Lyft Results Presentation Deck

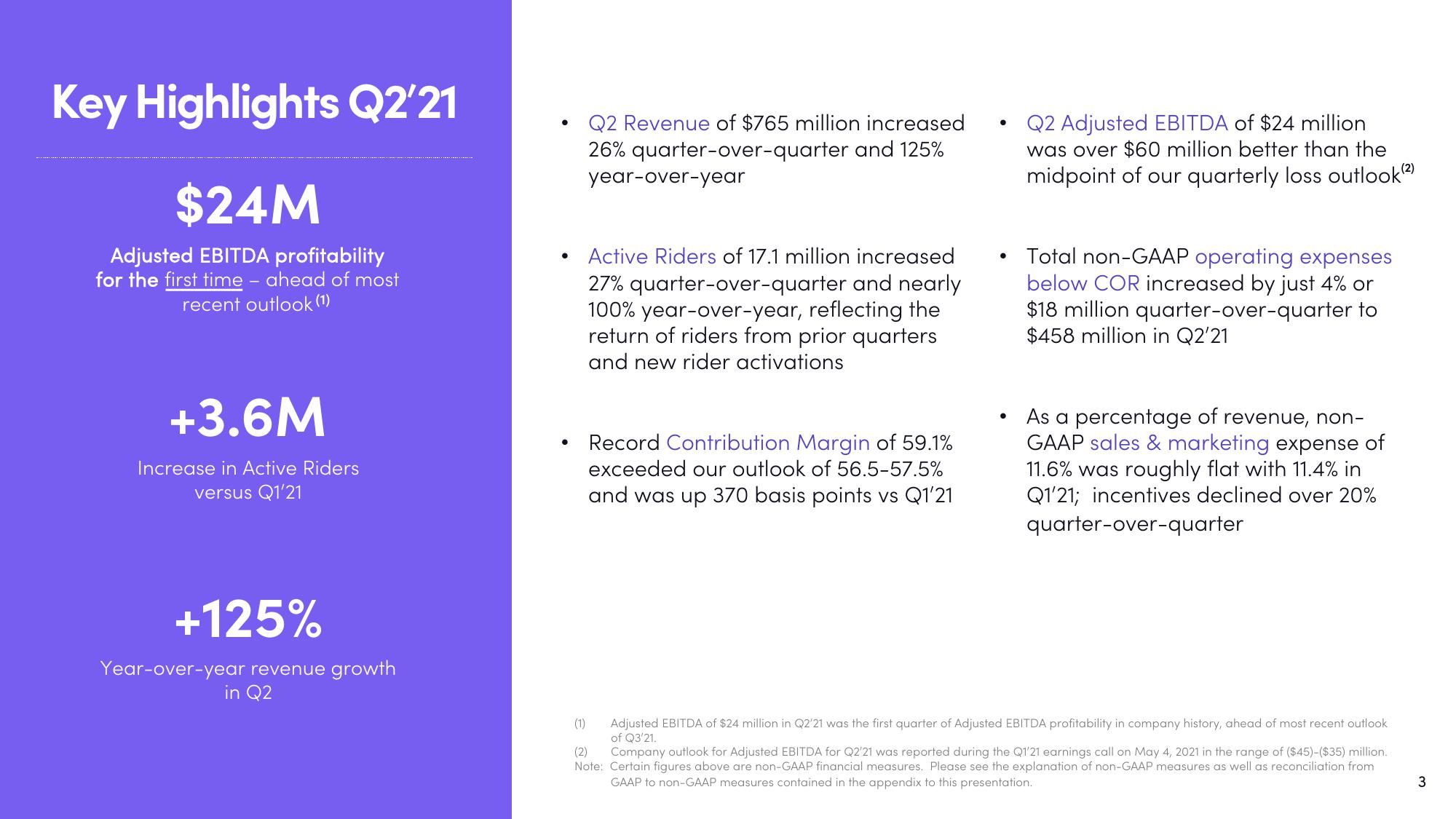

Key Highlights Q2'21

$24M

Adjusted EBITDA profitability

for the first time - ahead of most

recent outlook (1)

+3.6M

Increase in Active Riders

versus Q1'21

+125%

Year-over-year revenue growth

in Q2

●

●

Q2 Revenue of $765 million increased

26% quarter-over-quarter and 125%

year-over-year

Active Riders of 17.1 million increased

27% quarter-over-quarter and nearly

100% year-over-year, reflecting the

return of riders from prior quarters

and new rider activations

Record Contribution Margin of 59.1%

exceeded our outlook of 56.5-57.5%

and was up 370 basis points vs Q1'21

●

●

Q2 Adjusted EBITDA of $24 million

was over $60 million better than the

midpoint of our quarterly loss outlook(²)

Total non-GAAP operating expenses

below COR increased by just 4% or

$18 million quarter-over-quarter to

$458 million in Q2'21

As a percentage of revenue, non-

GAAP sales & marketing expense of

11.6% was roughly flat with 11.4% in

Q1'21; incentives declined over 20%

quarter-over-quarter

(1)

Adjusted EBITDA of $24 million in Q2'21 was the first quarter of Adjusted EBITDA profitability in company history, ahead of most recent outlook

of Q3'21.

(2) Company outlook for Adjusted EBITDA for Q2'21 was reported during the Q1'21 earnings call on May 4, 2021 in the range of ($45)-($35) million.

Note: Certain figures above are non-GAAP financial measures. Please see the explanation of non-GAAP measures as well as reconciliation from

GAAP to non-GAAP measures contained in the appendix to this presentation.

3View entire presentation