Baird Investment Banking Pitch Book

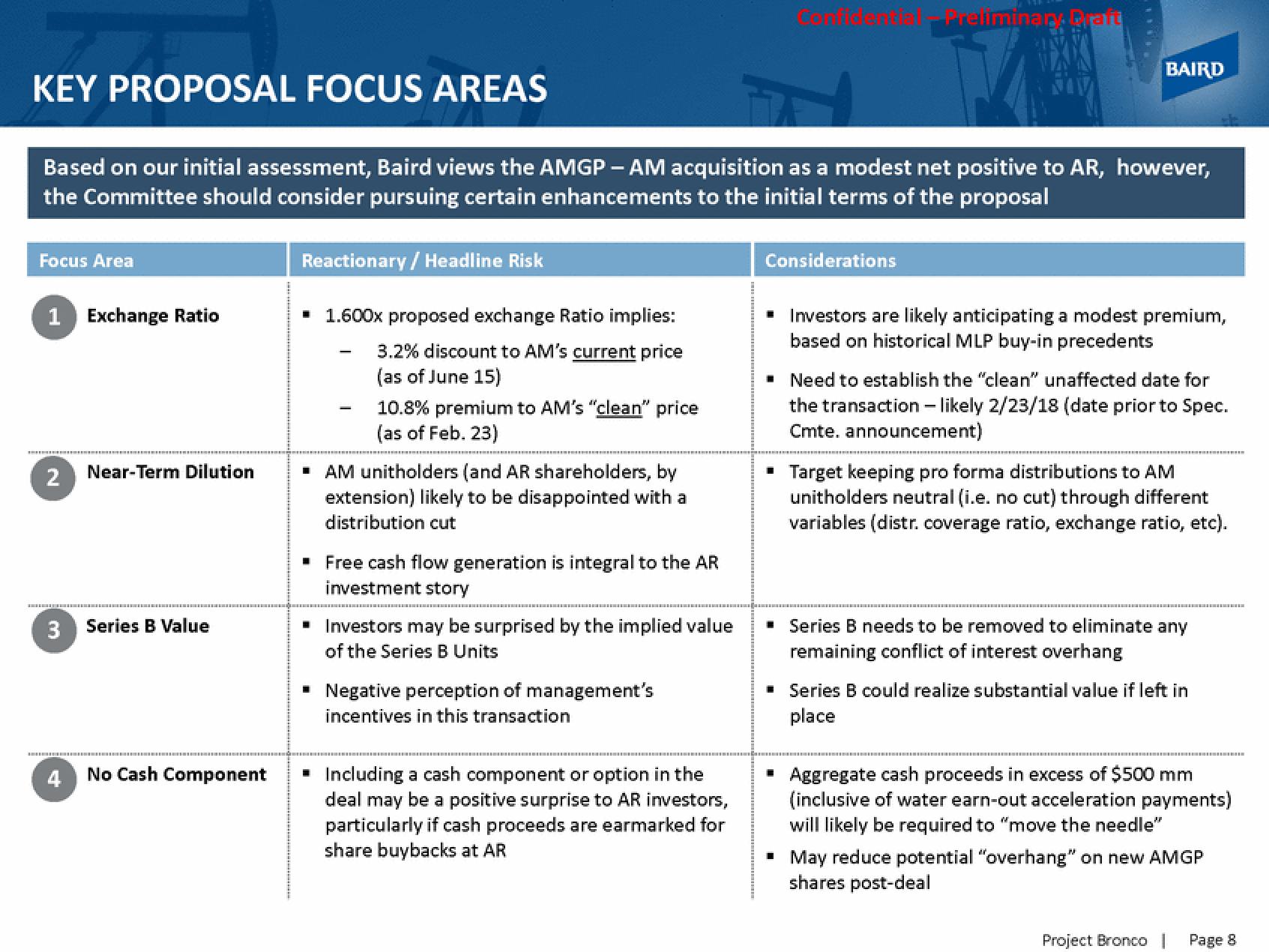

KEY PROPOSAL FOCUS AREAS

Focus Area

1 Exchange Ratio

Based on our initial assessment, Baird views the AMGP - AM acquisition as a modest net positive to AR, however,

the Committee should consider pursuing certain enhancements to the initial terms of the proposal

2

Near-Term Dilution

3 Series B Value

4

No Cash Component

Reactionary / Headline Risk

▪ 1.600x proposed exchange Ratio implies:

3.2% discount to AM's current price

(as of June 15)

-

10.8% premium to AM's "clean" price

(as of Feb. 23)

▪ AM unitholders (and AR shareholders, by

extension) likely to be disappointed with a

distribution cut

▪ Free cash flow generation is integral to the AR

investment story

Investors may be surprised by the implied value

of the Series B Units

▪ Negative perception of management's

incentives in this transaction

7

▪ Including a cash component or option in the

deal may be a positive surprise to AR investors,

particularly if cash proceeds are earmarked for

share buybacks at AR

Preliminar Paft

Considerations

BAIRD

▪ Investors are likely anticipating a modest premium,

based on historical MLP buy-in precedents

■ Need to establish the "clean" unaffected date for

the transaction - likely 2/23/18 (date prior to Spec.

Cmte. announcement)

■ Target keeping pro forma distributions to AM

unitholders neutral (i.e. no cut) through different

variables (distr. coverage ratio, exchange ratio, etc).

▪ Series B needs to be removed to eliminate any

remaining conflict of interest overhang

▪ Series B could realize substantial value if left in

place

▪ Aggregate cash proceeds in excess of $500 mm

(inclusive of water earn-out acceleration payments)

will likely be required to "move the needle"

▪ May reduce potential "overhang" on new AMGP

shares post-deal

Project Bronco

Page 8View entire presentation