Apollo Global Management Investor Day Presentation Deck

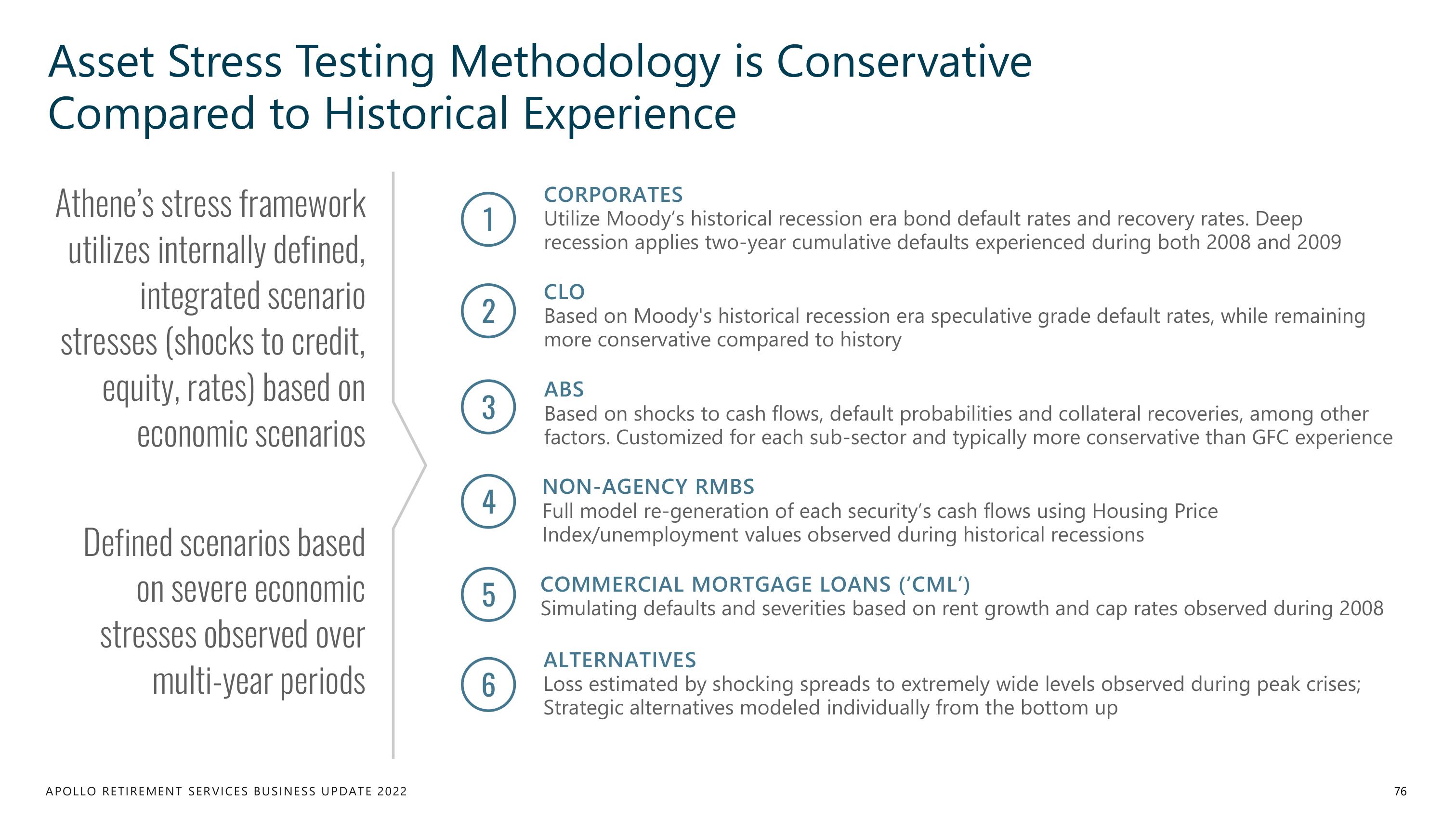

Asset Stress Testing Methodology is Conservative

Compared to Historical Experience

Athene's stress framework

utilizes internally defined,

integrated scenario

stresses (shocks to credit,

equity, rates) based on

economic scenarios

Defined scenarios based

on severe economic

stresses observed over

multi-year periods

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

2

3

4

5

6

CORPORATES

Utilize Moody's historical recession era bond default rates and recovery rates. Deep

recession applies two-year cumulative defaults experienced during both 2008 and 2009

CLO

Based on Moody's historical recession era speculative grade default rates, while remaining

more conservative compared to history

ABS

Based on shocks to cash flows, default probabilities and collateral recoveries, among other

factors. Customized for each sub-sector and typically more conservative than GFC experience

NON-AGENCY RMBS

Full model re-generation of each security's cash flows using Housing Price

Index/unemployment values observed during historical recessions

COMMERCIAL MORTGAGE LOANS ('CML')

Simulating defaults and severities based on rent growth and cap rates observed during 2008

ALTERNATIVES

Loss estimated by shocking spreads to extremely wide levels observed during peak crises;

Strategic alternatives modeled individually from the bottom up

76View entire presentation