Kinnevik Results Presentation Deck

Intro

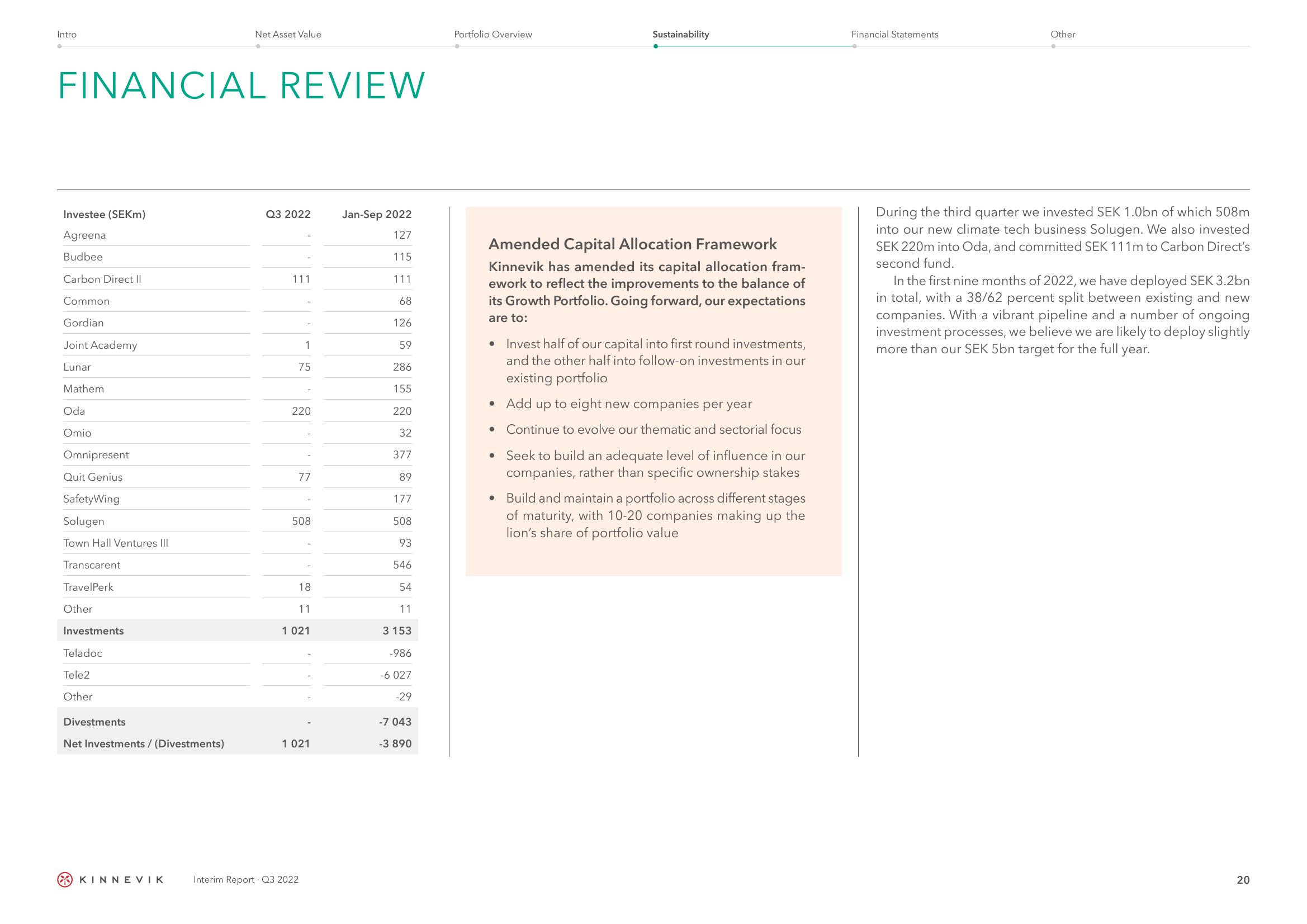

FINANCIAL REVIEW

Investee (SEKm)

Agreena

Budbee

Carbon Direct II

Common.

Gordian

Joint Academy

Lunar

Mathem

Oda

Omio

Omnipresent

Quit Genius

SafetyWing

Solugen

Town Hall Ventures III

Transcarent

TravelPerk

Other

Investments

Teladoc

Tele2

Other

Divestments

Net Investments / (Divestments)

Net Asset Value

KINNEVIK

Q3 2022

111

1

75

220

77

508

18

11

1 021

1 021

Interim Report Q3 2022

Jan-Sep 2022

127

115

111

68

126

59

286

155

220

32

377

89

177

508

93

546

54

11

3 153

-986

-6 027

-29

-7 043

-3 890

Portfolio Overview

Amended Capital Allocation Framework

Kinnevik has amended its capital allocation fram-

ework to reflect the improvements to the balance of

its Growth Portfolio. Going forward, our expectations

are to:

• Invest half of our capital into first round investments,

and the other half into follow-on investments in our

existing portfolio

●

Sustainability

●

●

Add up to eight new companies per year

Continue to evolve our thematic and sectorial focus

• Seek to build an adequate level of influence in our

companies, rather than specific ownership stakes

Build and maintain a portfolio across different stages

of maturity, with 10-20 companies making up the

lion's share of portfolio value

Financial Statements

Other

During the third quarter we invested SEK 1.0bn of which 508m

into our new climate tech business Solugen. We also invested

SEK 220m into Oda, and committed SEK 111m to Carbon Direct's

second fund.

In the first nine months of 2022, we have deployed SEK 3.2bn

in total, with a 38/62 percent split between existing and new

companies. With a vibrant pipeline and a number of ongoing

investment processes, we believe we are likely to deploy slightly

more than our SEK 5bn target for the full year.

20View entire presentation