Quanergy SPAC Presentation Deck

Transaction overview

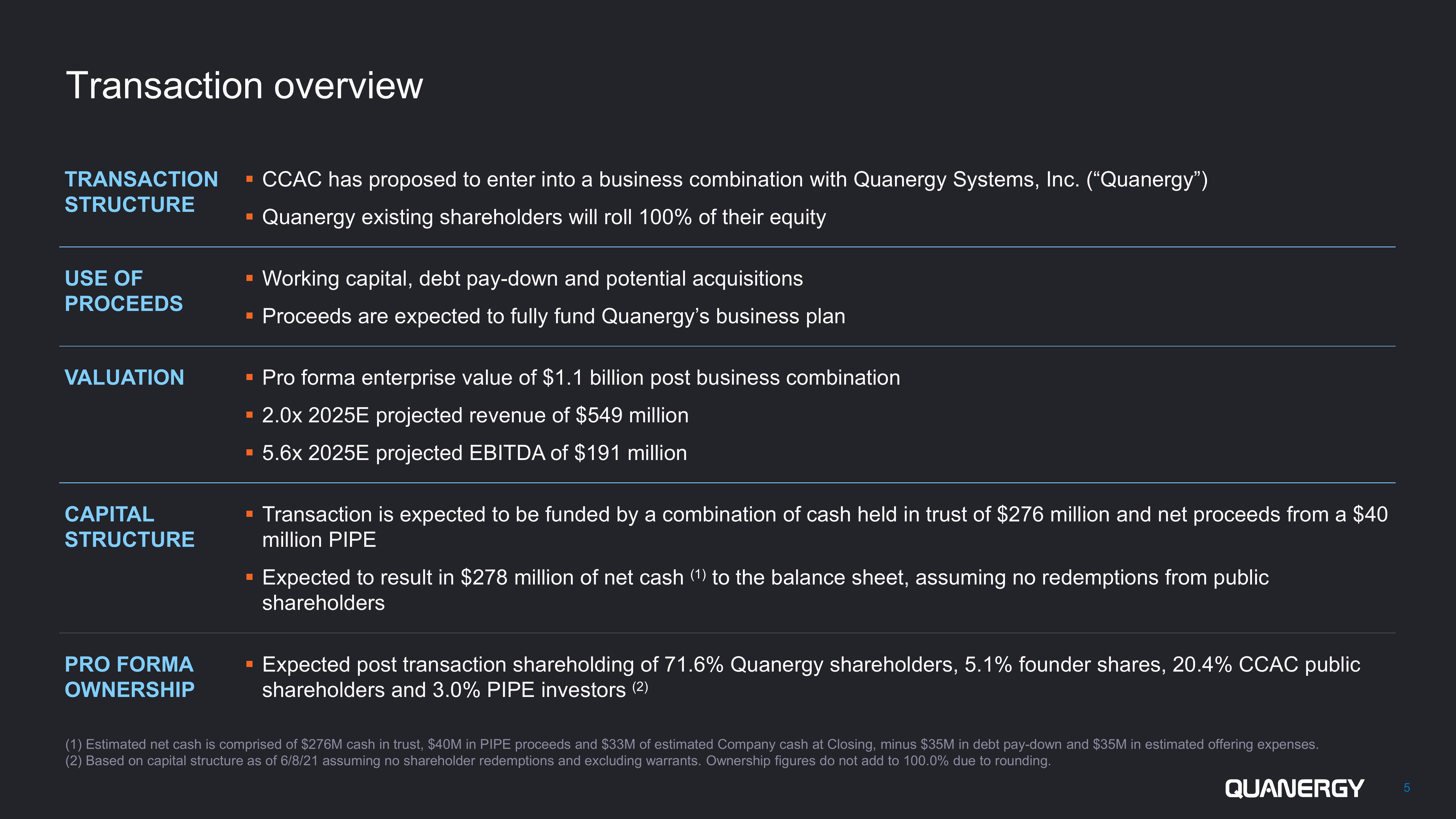

TRANSACTION

STRUCTURE

USE OF

PROCEEDS

VALUATION

CAPITAL

STRUCTURE

PRO FORMA

OWNERSHIP

■

■

■

Working capital, debt pay-down and potential acquisitions

▪ Proceeds are expected to fully fund Quanergy's business plan

▪ Pro forma enterprise value of $1.1 billion post business combination

▪ 2.0x 2025E projected revenue of $549 million

▪ 5.6x 2025E projected EBITDA of $191 million

■

CCAC has proposed to enter into a business combination with Quanergy Systems, Inc. ("Quanergy")

Quanergy existing shareholders will roll 100% of their equity

■

■

Transaction is expected to be funded by a combination of cash held in trust of $276 million and net proceeds from a $40

million PIPE

Expected to result in $278 million of net cash (1) to the balance sheet, assuming no redemptions from public

shareholders

Expected post transaction shareholding of 71.6% Quanergy shareholders, 5.1% founder shares, 20.4% CCAC public

shareholders and 3.0% PIPE investors (2)

(1) Estimated net cash is comprised of $276M cash in trust, $40M in PIPE proceeds and $33M of estimated Company cash at Closing, minus $35M in debt pay-down and $35M in estimated offering expenses.

(2) Based on capital structure as of 6/8/21 assuming no shareholder redemptions and excluding warrants. Ownership figures do not add to 100.0% due to rounding.

QUANERGY

5View entire presentation