Allwyn Results Presentation Deck

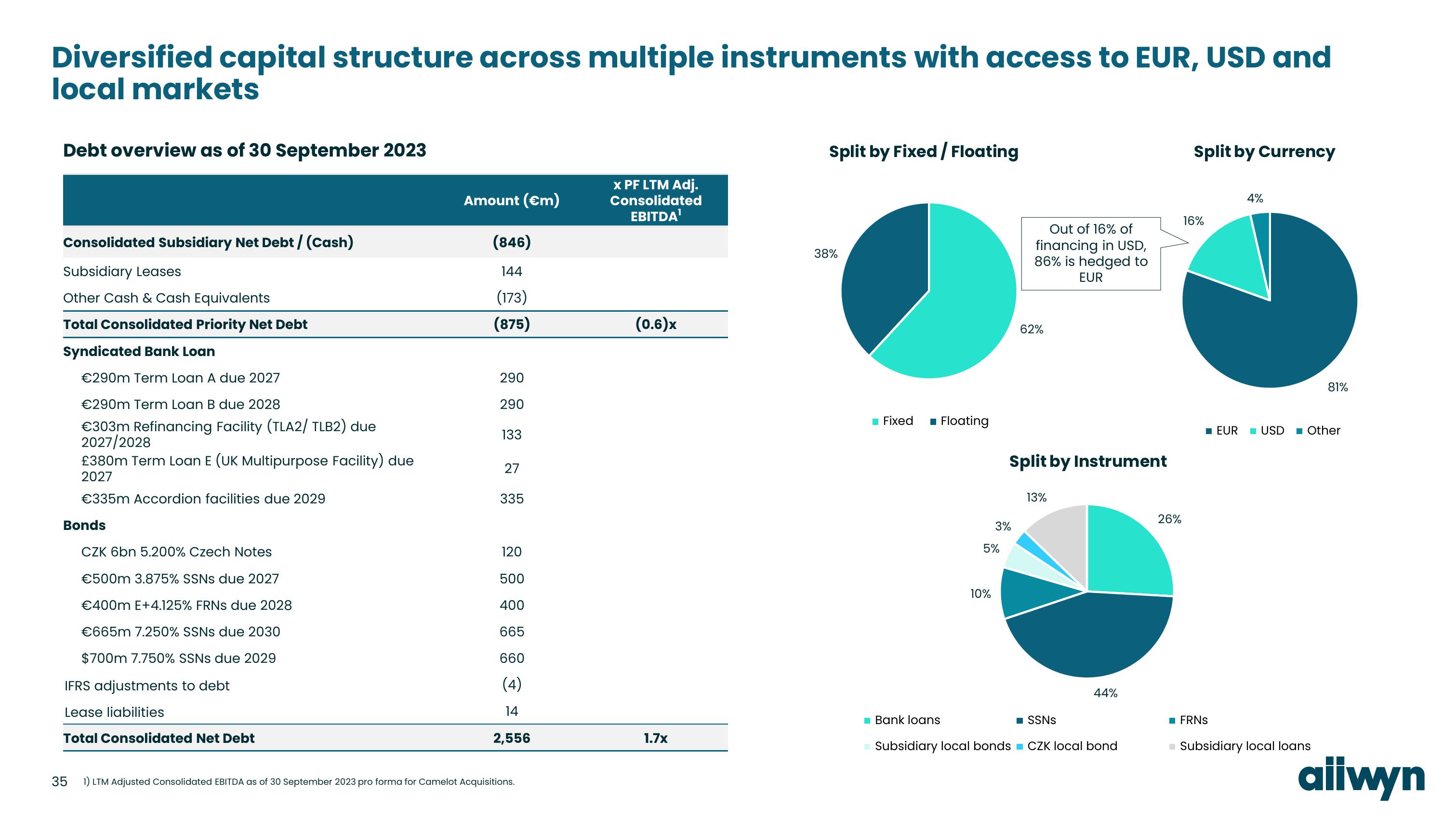

Diversified capital structure across multiple instruments with access to EUR, USD and

local markets

Debt overview as of 30 September 2023

Consolidated Subsidiary Net Debt / (Cash)

Subsidiary Leases

Other Cash & Cash Equivalents

Total Consolidated Priority Net Debt

Syndicated Bank Loan

€290m Term Loan A due 2027

€290m Term Loan B due 2028

€303m Refinancing Facility (TLA2/ TLB2) due

2027/2028

£380m Term Loan E (UK Multipurpose Facility) due

2027

€335m Accordion facilities due 2029

Bonds

CZK 6bn 5.200% Czech Notes

€500m 3.875% SSNS due 2027

€400m E+4.125% FRNS due 2028

€665m 7.250% SSNS due 2030

$700m 7.750% SSNs due 2029

IFRS adjustments to debt

Lease liabilities

Total Consolidated Net Debt

Amount (€m)

(846)

144

(173)

(875)

290

290

133

27

335

120

500

400

665

660

(4)

14

2,556

35 1) LTM Adjusted Consolidated EBITDA as of 30 September 2023 pro forma for Camelot Acquisitions.

x PF LTM Adj.

Consolidated

EBITDA¹

(0.6)x

1.7x

Split by Fixed / Floating

38%

Fixed ■ Floating

■ Bank loans

5%

10%

3%

Out of 16% of

financing in USD,

86% is hedged to

EUR

62%

Split by Instrument

13%

44%

■SSNS

Subsidiary local bonds CZK local bond

26%

Split by Currency

16%

■ EUR

■ FRNS

4%

81%

USD ■ Other

Subsidiary local loans

aiiwynView entire presentation