LSE Investor Presentation Deck

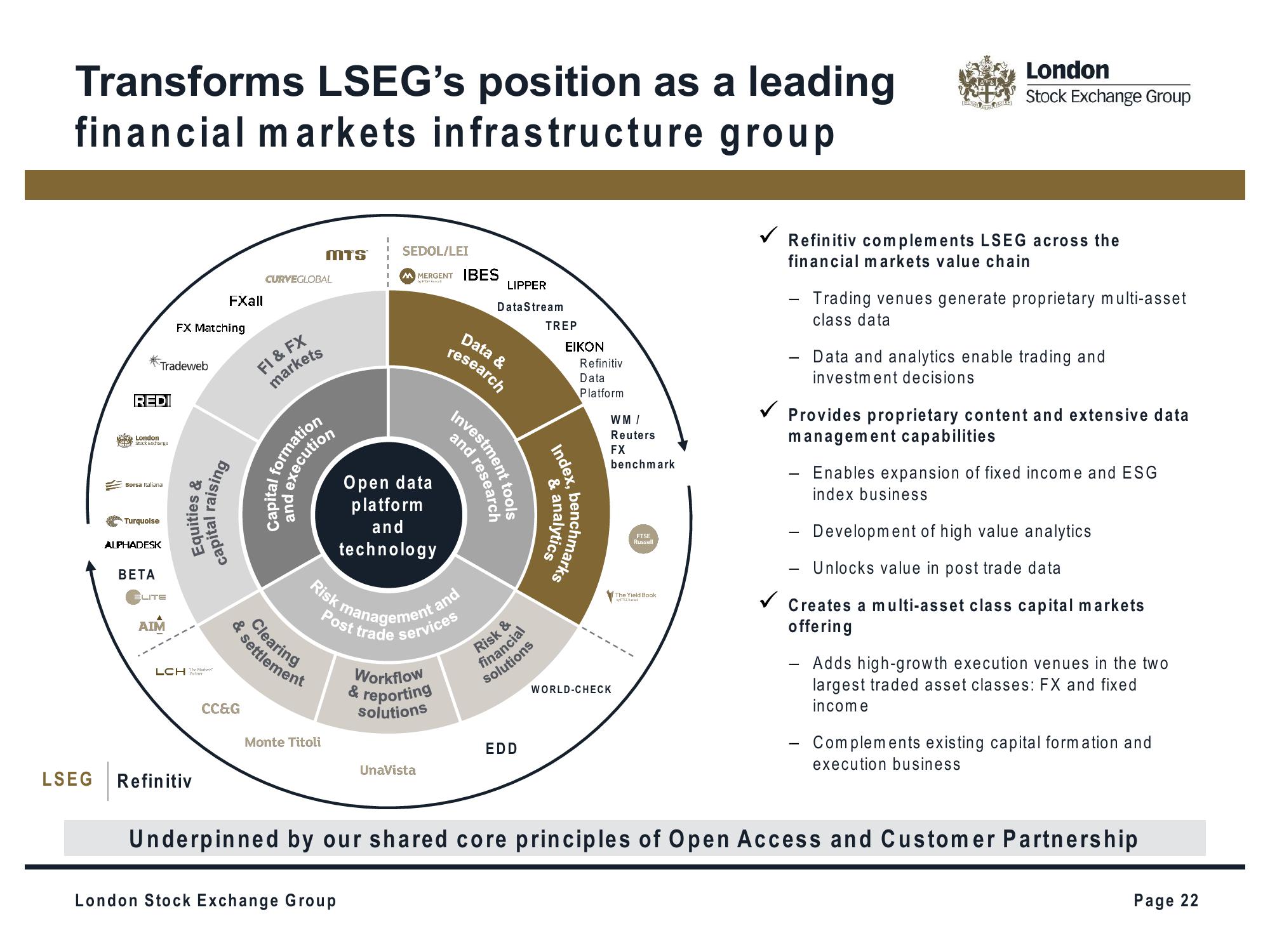

Transforms LSEG's position as a leading

financial markets infrastructure group

LSEG

REDI

London

Stock Excherge

Tradeweb

Borsa Italiana

Turquoise

ALPHADESK

BETA

ELITE

AIM

FX Matching

LCH

Equities &

The Marke

Refinitiv

FXall

capital

raising

&

CC&G

CURVEGLOBAL

FI & FX

markets

MTS

formation

xecution

Monte Titoli

Clearing

settlement

SEDOL/LEI

MMERGENT IBES

by

Open data

platform

and

technology

London Stock Exchange Group

Risk management and

Post

t trade services

Workflow

& reporting

solutions

UnaVista

Data &

research

Investmen

and research

tools

LIPPER

Data Stream

Risk &

financial

solutions

EDD

TREP

ΕΙΚΟΝ

Index,

8

nalytics

Refinitiv

Data

Platform

WM /

Reuters

FX

benchmark

WORLD-CHECK

FTSE

Russell

The Yield Book

syst

DEGHECKIN

London

Stock Exchange Group

Refinitiv complements LSEG across the

financial markets value chain

-

Trading venues generate proprietary multi-asset

class data

Data and analytics enable trading and

investment decisions

Provides proprietary content and extensive data

management capabilities

Enables expansion of fixed income and ESG

index business

Development of high value analytics

Unlocks value in post trade data

Creates a multi-asset class capital markets

offering

Adds high-growth execution venues in the two

largest traded asset classes: FX and fixed

income

Complements existing capital formation and

execution business

Underpinned by our shared core principles of Open Access and Customer Partnership

Page 22View entire presentation