CorpAcq SPAC Presentation Deck

33

3A

Debt:

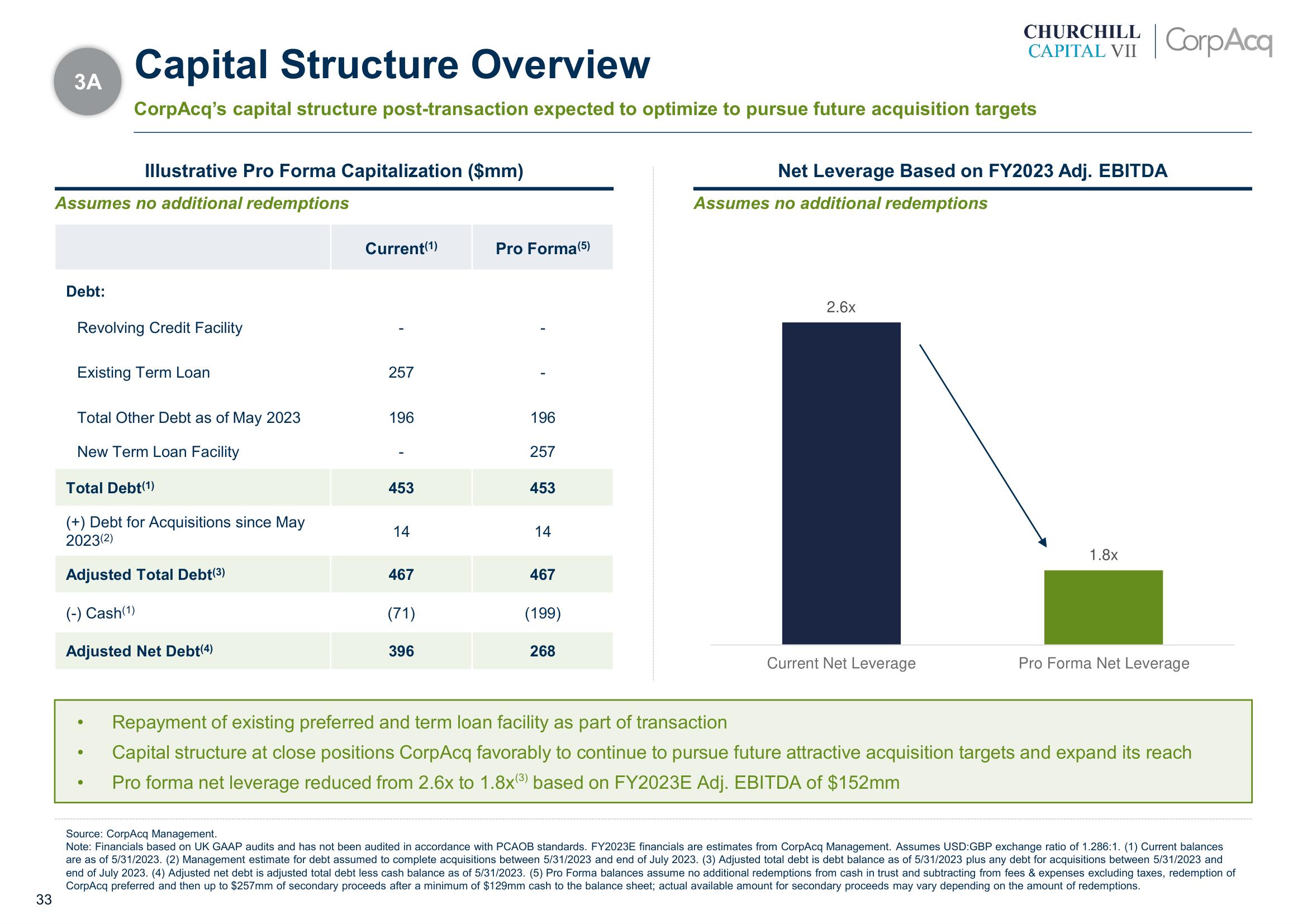

Capital Structure Overview

CorpAcq's capital structure post-transaction expected to optimize to pursue future acquisition targets

Illustrative Pro Forma Capitalization ($mm)

Assumes no additional redemptions

Revolving Credit Facility

Existing Term Loan

Total Other Debt as of May 2023

New Term Loan Facility

Total Debt(1)

(+) Debt for Acquisitions since May

2023(2)

Adjusted Total Debt(3)

(-) Cash(1)

Adjusted Net Debt(4)

Current (1)

257

196

453

14

467

(71)

396

Pro Forma (5)

196

257

453

14

467

(199)

268

CHURCHILL

CAPITAL VII CorpAcq

Net Leverage Based on FY2023 Adj. EBITDA

Assumes no additional redemptions

2.6x

Current Net Leverage

1.8x

Pro Forma Net Leverage

Repayment of existing preferred and term loan facility as part of transaction

Capital structure at close positions CorpAcq favorably to continue to pursue future attractive acquisition targets and expand its reach

Pro forma net leverage reduced from 2.6x to 1.8x(³) based on FY2023E Adj. EBITDA of $152mm

Source: CorpAcq Management.

Note: Financials based on UK GAAP audits and has not been audited in accordance with PCAOB standards. FY2023E financials are estimates from CorpAcq Management. Assumes USD:GBP exchange ratio of 1.286:1. (1) Current balances

are as of 5/31/2023. (2) Management estimate for debt assumed to complete acquisitions between 5/31/2023 and end of July 2023. (3) Adjusted total debt is debt balance as of 5/31/2023 plus any debt for acquisitions between 5/31/2023 and

end of July 2023. (4) Adjusted net debt is adjusted total debt less cash balance as of 5/31/2023. (5) Pro Forma balances assume no additional redemptions from cash in trust and subtracting from fees & expenses excluding taxes, redemption of

CorpAcq preferred and then up to $257mm of secondary proceeds after a minimum of $129mm cash to the balance sheet; actual available amount for secondary proceeds may vary depending on the amount of redemptions.View entire presentation