Crowdstrike Investor Day Presentation Deck

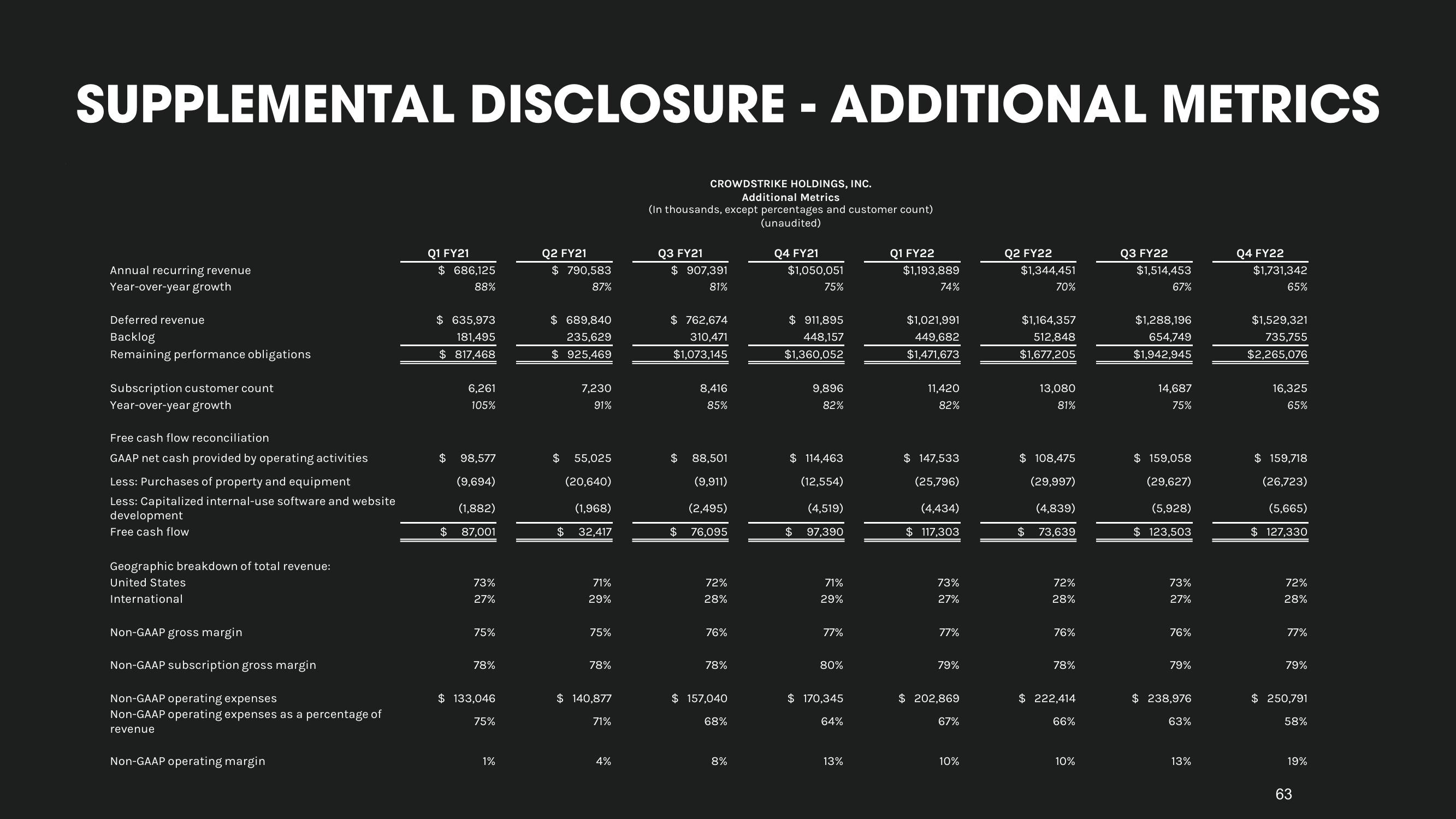

SUPPLEMENTAL DISCLOSURE - ADDITIONAL METRICS

Annual recurring revenue

Year-over-year growth

Deferred revenue

Backlog

Remaining performance obligations

Subscription customer count

Year-over-year growth

Free cash flow reconciliation

GAAP net cash provided by operating activities

Less: Purchases of property and equipment

Less: Capitalized internal-use software and website

development

Free cash flow

Geographic breakdown of total revenue:

United States

International

Non-GAAP gross margin

Non-GAAP subscription gross margin

Non-GAAP operating expenses

Non-GAAP operating expenses as a percentage of

revenue

Non-GAAP operating margin

Q1 FY21

$ 686,125

88%

$ 635,973

181,495

$817,468

6,261

105%

$ 98,577

(9,694)

$

(1,882)

87,001

73%

27%

75%

78%

$ 133,046

75%

1%

Q2 FY21

$ 790,583

87%

$ 689,840

235,629

$925,469

7,230

91%

$ 55,025

(20,640)

$

(1,968)

32,417

71%

29%

75%

78%

$ 140,877

71%

4%

(In thousands, except percentages and customer count)

(unaudited)

Q3 FY21

CROWDSTRIKE HOLDINGS, INC.

Additional Metrics

$ 907,391

81%

$ 762,674

310,471

$1,073,145

$

$

8,416

85%

88,501

(9,911)

(2,495)

76,095

72%

28%

76%

78%

$ 157,040

68%

8%

Q4 FY21

$1,050,051

75%

$ 911,895

448,157

$1,360,052

9,896

82%

$ 114,463

(12,554)

(4,519)

97,390

$

71%

29%

77%

80%

$ 170,345

64%

13%

Q1 FY22

$1,193,889

74%

$1,021,991

449,682

$1,471,673

11,420

82%

$ 147,533

(25,796)

(4,434)

$ 117,303

73%

27%

77%

79%

$ 202,869

67%

10%

Q2 FY22

$1,344,451

70%

$1,164,357

512,848

$1,677,205

13,080

81%

$ 108,475

(29,997)

(4,839)

$ 73,639

72%

28%

76%

78%

$ 222,414

66%

10%

Q3 FY22

$1,514,453

67%

$1,288,196

654,749

$1,942,945

14,687

75%

$ 159,058

(29,627)

(5,928)

$ 123,503

73%

27%

76%

79%

$ 238,976

63%

13%

Q4 FY22

$1,731,342

65%

$1,529,321

735,755

$2,265,076

16,325

65%

$ 159,718

(26,723)

(5,665)

$ 127,330

72%

28%

77%

79%

$ 250,791

58%

19%

63View entire presentation