Fresnillo Results Presentation Deck

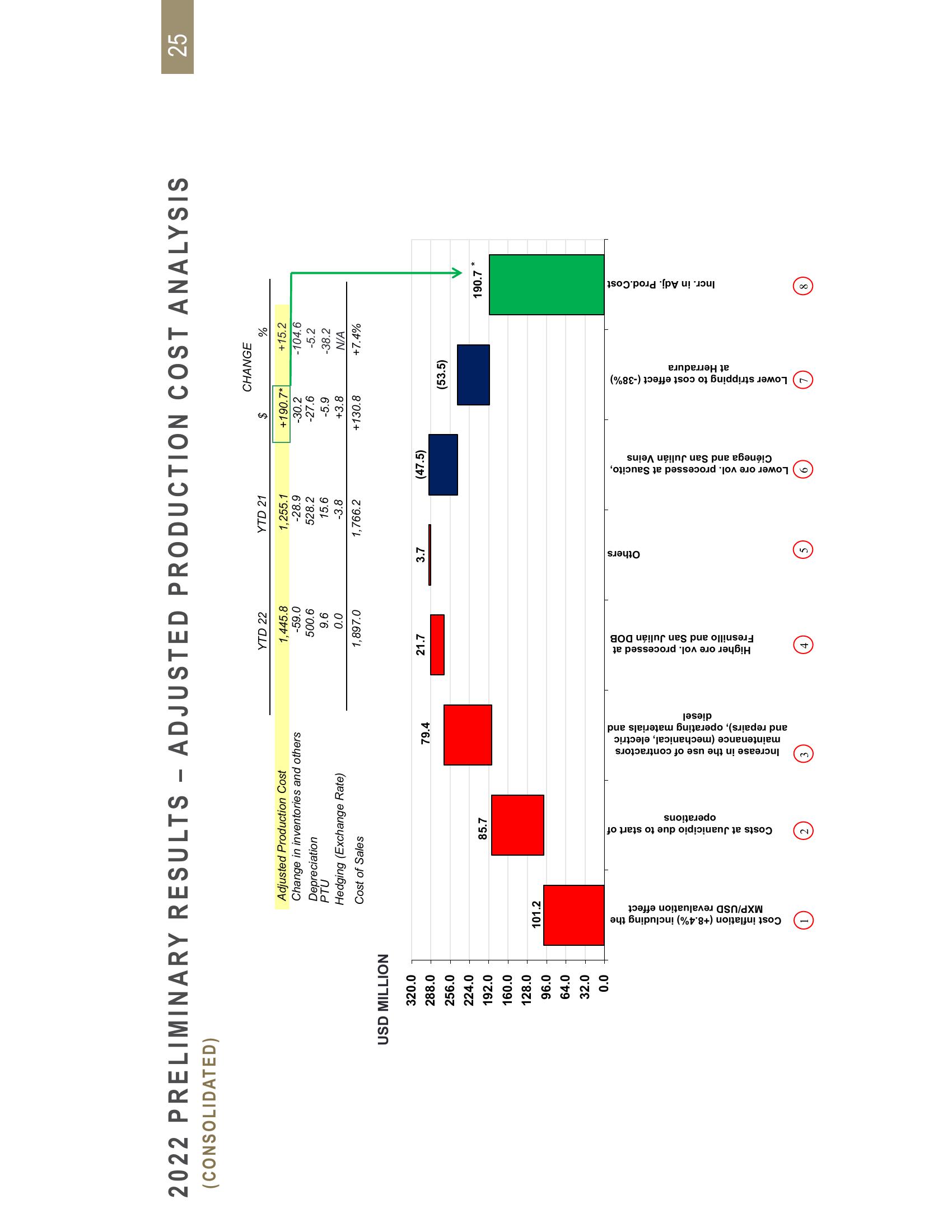

2022 PRELIMINARY RESULTS ADJUSTED PRODUCTION COST ANALYSIS

(CONSOLIDATED)

USD MILLION

320.0

288.0

256.0

224.0

192.0

160.0

128.0

96.0

64.0

32.0

0.0

MXP/USD (84%) including the

revaluation effect

Adjusted Production Cost

Change in inventories and others

Depreciation

101.2

Cost inflation

PTU

Hedging (Exchange Rate)

Cost of Sales

85.7

Costs at Juanicipio due to start of

operations

79.4

Increase in the use of contractors

maintenance (mechanical, electric

and repairs), operating materials and

diesel

YTD 22

1,445.8

-59.0

500.6

9.6

0.0

1,897.0

21.7

Higher ore vol. processed at

Fresnillo and San Julián DOB

4

3.7

Others

YTD 21

1,255.1

-28.9

528.2

15.6

-3.8

1,766.2

(47.5)

Lower ore vol. processed at Saucito,

Ciénega and San Julián Veins

CHANGE

$

+190.7*

-30.2

-27.6

-5.9

+3.8

+130.8

(53.5)

(Lower stripping to cost effect (-38%)

at Herradura

%

+15.2

-104.6

-5.2

-38.2

N/A

+7.4%

190.7

Incr. in Adj. Prod.Cost

*

25View entire presentation