Coppersmith Presentation to Alere Inc Stockholders

PAGE 36 |

COPPERSMITH

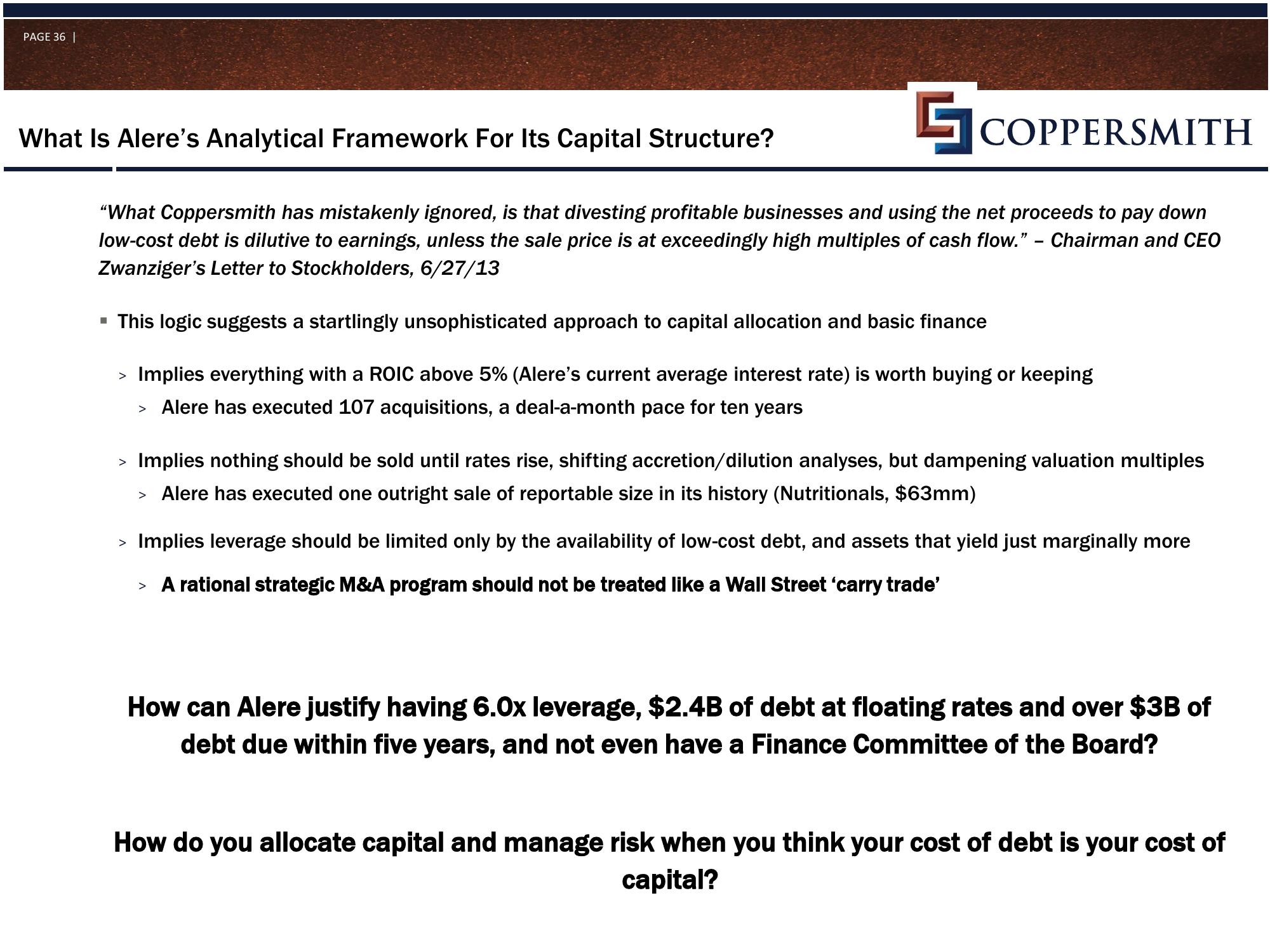

"What Coppersmith has mistakenly ignored, is that divesting profitable businesses and using the net proceeds to pay down

low-cost debt is dilutive to earnings, unless the sale price is at exceedingly high multiples of cash flow." - Chairman and CEO

Zwanziger's Letter to Stockholders, 6/27/13

▪ This logic suggests a startlingly unsophisticated approach to capital allocation and basic finance

> Implies everything with a ROIC above 5% (Alere's current average interest rate) is worth buying or keeping

> Alere has executed 107 acquisitions, a deal-a-month pace for ten years

What Is Alere's Analytical Framework For Its Capital Structure?

> Implies nothing should be sold until rates rise, shifting accretion/dilution analyses, but dampening valuation multiples

> Alere has executed one outright sale of reportable size in its history (Nutritionals, $63mm)

> Implies leverage should be limited only by the availability of low-cost debt, and assets that yield just marginally more

> A rational strategic M&A program should not be treated like a Wall Street 'carry trade'

How can Alere justify having 6.0x leverage, $2.4B of debt at floating rates and over $3B of

debt due within five years, and not even have a Finance Committee of the Board?

How do you allocate capital and manage risk when you think your cost of debt is your cost of

capital?View entire presentation