Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

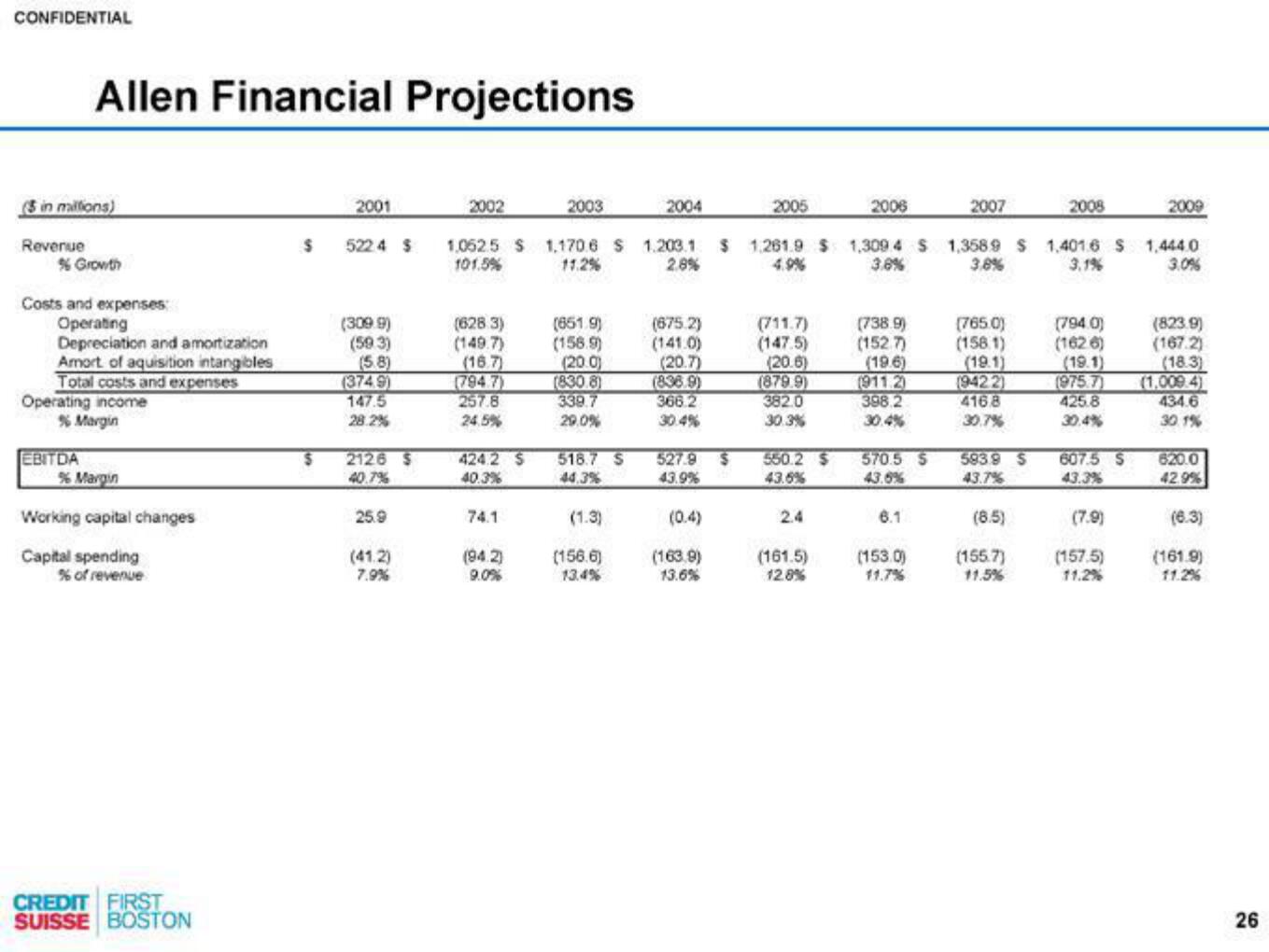

Allen Financial Projections

(3 in millions)

Revenue

% Growth

Costs and expenses

Operating

Depreciation and amortization

Amort of aquisition intangibles

Total costs and expenses

Operating income

% Margin

EBITDA

% Margin

Working capital changes

Capital spending

% of revenue

CREDIT FIRST

SUISSE BOSTON

2001

(3099)

(593)

(5.8)

(374.9)

147.5

28.2%

$ 2126 $

40.7%

$ 5224 S 1,0525 $ 1,170.6 $ 1.203.1

101.5%

11.2%

2.8%

25.9

2002

(41.2)

7.9%

(628.3)

(149.7)

(16.7)

257.8

24.5%

424.2 S

40.3%

74.1

2003

(94.2)

9.0%

(661.9)

(158.9)

(20.0)

(830.8)

339.7

29.0%

518.7 S

44.3%

(1.3)

2004

(156.6)

13.4%

(675.2)

(141.0)

(20.7)

(838.9)

366.2

30.4%

(0.4)

2005

(163.9)

13.6%

(711.7)

(147.5)

(20.6)

(879.9)

527.9 $ 550.2 $

43.9%

43.6%

382.0

30.3%

$ 1.261.9 $ 1,309.4 $ 1,3589 $ 1.4016 S 1,444.0

4.9%

3.8%

3.8%

3.1%

3.0%

2.4

2006

(161.5)

12.8%

(738.9)

(152.7)

(19.6)

(911.2)

398.2

30.4%

570.5 S

43.6%

6.1

2007

(153.0)

(765.0)

(158.1)

(19.1)

(9422)

416.8

30.7%

593.9 S

43.7%

2008

(8.5)

(155.7)

11.5%

(794.0)

(1626)

(19.1)

(975.7)

425.8

30.4%

607.5 S

43.3%

(7.9)

2009

(157.5)

11.2%

(823.9)

(167.2)

(18.3)

(1,009.4)

434.6

30.1%

620.0

42.9%

(6.3)

(161.9)

11.2%

26View entire presentation