Pershing Square Investor Presentation Deck

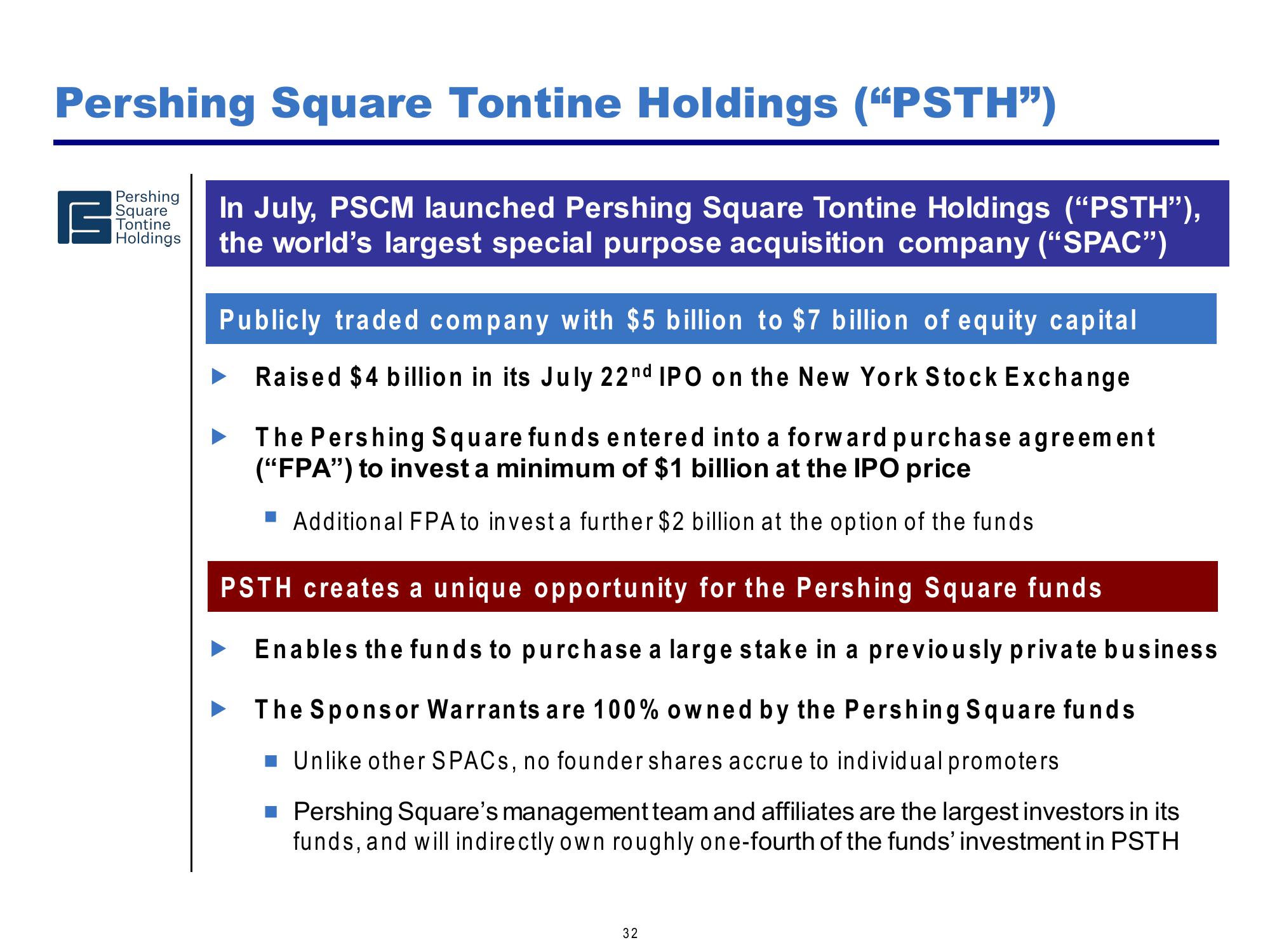

Pershing Square Tontine Holdings ("PSTH")

더 In July, PSCM launched Pershing Square Tontine Holdings (“PSTH”),

the world's largest special purpose acquisition company ("SPAC")

Pershing

Square

Tontine

Holdings

Publicly traded company with $5 billion to $7 billion of equity capital

Raised $4 billion in its July 22nd IPO on the New York Stock Exchange

The Pershing Square funds entered into a forward purchase agreement

("FPA") to invest a minimum of $1 billion at the IPO price

Additional FPA to invest a further $2 billion at the option of the funds

PSTH creates a unique opportunity for the Pershing Square funds

Enables the funds to purchase a large stake in a previously private business

The Sponsor Warrants are 100% owned by the Pershing Square funds

Unlike other SPACs, no founder shares accrue to individual promoters

■ Pershing Square's management team and affiliates are the largest investors in its

funds, and will indirectly own roughly one-fourth of the funds' investment in PSTH

32View entire presentation