Affirm Results Presentation Deck

Income Statement Reconciliations

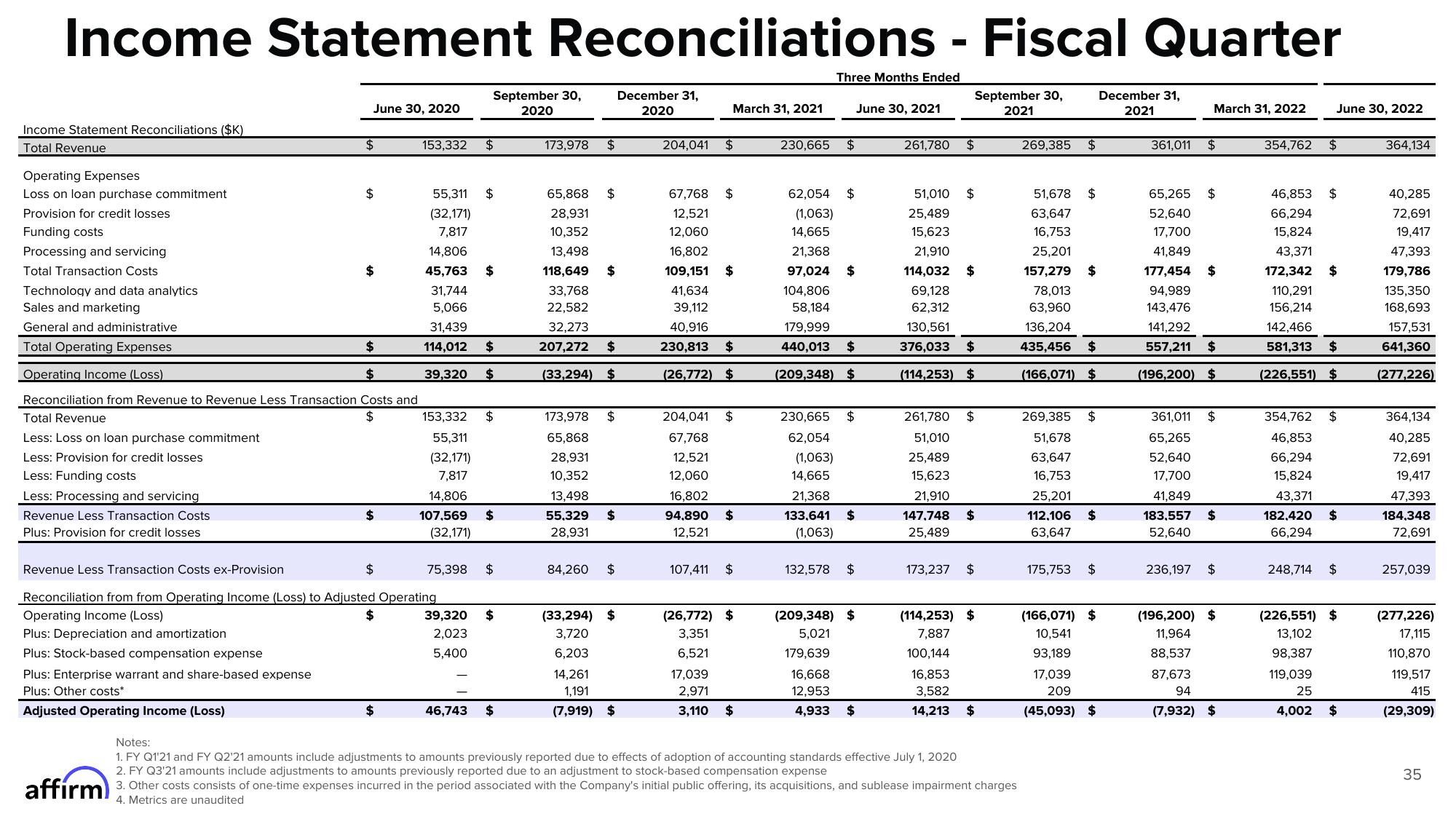

Income Statement Reconciliations ($K)

Total Revenue

Operating Expenses

Loss on loan purchase commitment

Provision for credit losses

Funding costs

Processing and servicing

Total Transaction Costs

Less: Processing and servicing

Revenue Less Transaction Costs

Plus: Provision for credit losses

June 30, 2020

$

Technology and data analytics

Sales and marketing

General and administrative

Total Operating Expenses

$

Operating Income (Loss)

$

Reconciliation from Revenue to Revenue Less Transaction Costs and

Total Revenue

$

Less: Loss on loan purchase commitment

Less: Provision for credit losses

Less: Funding costs

Plus: Enterprise warrant and share-based expense

Plus: Other costs*

Adjusted Operating Income (Loss)

$

$

$

153,332

$

Revenue Less Transaction Costs ex-Provision

Reconciliation from from Operating Income (Loss) to Adjusted Operating

Operating Income (Loss)

Plus: Depreciation and amortization

Plus: Stock-based compensation expense

September 30,

2020

$

55,311

(32,171)

7,817

14,806

45,763

31,744

5,066

31,439

114,012 $

39,320 $

$

$

153,332 $

55,311

(32,171)

7,817

14,806

107,569 $

(32,171)

75,398 $

39,320 $

2,023

5,400

46,743 $

173,978 $

65,868

28,931

10,352

13,498

118,649

33,768

22,582

32,273

207,272 $

(33,294) $

$

$

173,978 $

65,868

28,931

10,352

13,498

55,329 $

28,931

84,260 $

(33,294) $

3,720

6,203

14,261

1,191

(7,919) $

December 31,

2020

March 31, 2021

204,041 $

67,768 $

12,521

12,060

16,802

109,151

41,634

39,112

40,916

230,813 $

(26,772) $

$

204,041 $

67,768

12,521

12,060

16,802

94,890 $

12,521

107,411 $

(26,772) $

3,351

6,521

17,039

2,971

3,110 $

Three Months Ended

230,665 $

62,054 $

(1,063)

14,665

21,368

97,024 $

104,806

58,184

179,999

440,013 $

(209,348) $

230,665 $

62,054

(1,063)

14,665

21,368

133,641 $

(1,063)

132,578 $

June 30, 2021

(209,348) $

5,021

179,639

16,668

12,953

4,933 $

261,780 $

261,780

51,010

25,489

15,623

· Fiscal Quarter

51,010

25,489

15,623

21,910

114,032

69,128

62,312

130,561

376,033 $

(114,253) $

21,910

147.748

25,489

173,237

$

September 30,

2021

$

$

$

(114,253) $

7,887

100,144

16,853

3,582

14,213 $

Notes:

1. FY Q1'21 and FY Q2'21 amounts include adjustments to amounts previously reported due to effects of adoption of accounting standards effective July 1, 2020

2. FY Q3'21 amounts include adjustments to amounts previously reported due to an adjustment to stock-based compensation expense

affirm) 3. Other costs consists of one-time expenses incurred in the period associated with the Company's initial public offering, its acquisitions, and sublease impairment charges

4. Metrics are unaudited

269,385 $

51,678

63,647

16,753

25,201

157,279

78,013

63,960

136,204

435,456 $

(166,071) $

$

25,201

112.106

63,647

$

269,385 $

51,678

63,647

16,753

$

175,753 $

(166,071) $

10,541

93,189

17,039

209

(45,093) $

December 31,

2021

March 31, 2022

361,011 $

65,265

52,640

17,700

41,849

177,454

94,989

143,476

141,292

557,211 $

(196,200) $

$

236,197

$

361,011 $

65,265

52,640

17,700

41,849

183,557 $

52,640

$

(196,200) $

11,964

88,537

87,673

94

(7,932) $

June 30, 2022

354,762 $

46,853

66,294

15,824

43,371

172,342

110,291

156,214

142,466

581,313 $

(226,551) $

$

$

354,762 $

46,853

66,294

15,824

43,371

182,420 $

66,294

248,714 $

(226,551) $

13,102

98,387

119,039

25

4,002

$

364,134

40,285

72,691

19,417

47,393

179,786

135,350

168,693

157,531

641,360

(277,226)

364,134

40,285

72,691

19,417

47,393

184,348

72,691

257,039

(277,226)

17,115

110,870

119,517

415

(29,309)

35View entire presentation