Credit Suisse Results Presentation Deck

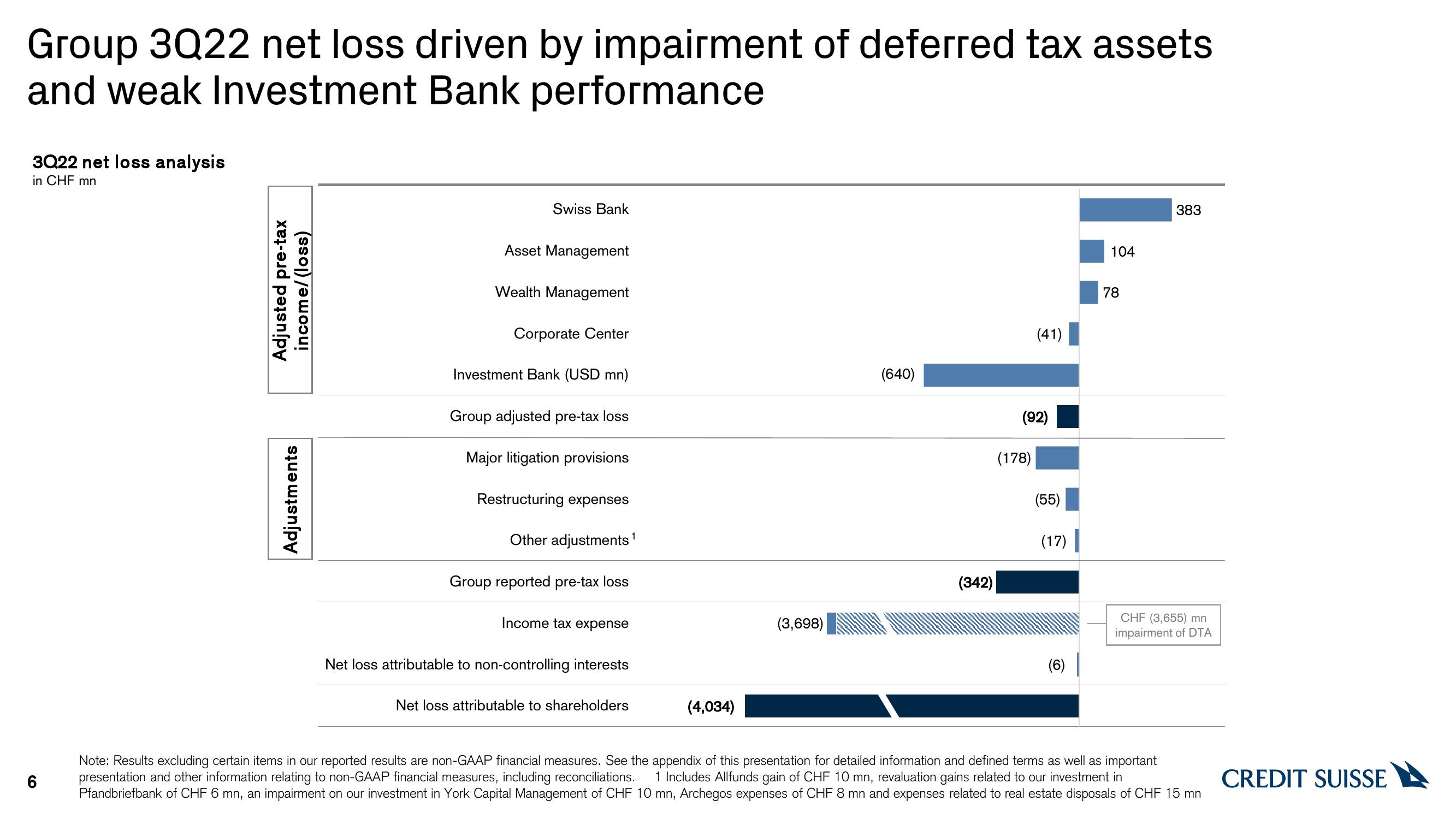

Group 3Q22 net loss driven by impairment of deferred tax assets

and weak Investment Bank performance

3Q22 net loss analysis

in CHF mn

6

Adjusted pre-tax

income/(loss)

Adjustments

Swiss Bank

Asset Management

Wealth Management

Corporate Center

Investment Bank (USD mn)

Group adjusted pre-tax loss

Major litigation provisions

Restructuring expenses

Other adjustments ¹

Group reported pre-tax loss

Income tax expense

Net loss attributable to non-controlling interests

Net loss attributable to shareholders

(4,034)

(3,698)

(640)

(342)

(41)

(92)

(178)

(55)

(17)

(6)

104

78

383

CHF (3,655) mn

impairment of DTA

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 Includes Allfunds gain of CHF 10 mn, revaluation gains related to our investment in

Pfandbriefbank of CHF 6 mn, an impairment on our investment in York Capital Management of CHF 10 mn, Archegos expenses of CHF 8 mn and expenses related to real estate disposals of CHF 15 mn

CREDIT SUISSEView entire presentation