First Foundation Investor Presentation Deck

Our Multifamily Expertise

The Bank has been originating multifamily loans since 2008 with zero losses to date on its portfolio.

I

■

■

·

Product Overview - Essential Housing Focus

Primary focus is on small balance (average size of $3.3 million) loans on non-luxury

Essential Housing apartment stock

Average property has 22 units

■

■

Approx. 68% of the $2.4B originations in 2022 were rent controlled and on

average 14% below market, providing potential upside in rents if units turn over

Loans are generally fixed for 3-,5-,7- and 10-year periods

Weighted average life of portfolio is 5 (¹) years

"

■

Buildings tend to be older and smaller in size with over 60% of properties built

between 1950-1980 catering towards at or below median income earners

I

30-year maturity with 30-year amortization

Conservative Underwriting

Conservative underwriting to the lower of in-place rents or market and the higher of

market or actual vacancy and expenses

No credit is given for future or pro forma figures for rents

Loan amounts are underwritten to DSCRs using a qualifying rate that is higher than the

initial rate for 3- and 5-year fixed loans

7 and 10 year fixed are underwritten to the initial start rate

Interest only options for lower LTV and higher DSCR properties with strong sponsorship

All IO loans underwritten to a fully amortizing DSCR

X

FIRST FOUNDATION

Copyright © 2023 First Foundation Inc. All Rights Reserved

X

Sponsors are required to meet minimum liquidity requirements of 6-12 months principal,

interest, taxes and insurance, and a minimum of 10% of the loan amount

1)

WA Life per Moody's Analytics

CMM/Impairment Studio reporting as of

09.30.2023

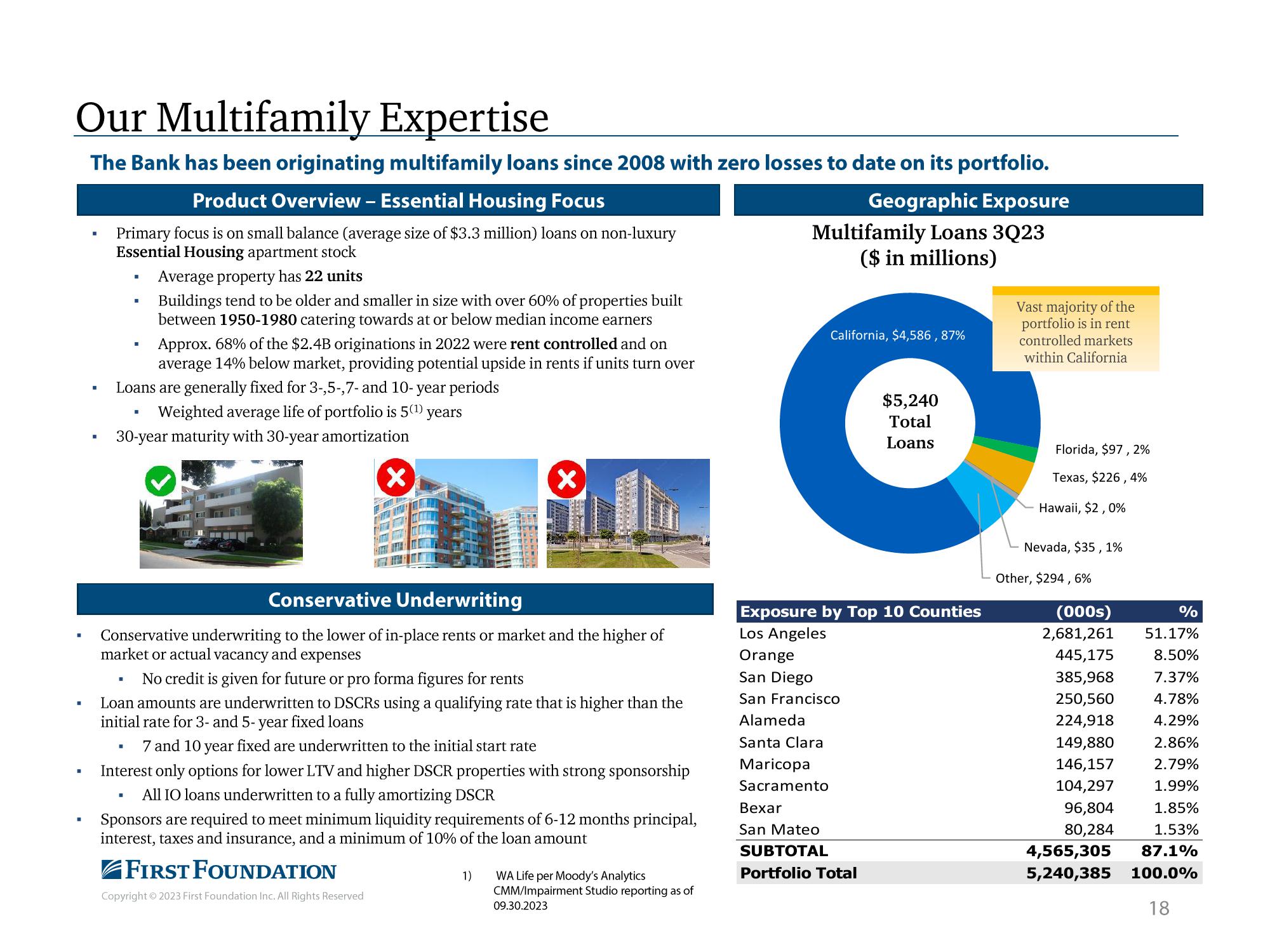

Geographic Exposure

Multifamily Loans 3Q23

($ in millions)

California, $4,586, 87%

Alameda

Santa Clara

Maricopa

Sacramento

Bexar

San Mateo

SUBTOTAL

Portfolio Total

$5,240

Total

Loans

Exposure by Top 10 Counties

Los Angeles

Orange

San Diego

San Francisco

Vast majority of the

portfolio is in rent

controlled markets

within California

Florida, $97, 2%

Texas, $226, 4%

Hawaii, $2,0%

Nevada, $35, 1%

Other, $294, 6%

(000s)

2,681,261

445,175

385,968

250,560

224,918

149,880

146,157

104,297

96,804

80,284

%

51.17%

8.50%

7.37%

4.78%

4.29%

2.86%

2.79%

1.99%

1.85%

1.53%

4,565,305 87.1%

5,240,385 100.0%

18View entire presentation