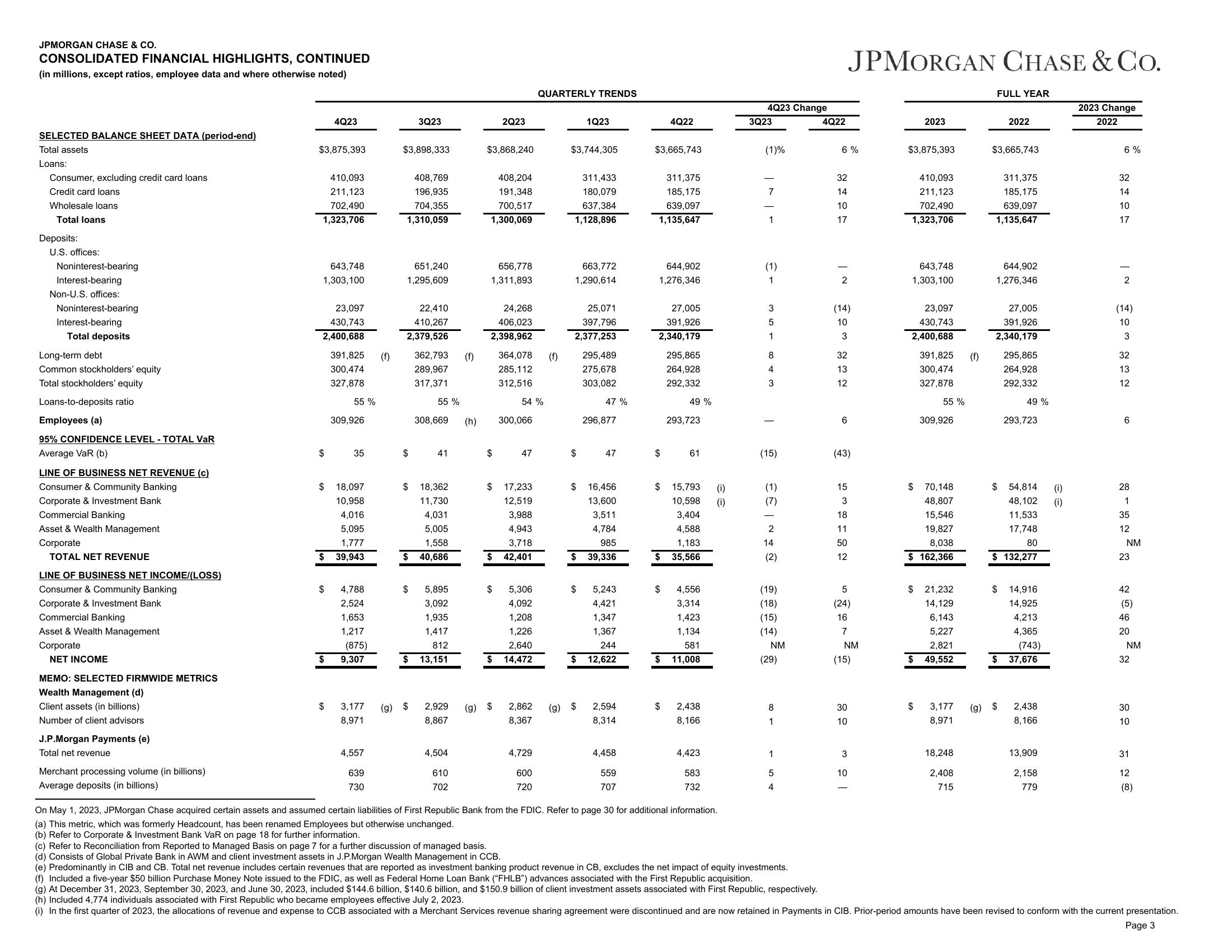

CONSOLIDATED FINANCIAL HIGHLIGHTS, CONTINUED

(in millions, except ratios, employee data and where otherwise noted)

SELECTED BALANCE SHEET DATA (period-end)

Total assets

Loans:

Consumer, excluding credit card loans

Credit card loans

Wholesale loans

Total loans

Deposits:

U.S. offices:

Noninterest-bearing

Interest-bearing

Non-U.S. offices:

Noninterest-bearing

Interest-bearing

Total deposits

Long-term debt

Common stockholders' equity

Total stockholders' equity

Loans-to-deposits ratio

Employees (a)

95% CONFIDENCE LEVEL - TOTAL VAR

Average VaR (b)

LINE OF BUSINESS NET REVENUE (c)

Consumer & Community Banking

Corporate & Investment Bank

Commercial Banking

Asset & Wealth Management

Corporate

TOTAL NET REVENUE

LINE OF BUSINESS NET INCOME/(LOSS)

Consumer & Community Banking

Corporate & Investment Bank

Commercial Banking

Asset & Wealth Management

Corporate

NET INCOME

MEMO: SELECTED FIRMWIDE METRICS

Wealth Management (d)

Client assets (in billions)

Numbe

ent advis

J.P.Morgan Payments (e)

Total net revenue

Merchant processing volume (in billions)

Average deposits (in billions)

$3,875,393

410,093

211,123

702,490

1,323,706

643,748

1,303,100

23,097

430,743

2,400,688

$

4Q23

$

$

$

$

391,825 (f)

300,474

327,878

55 %

309,926

35

18,097

10,958

4,016

5,095

1,777

39,943

4,788

2,524

1,653

1,217

(875)

9,307

3,177

8,971

4,557

639

730

$3,898,333

408,769

196,935

704,355

1,310,059

3Q23

651,240

1,295,609

22,410

410,267

2,379,526

$

$

362,793

289,967

317,371

55 %

(g) $

308,669

$ 18,362

11,730

4,031

41

5,005

1,558

$ 40,686

5,895

3,092

1,935

1,417

812

$13,151

2,929

8,867

4,504

610

702

(f)

(h)

(g)

$3,868,240

2Q23

408,204

191,348

700,517

1,300,069

656,778

1,311,893

24,268

406,023

2,398,962

$

$

364,078 (f)

285,112

312,516

54%

300,066

47

17,233

12,519

3,988

4,943

3,718

$ 42,401

5,306

4,092

1,208

1,226

2,640

$ 14,472

QUARTERLY TRENDS

2,862

8,367

4,729

600

720

$3,744,305

311,433

180,079

637,384

1,128,896

1Q23

663,772

1,290,614

25,071

397,796

2,377,253

295,489

275,678

303,082

$

$

47 %

(g) $

296,877

$ 16,456

13,600

3,511

4,784

985

$ 39,336

47

5,243

4,421

1,347

1,367

244

$12,622

2,594

8,31.

4,458

559

707

$3,665,743

311,375

185,175

639,097

1,135,647

644,902

1,276,346

4Q22

27,005

391,926

2,340,179

295,865

264,928

292,332

$

$

$

$

49 %

$ 15,793 (1)

10,598

3,404

(1)

4,588

1,183

$ 35,566

293,723

61

4,556

3,314

1,423

1,134

581

11,008

2,438

8,166

4,423

583

732

On May 1, 2023, JPMorgan Chase acquired certain assets and assumed certain liabilities of First Republic Bank from the FDIC. Refer to page 30 for additional information.

(a) This metric, which was formerly Headcount, has been renamed Employees but otherwise unchanged.

(b) Refer to Corporate & Investment Bank VaR on page 18 for further information.

4Q23 Change

3Q23

(1)%

7

1

(1)

1

35-00 +3

1

8

4

T

(15)

(1)

(7)

2

14

(2)

(19)

(18)

(15)

(14)

NM

(29)

8

1

1

5

4

(c) Refer to Reconciliation from Reported to Managed Basis on page 7 for a further discussion of managed basis.

(d) Consists of Global Private Bank in AWM and client investment assets in J.P.Morgan Wealth Management in CCB.

(e) Predominantly in CIB and CB. Total net revenue includes certain revenues that are reported as investment banking product revenue in CB, excludes the net impact of equity investments.

4Q22

6%

32

14

10

17

2

(14)

10

JPMORGAN CHASE & CO.

3

32

13

12

6

(43)

15

3

18

11

50

12

5

(24)

16

7

NM

(15)

30

10

3

10

2023

$3,875,393

410,093

211,123

702,490

1,323,706

643,748

1,303, 100

23,097

430,743

2,400,688

391,825 (f)

300,474

327,878

$

55 %

309,926

$ 70,148

48,807

15,546

19,827

8,038

$ 162,366

$ 21,232

14,129

6,143

5,227

2,821

49,552

3,177

8,971

18,248

2,408

715

FULL YEAR

2022

$3,665,743

311,375

185, 175

639,097

1,135,647

644,902

1,276,346

27,005

391,926

2,340,179

295,865

264,928

292,332

49%

293,723

$ 54,814

(1)

48,102 (i)

11,533

17,748

80

$ 132,277

$ 14,916

14,925

4,213

4,365

(743)

$ 37,676

(g) $ 2,438

8,166

13,909

2,158

779

2023 Change

2022

6%

32

14

10

17

2

(14)

10

3

32

13

12

6

28

1

35

12

NM

23

42

(5)

46

20

NM

32

30

10

31

12

(8)

(f) Included a five-year $50 billion Purchase Money Note issued to the FDIC, as well as Federal Home Loan Bank ("FHLB") advances associated with the First Republic acquisition.

(g) At December 31, 2023, September 30, 2023, and June 30, 2023, included $144.6 billion, $140.6 billion, and $150.9 billion of client investment assets associated with First Republic, respectively.

(h) Included 4,774 individuals associated with First Republic who became employees effective July 2, 2023.

(i) In the first quarter of 2023, the allocations of revenue and expense to CCB associated with a Merchant Services revenue sharing agreement were discontinued and are now retained in Payments in CIB. Prior-period amounts have been revised to conform with the current presentation.

Page 3View entire presentation