Credit Suisse Results Presentation Deck

Wealth Management

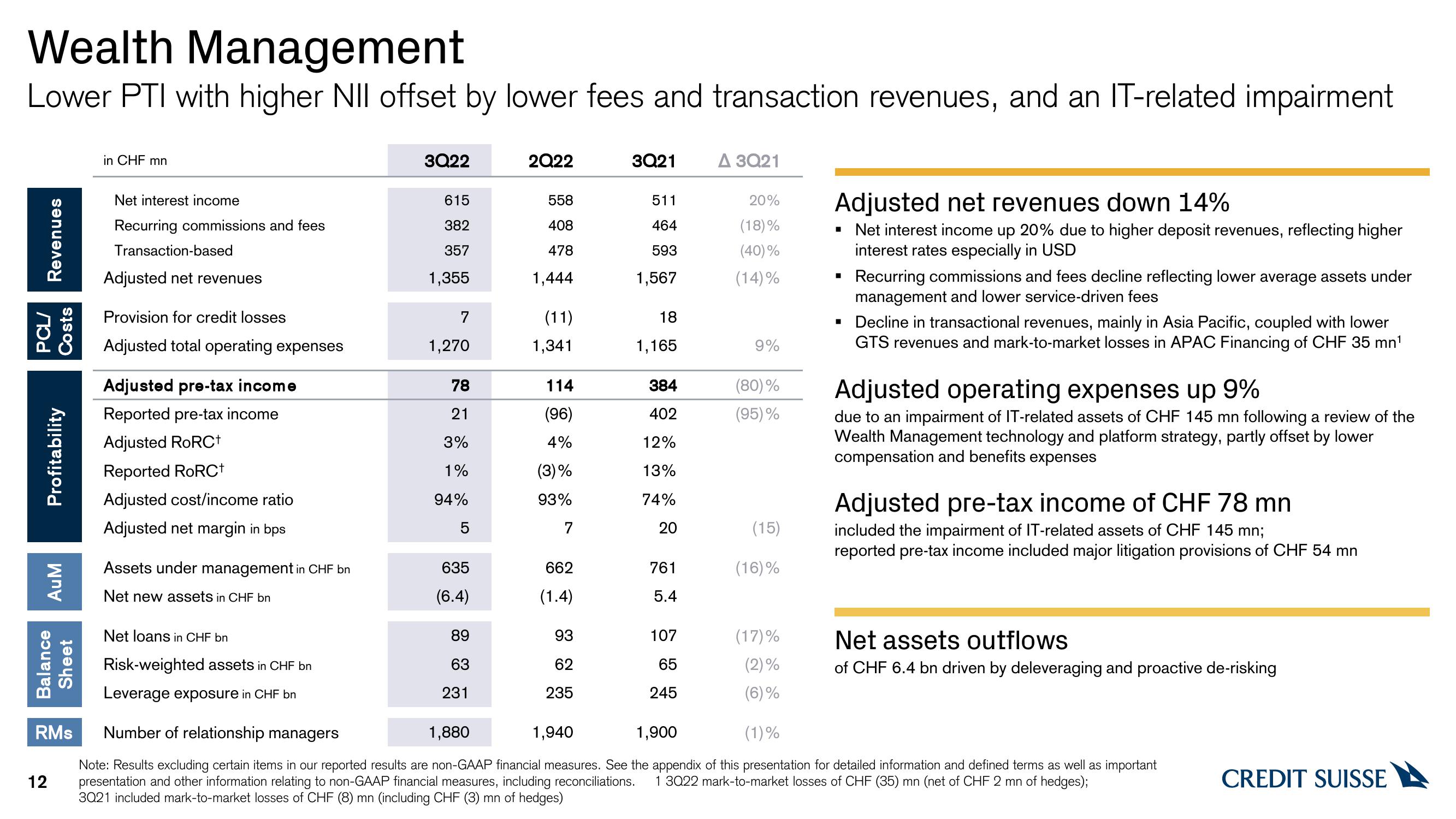

Lower PTI with higher NII offset by lower fees and transaction revenues, and an IT-related impairment

Revenues

PCL/

Costs

Profitability

AuM

Balance

Sheet

in CHF mn

12

Net interest income

Recurring commissions and fees

Transaction-based

Adjusted net revenues

Provision for credit losses

Adjusted total operating expenses

pre-tax income

Adjusted

Reported pre-tax income

Adjusted RoRCt

Reported RoRC+

Adjusted cost/income ratio

Adjusted net margin in bps

Assets under management in CHF bn

Net new assets in CHF bn

Net loans in CHF bn

Risk-weighted assets in CHF bn

Leverage exposure in CHF bn

3Q22

615

382

357

1,355

7

1,270

78

21

3%

1%

94%

635

(6.4)

89

63

231

2Q22

558

408

478

1,444

(11)

1,341

114

(96)

4%

(3)%

93%

7

662

(1.4)

93

62

235

3Q21

511

464

593

1,567

18

1,165

384

402

12%

13%

74%

20

761

5.4

107

65

245

A 3Q21

20%

(18)%

(40)%

(14)%

9%

(80)%

(95)%

(15)

(16)%

(17)%

(2)%

(6)%

Adjusted net revenues down 14%

▪ Net interest income up 20% due to higher deposit revenues, reflecting higher

interest rates especially in USD

Recurring commissions and fees decline reflecting lower average assets under

management and lower service-driven fees

Decline in transactional revenues, mainly in Asia Pacific, coupled with lower

GTS revenues and mark-to-market losses in APAC Financing of CHF 35 mn¹

Adjusted operating expenses up 9%

due to an impairment of IT-related assets of CHF 145 mn following a review of the

Wealth Management technology and platform strategy, partly offset by lower

compensation and benefits expenses

Adjusted pre-tax income of CHF 78 mn

included the impairment of IT-related assets of CHF 145 mn;

reported pre-tax income included major litigation provisions of CHF 54 mn

Net assets outflows

of CHF 6.4 bn driven by deleveraging and proactive de-risking

RMs Number of relationship managers

1,880

1,940

1,900

(1)%

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 3Q22 mark-to-market losses of CHF (35) mn (net of CHF 2 mn of hedges);

3021 included mark-to-market losses of CHF (8) mn (including CHF (3) mn of hedges)

CREDIT SUISSEView entire presentation