Investor Presentation

.

•

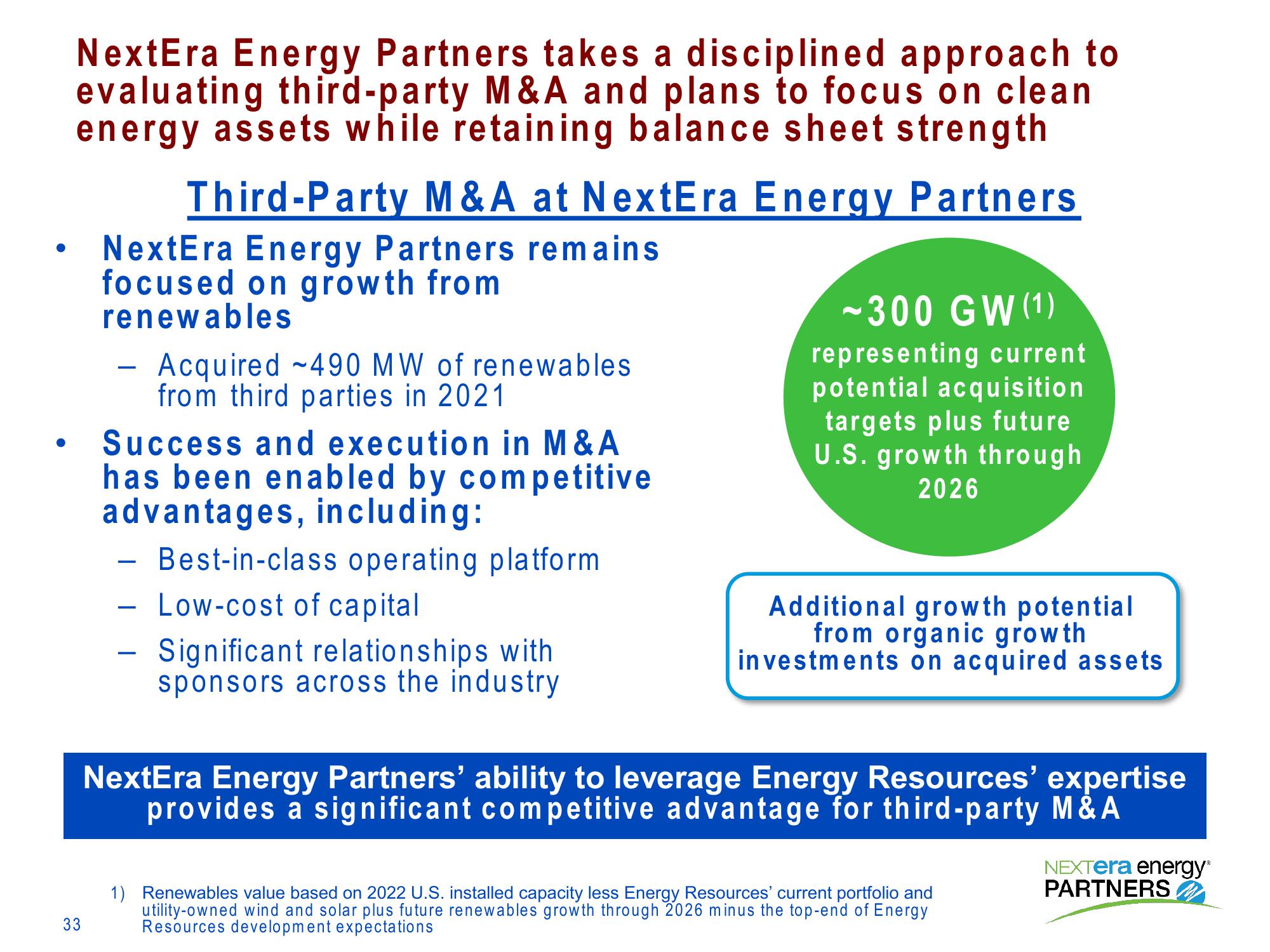

NextEra Energy Partners takes a disciplined approach to

evaluating third-party M&A and plans to focus on clean

energy assets while retaining balance sheet strength

Third-Party M&A at NextEra Energy Partners

NextEra Energy Partners remains

focused on growth from

renewables

-

Acquired ~490 MW of renewables

from third parties in 2021

Success and execution in M&A

has been enabled by competitive

advantages, including:

-

-

-

Best-in-class operating platform

Low-cost of capital

Significant relationships with

sponsors across the industry

~300 GW (1)

representing current

potential acquisition

targets plus future

U.S. growth through

2026

Additional growth potential

from organic growth

investments on acquired assets

NextEra Energy Partners' ability to leverage Energy Resources' expertise

provides a significant competitive advantage for third-party M&A

NEXTera energy®

PARTNERS

33

1) Renewables value based on 2022 U.S. installed capacity less Energy Resources' current portfolio and

utility-owned wind and solar plus future renewables growth through 2026 minus the top-end of Energy

Resources development expectationsView entire presentation