Toyota Investor Presentation Deck

Managed Portfolio Performance

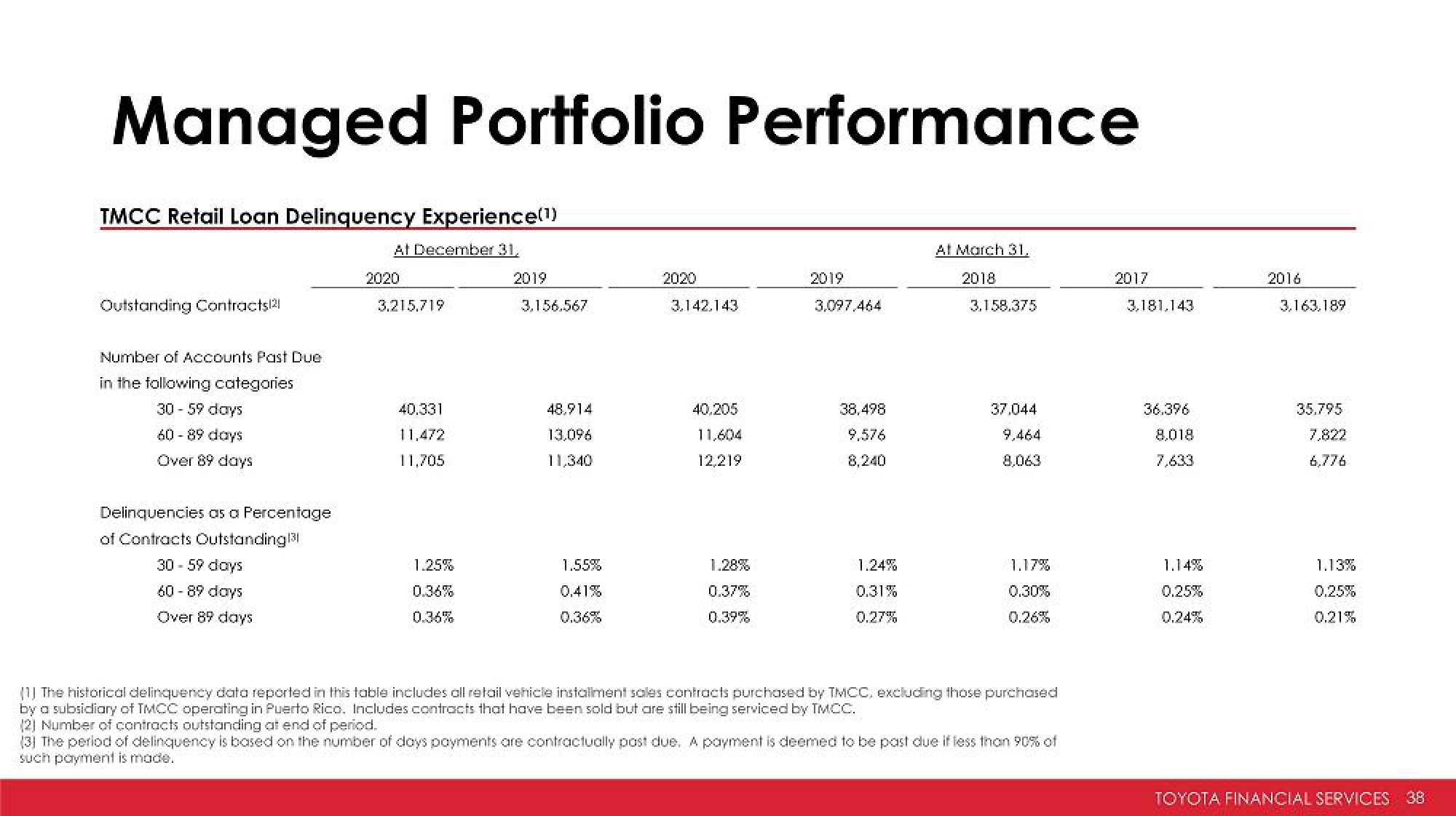

TMCC Retail Loan Delinquency Experience(¹)

At December 31,

Outstanding Contracts/21

Number of Accounts Past Due:

in the following categories

30-59 days

60-89 days

Over 89 days

Delinquencies as a Percentage

of Contracts Outstanding1³1

30 - 59 days

60-89 days

Over 89 days

2020

3,215,719

40.331

11,472

11,705

1.25%

0.36%

0.36%

2019

3.156.567

48.914

13.096

11,340

1.55%

0.41%

2020

3.142.143

40.205

11,604

12219

1.28%

0.37%

0.39%

2019

3,097,464

38,498

9,576

8,240

1.24%

0.31%

0.27%

At March 31.

2018

3.158.375

37,044

9,464

8,063

1.17%

0.30%

0.26%

[1] The historical delinquency data reported in this table includes all retail vehicle installment sales contracts purchased by TMCC, excluding those purchased

by a subsidiary of TMCC operating in Puerto Rico. Includes contracts that have been sold but are still being serviced by TMCC.

(2) Number of contracts outstanding at end of period.

(3) The period of delinquency is based on the number of days payments are contractually post due. A payment is deemed to be past due if less than 90% of

such payment is made.

2017

3.181.143

36.396

8,018

1.14%

0.25%

0.24%

2016

3.163.189

35,795

7.822

6,776

1.13%

0.25%

0.21%

TOYOTA FINANCIAL SERVICES 38View entire presentation