Apollo Global Management Investor Day Presentation Deck

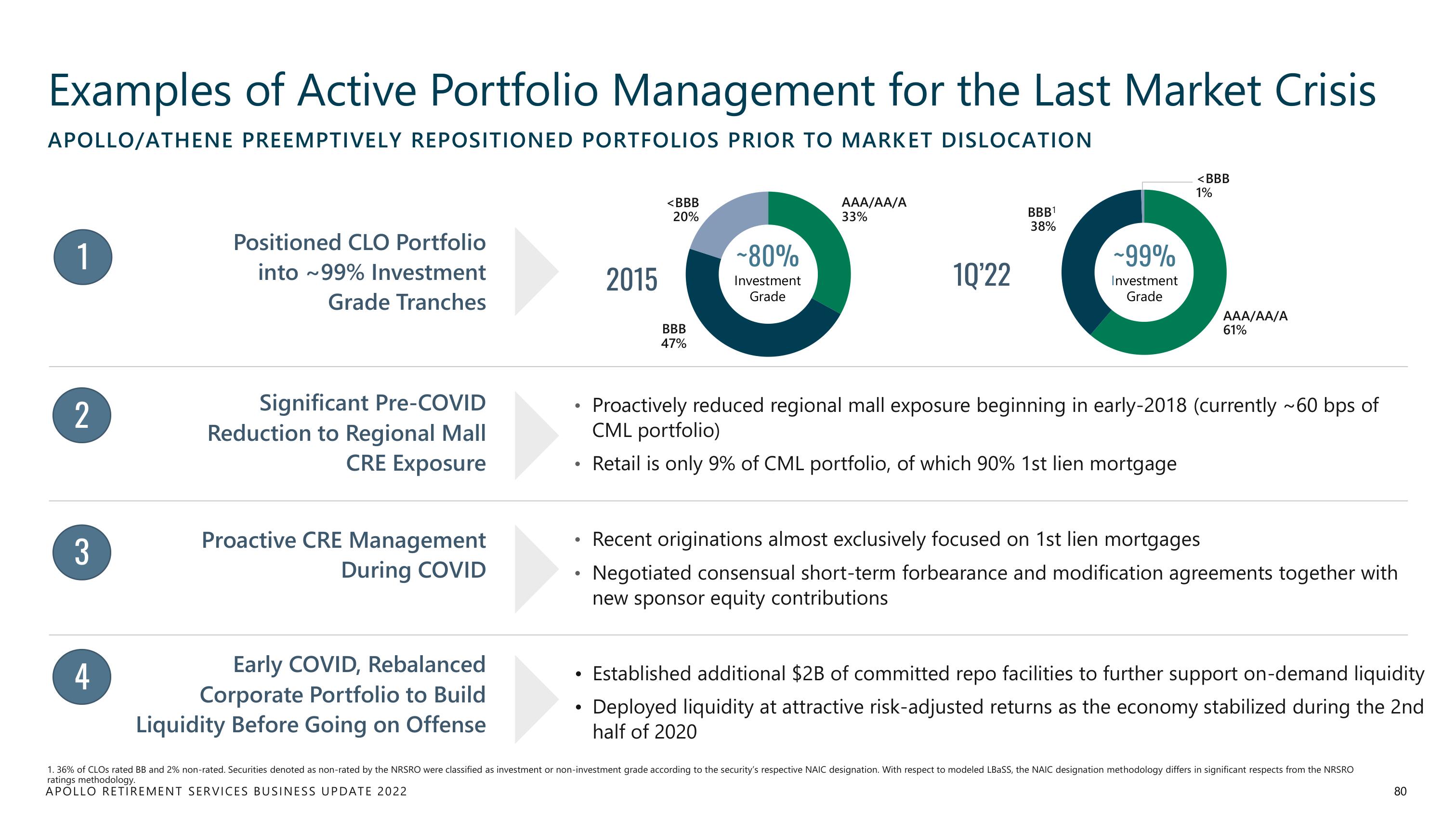

Examples of Active Portfolio Management for the Last Market Crisis

APOLLO/ATHENE PREEMPTIVELY REPOSITIONED PORTFOLIOS PRIOR TO MARKET DISLOCATION

1

2

3

4

Positioned CLO Portfolio

into ~99% Investment

Grade Tranches

Significant Pre-COVID

Reduction to Regional Mall

CRE Exposure

Proactive CRE Management

During COVID

Early COVID, Rebalanced

Corporate Portfolio to Build

Liquidity Before Going on Offense

e

●

●

2015

●

<BBB

20%

BBB

47%

~80%

Investment

Grade

AAA/AA/A

33%

10'22

BBB¹

38%

Proactively reduced regional mall exposure beginning in early-2018 (currently ~60 bps of

CML portfolio)

• Retail is only 9% of CML portfolio, of which 90% 1st lien mortgage

~99%

Investment

Grade

<BBB

1%

AAA/AA/A

61%

Recent originations almost exclusively focused on 1st lien mortgages

Negotiated consensual short-term forbearance and modification agreements together with

new sponsor equity contributions

Established additional $2B of committed repo facilities to further support on-demand liquidity

Deployed liquidity at attractive risk-adjusted returns as the economy stabilized during the 2nd

half of 2020

1.36% of CLOS rated BB and 2% non-rated. Securities denoted as non-rated by the NRSRO were classified as investment or non-investment grade according to the security's respective NAIC designation. With respect to modeled LBaSS, the NAIC designation methodology differs in significant respects from the NRSRO

ratings methodology.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

80View entire presentation